Since OPEC+ started in early 2017, an open invitation was extended to US shale producers to address global oil supply and demand issues. Progress appears to have been slow to say the least.

Two years ago an OPEC delegation attending a prominent industry conference met with oil industry leaders and innovators, including from the shale sector. Later they also met with North American independent operators. Discussions focused on the oil market environment as well as the challenges and opportunities facing the industry in the years ahead.

Such meetings represented a great opportunity to informally engage with all the key industry stakeholders from both the conventional and unconventional sectors of the industry.

The rebound in the oil price is encouraging news for shale producers, but they may not be out of the woods yet. US shale oil output fell by at least by 15 percent between March and May.

Even if the WTI grade of oil hovers around $40, it is doubtful if shale output can rebound quickly enough in the summer. The US oil rig count has also hit a historic low and has been firmly stuck in that trough for 12 straight weeks.

In May, their number fell to around 200, together capable of producing around 7 million barrels per day (bpd) of oil.

Shale oil economics won’t support drilling operations at current prices. They will need to rise much further if the industry is to regain the necessary support from the financial sector.

With so much at stake it is important that channels of communication remain open for all industry stakeholders. Industry-wide collaboration is required for upstream investment to return and meet rising demand which will inevitably return. And when it does, the world will need both conventional and unconventional supply.

Ultimately, it remains challenging for the shale sector to threaten OPEC market share, especially for the medium sour crude grades that most sophisticated refineries consume. This is why a dialogue is necessary to ensure balance between supply and demand across the entire industry. The shale industry cannot be a free rider on the OPEC+ bus.

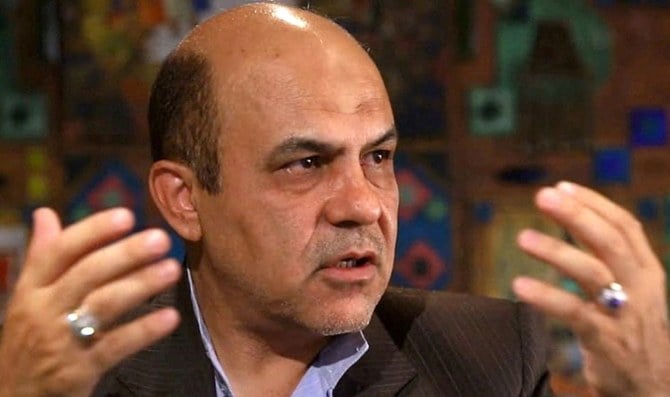

• Faisal Faeq is an energy and oil marketing adviser. He was formerly with OPEC and Saudi Aramco. Twitter:@faisalfaeq

Disclaimer: Views expressed by writers in this section are their own and do not necessarily reflect Arab News" point-of-view