RIYADH — The value of new residential mortgage loans for individuals during March 2021 reached an unprecedented record of SR17.5 billion, registering an annual growth of 56 percent, and the number of contracts recorded 32,440 contracts, a growth of 37 percent compared to 23,640 contracts worth SR11.2 billion in March 2020, according to the monthly report issued by Saudi Central Bank (SAMA).

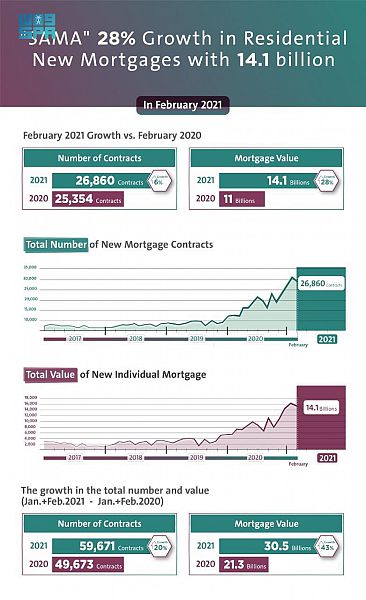

According to the report, the mortgages provided by real estate financing institutions and banks last month increased 21 percent in contracts compared to February 2021 and 24 percent in value. The report pointed out that mortgage loans in February 2021 recorded 26,860 contracts valued at SR14.1 billion.

SAMA report revealed that 97 percent of newly mortgages concluded through banks, while 3 percent of them through financing companies. In March 2021, 80 percent of the fund provided by banks and financing companies is for residential villas, apartments (16 percent), and lands (4 percent).

It is noteworthy that the official statistics of the Central Bank recorded last year a record growth in the number of contracts exceeding what was submitted during the four years, with the number of contracts reaching 295,590 worth SR140.7 billion.

In 2019 mortgage loans jumped 3 times with 179,217 contracts executed worth SR 79,128 billion compared to 2018 that recorded 50,496 contracts with a value of SR29.5 billion.

In 2017 about 30,833 contracts were executed worth SR 21,025 billion, while 2016 was about 22,259 contracts worth 17,096 billion. — SG