When the long-running BBC radio series Desert Island Discs invited Nicholas Goodison to take part in the programme in 1987, he made one stipulation. The interview had to be recorded in his own office, 22 storeys above the City of London, rather than in a BBC studio. Goodison, who has died aged 87, was at the time chairman of the London Stock Exchange, and he had just piloted that institution through the period of enormous change that had acquired the epithet the big bang.

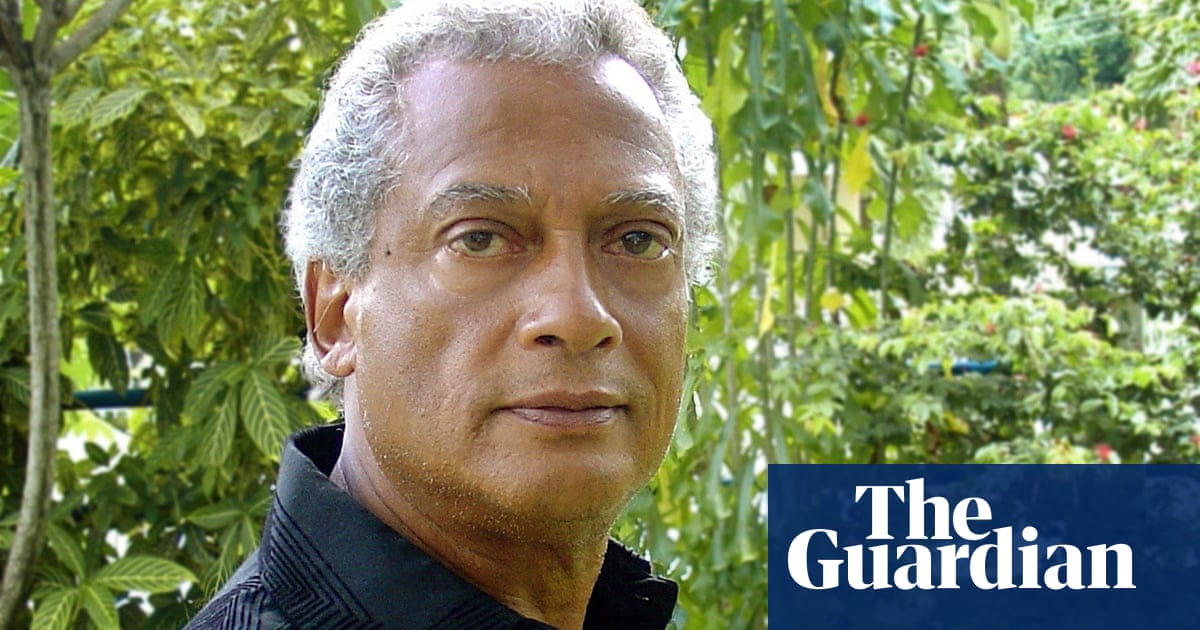

Tall, slightly stooping, quietly spoken and rarely ruffled, Goodison believed that the workplace should be “a place of delight”, and his office reflected that belief. It was furnished with specially commissioned chairs, a table and a bookcase hand-made by Alan Peters, exquisite ornaments, art, and examples of his special interest – barometers and clocks. The chairman’s office was an oasis of calm within a building that hummed with the frenetic energy of Europe’s leading international financial marketplace.

The big bang had arisen from a deal made between the London Stock Exchange and the Conservative government, largely to avoid the financial institution being taken to the Restrictive Practices Court.

The Stock Exchange had always dealt on the basis of fixed commissions and rigorous separation of roles in the securities markets. Brokers (such as Goodison’s family firm Quilter Goodison) traded only for clients, were prohibited from “own account” trading, and were owned by partnerships of individual members. They bought and sold their clients’ securities from and to jobbers, acting effectively as wholesalers who ran trading books.

It was a comfortable closed shop, a cartel that Margaret Thatcher’s administration was determined to break. With the big bang, the distinction between brokers and jobbers was abolished; outside firms, such as banks, were able to buy into the industry; and the traditional method of face-to-face dealing, based on the premise that “my word is my bond”, was swept away by computerised trading systems. Old-established city firms were snapped up by foreign investment banks with the capital to expand and trade on their own behalf.

Anyone meeting the aesthete Goodison for the first time, with his quiet manner, immaculate appearance, classics background and deep knowledge of music, arts and furniture, might be led to the conclusion that he would be better suited to academia or perhaps to the “old school” of the City. That would be to underestimate an iron will and genuine determination to see through the changes that he had persuaded the Stock Exchange council to embrace.

Although there was a hitch with the computer system on big bang day itself, 27 October 1986, the transformation achieved its objectives of broadening ownership, abolishing restrictive practices, and ensuring London remained at the centre of world financial markets. This was very much due to Goodison’s leadership. He thrived on change.

Less than a year later, markets ended a long positive run with a sharp and sudden downturn, during which Goodison was a voice of calm and reason who did much to restore confidence.

He was born into a stockbroking dynasty, the son of Eileen (nee Proctor) and Edmund Goodison. His father and grandfather were both successful City stockbrokers. Nicholas enjoyed a conventionally privileged education: Marlborough college and then Cambridge to study classics at King’s College. He sang in the school choir, at university and in the Bach choir, and told Michael Parkinson, who interviewed him for Desert Island Discs, that he got a “tremendous kick” out of church music.

Nevertheless, and despite strong contrary advice from his father, he joined the family firm, HE Goodison, later Quilter Goodison, “on a trial basis” in 1958, after university. Despite nearly leaving after two years, to take up teaching, he remained in the City and became a partner in 1962 and chairman in 1975. By that time he was already a member of the Stock Exchange council, having been elected in 1968. In 1976, a year after taking the top job at the family firm, he stepped up to the chairmanship of the London Stock Exchange. He was knighted in 1982.

He left Quilter Goodison when it was bought by Commercial Union in 1988 and accepted the chairmanship of TSB Group, another organisation where big changes were high up the agenda, remaining in that post until 1995, and then acting as deputy chairman of the Lloyds TSB group for a further five years.

The climb up the ranks of the City establishment did, however, still leave room for him to follow and develop his interests in music and fine arts. He published English Barometers 1680-1860 (1968), which became the standard work on the subject, and a monograph, Ormolu: The Work of Matthew Boulton (1974).

He became a devotee of opera and, even in the run-up to big bang, found the time to become vice-chairman of English National Opera (1980-98), and chairman of the National Art Collections Fund (1986-2002) and the Courtauld Institute (1982-2002), also serving many other institutions and societies linked to furniture and the arts.

In 1960 he married Judith Abel Smith. She and their son, Adam, and two daughters, Katharine and Rachel, survive him.

Nicholas Proctor Goodison, financier and art historian, born 16 May 1934; died 6 July 2021