Saudi Finance Minister Mohammed Al-Jadaan said that his country, which will host the G20 summit next year, would work on compromise solutions to face the tax challenges arising from the digital economy.

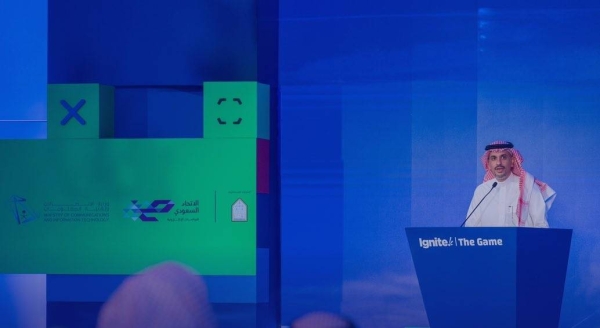

Speaking during the opening of the Zakat and Tax Conference on Wednesday, Jadaan said that the implementation of a value-added tax in Saudi Arabia was realized in record time and achieved fundamental changes in tax administration.

The Minister of Finance said during the two-day conference, which kicked off on Wednesday, that the rate of tax compliance amounted to 90 percent and exceeded all estimates made by the Zakat Authority, which initially set it at 60 or 70 percent.

Saudi Arabia began to apply a 5 percent VAT on goods and services in early January 2018, making this year the first fiscal year to include the tax in the public budget.

The minister said that within the framework of the Kingdom’s chairmanship of the next session of the G20 starting next month, his country would work with member states to reach a compromise solution in meeting tax challenges resulting from the digital economy and contribute with other countries to achieving stability in the global economy.

Locally, Jadaan said that the government has implemented a number of plans and initiatives to diversify the economy in order to provide greater opportunities for the private sector to invest and create more jobs.

He noted that modern technologies, such as artificial intelligence and block chain technology, could improve compliance with Zakat and tax, enrich the business sector and reduce the cost.

Jadaan went on to say that the tax policy in the Kingdom was aimed at achieving balance between the state’s financial and economic objectives, taking into account the preservation of financial sustainability in the medium and long terms, and to ensure the stimulation of economic growth rates.