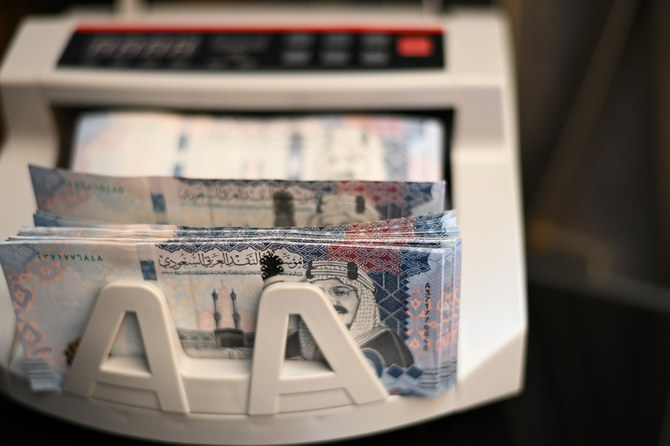

Saudi Arabia has issued Euro-denominated bonds, its first in that currency, after the Kingdom hired Goldman Sachs and Societe Generale as global coordinators and bookrunners for the potential new deal, while BNP Paribas, Morgan Stanley and Samba Capital were mandated as lead managers and passive bookrunners.

The Saudi issuance of Euro-denominated bonds in tranches of eight and 20 years, depending on market conditions, comes at a time when the country was rated A1 by Moodys and A + by Fitch Ratings.

Saudi Arabia has begun its approach to global markets by issuing bonds and sukuk in the dollar, and through the Euro-bonds, the country seeks to diversify its investor base, reduce costs and open up new markets, according to experts.

Financial expert Mohammed al-Omran explained that Saudi Arabia announced that it will target international markets and foreign currencies. He added that the euro-bonds will be relatively distant from the dollar-bonds, stressing that the goal is to diversify the currency, reduce cost and establish relations with new markets.

Omran indicated that euros current comparative advantage is the lower interest rates, less than 1 percent, while interest on the dollar is about 2 percent, noting that savings will be 1.25 percent per year in euros compared to the dollar.

For his part, economic expert Mohammed Al Abbas indicated that major institutions and banks are racing to enter the Saudi market which is trying to attract international investments and foreign funds, as investors seek confidence in the economy.

He stated that the rush on the Saudi market is an indication on high confidence that large companies and investors have in the Kingdom

He stressed that Saudi Arabia is interested in encouraging foreign investments and entering the European markets through Euro-bonds.

Bonds are low-risk financial instruments and can be disposed at any time, in addition that countries that issue the bonds are obliged to pay them according to the issuance date, according to economic expert Khalaf al-Shammari.

The euro market is characterized by a variety of investors from new institutions and portfolios, which analysts believe Saudi Arabia can take advantage of.