Boris Johnson’s government lacks public trust to tackle global tax avoidance despite mounting pressure for reform, at a time when US technology companies such as Amazon and Google have been reporting bumper profits during the Covid-19 pandemic.

A poll of more than 2,000 adults in the UK found less than a third trust the prime minister and the chancellor, Rishi Sunak, to take on big business interests as part of a crackdown on tax avoidance.

The polling, by Yonder on behalf of the Co-operative party, the sister party of Labour, showed that three-quarters of UK adults wanted Johnson’s government to play a leading global role to reform the tax system.

The lack of public faith comes as pressure mounts on world leaders to reform the global tax system to end decades of abuse by multinational firms, after a landmark intervention by Joe Biden last month.

In a marked shift in Washington, the Biden administration has put forward plans to limit the ability of large corporations to shift profits overseas, while taking steps to forge a landmark agreement on a worldwide minimum tax rate.

That move comes as part of talks taking place between 139 countries negotiating tax reforms at the Organisation for Economic Co-operation and Development, with an aim to reach an agreement by the middle of this year.

According to the Co-op party poll, as many as half of UK adults believe government failure to work with the US and other rich countries would damage the UK’s position on the world stage.

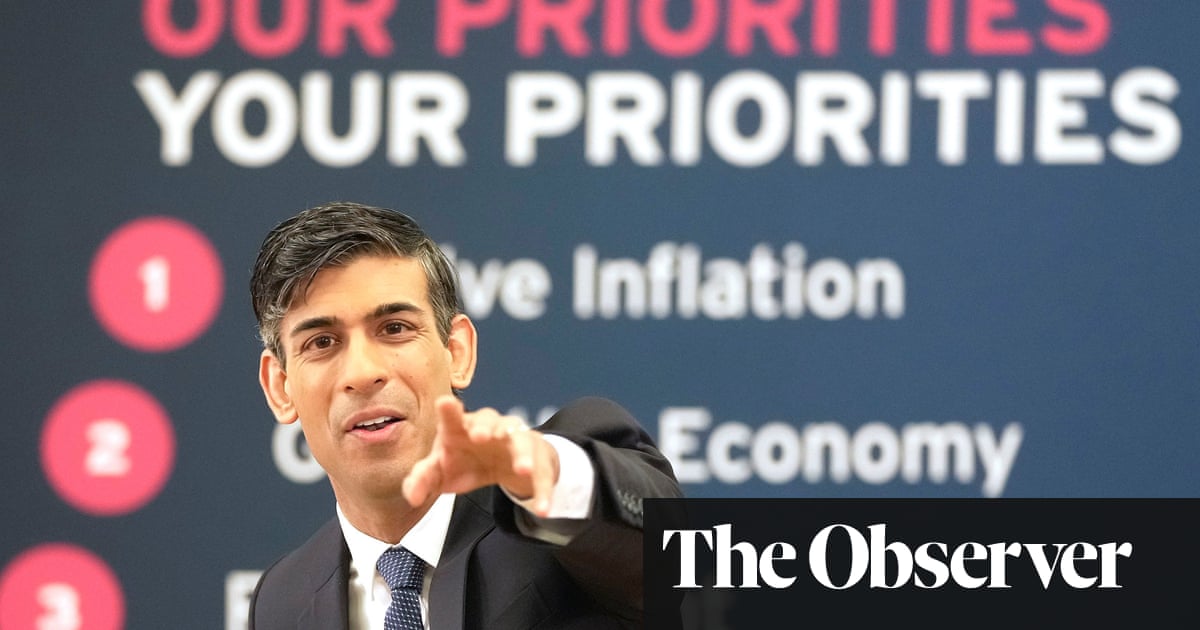

Sunak said on Tuesday that he wanted to reach a deal. Speaking at an event held by the Wall Street Journal, he said the UK was “open to having a package” that involved rules to end profit shifting and establishing a global minimum corporate tax.

But he also added: “The devil will be in the detail, and that’s what we’re working through now.”

The UK led on global tax reforms through the launch of a digital services tax last year, although Sunak has faced criticism for a relatively muted response to the Biden plans so far.

Anneliese Dodds, the shadow chancellor, said Biden’s proposals offered a historic chance to force big companies to pay their fair share in tax. She said: “With just a month until we host the G7 summit in Cornwall, the chancellor should be stepping up and showing leadership to deliver a fairer tax system, not letting others do the running.”

Raising pressure on countries to reach an agreement, the head of the International Monetary Fund, Kristalina Georgieva, said the fallout from the Covid pandemic and looming climate catastrophe meant there was a need for rapid action.

“These urgent needs, combined with a renewed spirit of multilateralism, give us a unique opportunity to rethink and fix the international tax system – to create a system that is truly fit for the 21st century,” she said.