Lord Rothermere is considering taking the Daily Mail private in a deal that could value the newspaper group at £810m, a move that would end a 90-year run as a publicly listed company on the London Stock Exchange.

The Rothermere family has put forward a potential offer that would involve buying about 70% of the Daily Mail & General Trust (DMGT) group that it does not already own. The move would give Rothermere, who is also chairman of the group, full control of DMGT and take the company off the stock exchange.

In a stock market announcement on Monday, the group said Rothermere’s Bermuda-registered holding company Rothermere Continuation Ltd (RCL) was considering a bid of 251p a share, valuing the group at about £810m.

RCL already has a 30% stake in the group – which also owns the Metro and i newspaper titles – and holds all of the vote-bearing shares in DMGT’s two-tier stock structure. It means that the deal is not at risk of facing opposition if a deal is put to a shareholder vote.

However, the publisher of the Daily Mail said a potential offer was contingent on a number of factors, including a planned sale of DMGT’s insurance risk business Risk Management Solutions, and the sale of its stake in the online car retailer Cazoo, which was valued at $7bn (£5bn) after being snapped up by a special purpose acquisition company (Spac) in March.

Cazoo is aiming to list on the New York stock exchange this year, with DMGT’s 16% stake worth about £800m at its current £5bn valuation.

DMGT said it has received a “number of inquiries” for RMS, which it bought in 1998. It is also seeking assurances that the group’s pension schemes will not be affected by the takeover.

The publisher of the Daily Mail has been reorganising the business through disposals and targeted acquisitions of its own in recent years, having bought the New Scientist magazine in a £70m deal in March, as well as the i newspaper in a £49.6m deal two years ago.

The company has made £1.2bn from disposals in recent years of its stake in the property portal Zoopla, the education business Hobsons and the energy data firm Genscape.

The cash proceeds of the deals – 610p a share – would be distributed to DMGT shareholders through a special dividend. It would give RCL at least £500m, and would probably help fund any takeover offer for the what remains of the newspaper group.

DMGT’s share price closed up about 3.5% after news of the potential buyout was announced on Monday, at £10.76.

“The independent directors have indicated … they would be minded to recommend the possible offer to DMGT’s shareholders,” the company said.

If DMGT is taken private it will leave Reach – the parent company of the Mirror, Express and Star national titles and regional publications such as the Manchester Evening News – as the only major UK newspaper group remaining as a publicly listed company on the London Stock Exchange.

In 2013, Rothermere, who has until 9 August to make a firm offer for the business or walk away, first signalled that he might seek to take the business private by increasing his control of the family-held voting shares to almost 90%.

The move sparked speculation that Rothermere might seek to approach the remaining shareholders to take full control of DMGT, which has been listed on the stock market since 1932. DMGT was founded by Harold Sidney Harmsworth, the first Viscount Rothermere, in 1922. He set up the Daily Mail with his brother Alfred in 1896, and subsequently launched the Daily Mirror.

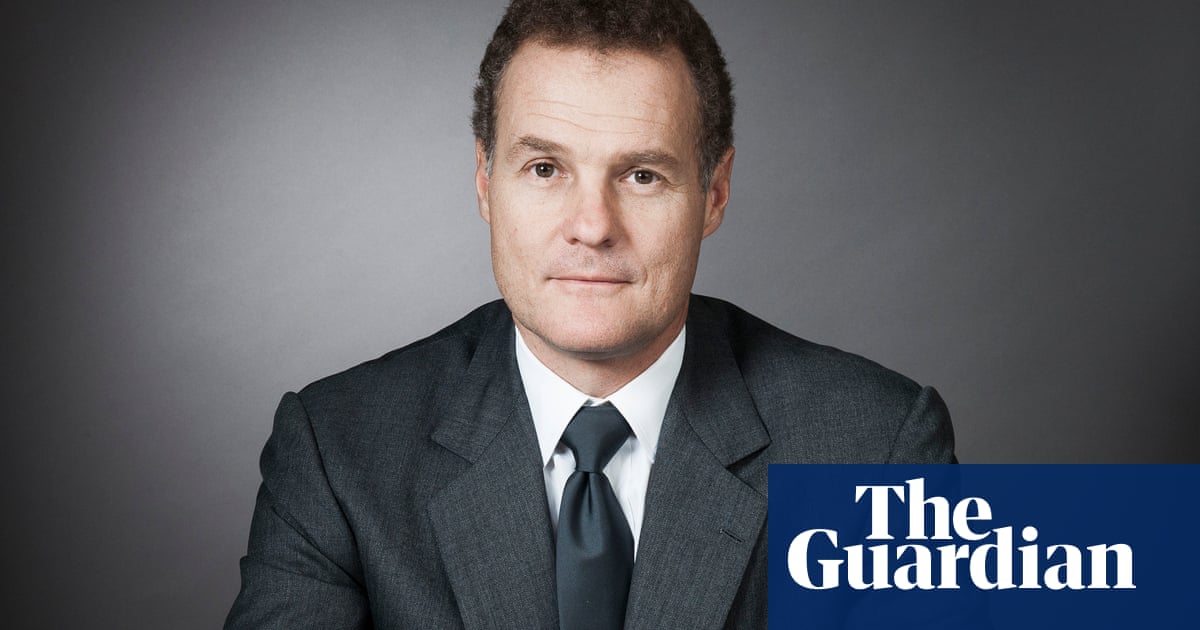

Jonathan Harmsworth, 53, Harold’s great-grandson and the 4th Viscount Rothermere, has led the business through huge technological change as print newspapers have had to refocus their business models in the digital age. MailOnline, launched in 2003, has grown to be one of the world’s most popular English language news sites.