Economic measures enforced by the Yemeni government and the Aden-based Central Bank of Yemen (CBY) has managed to close the tap on money laundering by the Houthi militias.

The host of regulations has sent shockwaves of panic among Houthis, who rely heavily on Iranian smuggled oil and their coercive monopoly over banks in areas under their control.

Contrary to counteractive measures targeting hostile Houthi banking practices, the Yemeni government eased some red tape in support of major importers and local commercial banks.

CBY crediting services were also expanded as to ease trade and cover commodity bills, including the country’s needed oil supply. This move pulls the rug from under Houthis who have, for years now, funneled money by trading oil obtained from Iran in the ailing country’s black market.

Many analysts agree that the Iran-backed militia has no viable defense against economic strangulation impacted by the CBY and Yemeni government.

Ruffled by the sudden and serious countermeasures, Houthis resorted to making terror threats such as blowing up oil reserves kept at the Ras Isa port in Hodeidah, which is run by militiamen since 2014.

Houthis also threatened to destroy Red Sea marine ecosystems and to target all commercial shipments sailing through Bab al-Mandab Strait.

The militia has managed to tank Yemen’s economy through barring traders, importers and commercial banks from dealing with the CBY in Yemen. Instead, Houthis force all business owners to conduct their dealings through its own shadow central bank, where the group can actively plunder funds.

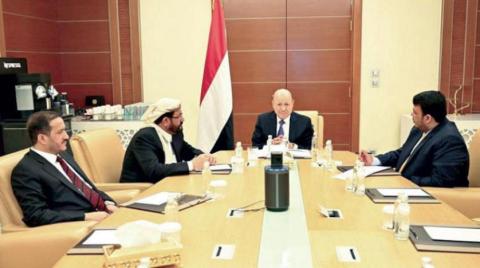

This week, CBY, at a board meeting in the interim capital, Aden, which included heads of commercial banks and prominent businessmen, announced a number of measures to protect banks operating in Sanaa and which have come under Houthi pressure.

The bank explained that it aims through these procedures, which were not entirely disclosed, to secure channels away from Houthi control so that CBY could safely cover the letter of credit and needs for hard currency.

Among these measures was, the CBY approving to sell banks foreign currency at a rate of 506 rials to the US dollar or at market rates.