The ongoing global shortage in the supply of semiconductors is affecting manufacturing in China and Japan, according to data, with car production among the industries hit.

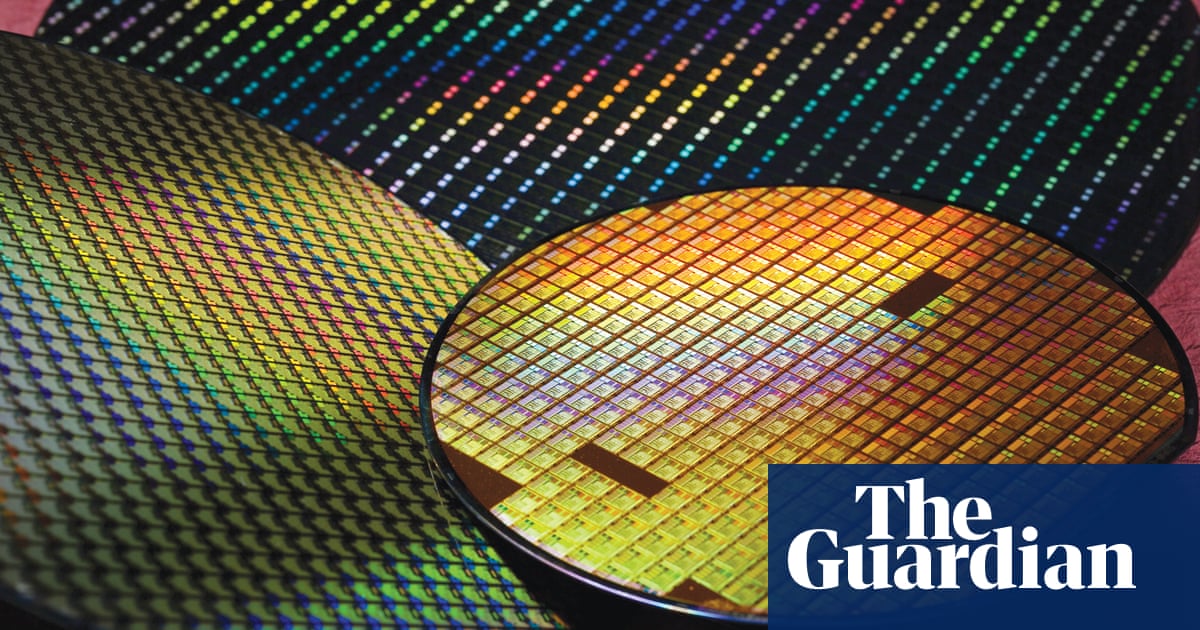

A shortage in semiconductor chips, which are the “brain” found inside every kind of electronic device, from PCs and TVs to games consoles and cars, has dogged economies for over a year.

Growth at factories in China has slid to a four-month low, according to figures on Wednesday, as a result of semiconductor chip shortages, combined with supply chain problems and rising raw material costs.

Japan has also experienced the biggest monthly drop in industrial output in a year, with an almost 6% fall in May compared with a month earlier, as manufacturing of cars and production machinery fell. The biggest falls were in car production, which tumbled by over 19% last month, largely because of a lack of semiconductor chips, according to Japan’s ministry of economy, trade and industry.

The owner of UK car dealerships Evans Halshaw and Stratstone also warned on Wednesday that supply of cars was likely to be restricted during the second half of 2021.

Pendragon said in a trading update “vehicle order times are already being extended”.

As demand for chips continues to exceed supply, the auto industry is forecast to be the biggest loser in 2021, with up to $20bn (£14bn) wiped off global carmakers’ operating profit this year, according to Goldman Sachs estimates.

Semiconductor manufacturers temporarily shut down their operations as the coronavirus first took hold in early 2020, and their customers cut or cancelled orders, anticipating weaker consumer demand.

However, the opposite happened and shoppers rushed to buy computers and other electronic devices to keep themselves entertained during successive lockdowns. Fear of Covid-19 has also fuelled car sales, as people avoided public transport.

Even though production has been returning to normal, shortages persist, which continues to have an effect on manufacturing in Asia.

“The shortage has been caused by a combination of better-than-expected demand and also a very bumpy recovery on the supply side,” said Toshiya Hari, a research analyst at Goldman Sachs.

“It does take a very long time for semiconductor companies to increase output. It takes time to purchase the tools. It takes time to install the tools. The actual manufacturing of the chips takes a couple of months as well.”

Hari added that a semiconductor chip can take as long as three to four months to produce.

Analysts are warning that the global economy has entered a peak shortage for chips, with tightness in supply expected to ease slightly in the third and fourth quarters of the year. However, global stock of semiconductors is not forecast to return to pre-pandemic levels until 2022.

The high demand for semiconductors is also expected to fall off as economies open up from lockdowns, and consumers begin to spend their money on holidays and hospitality, rather than electronic devices.

However, carmakers are viewed as the most vulnerable to the ongoing squeeze in supply.

Auto manufacturers were among the companies that cut chip orders as vehicle sales fell early in the pandemic, but then found themselves at the back of the queue when they tried to reorder. The auto sector accounts for fewer than 10% of global semiconductor orders, which are dwarfed by those of technology firms such as Apple.

The global car industry will lose out on approximately 3% of annual production this year as a result of the semiconductor shortage, according to estimates by Goldman Sachs analysts. This equates to a $15-20bn loss in operating profit for global automakers, according to research analyst Kota Yuzawa.

“It is having a very, very big impact, especially on the used car market,” Yuzawa said. “If you take a look at the US auto market, the used car price actually doubled over the past six months on the back of special demand created by Covid-19 and also the supply-demand tightness of the car vehicle itself”.