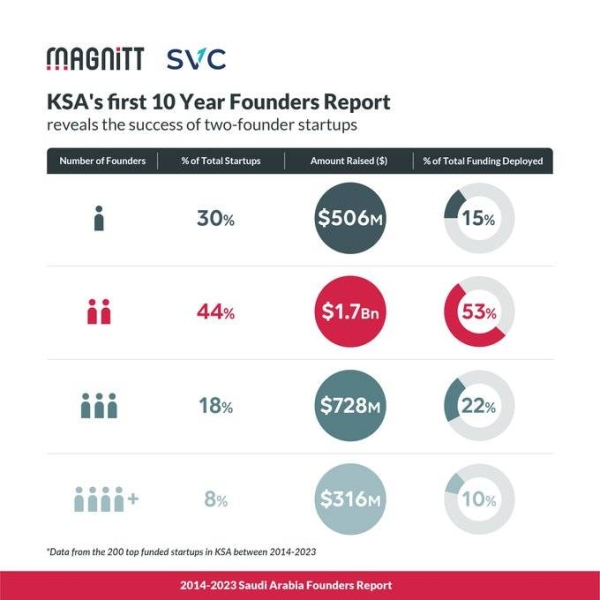

RIYADH — The first half of 2021 saw a record-setting volume of investment in Saudi startups that reached SR630 million, signaling a growth of 65% compared with the same period last year, according to MAGNiTT Venture Capital (VC) Investment Report.

In its periodical report released on Monday, MAGNiTT, a leading community and data platform for startups, investors, corporates and enablers, indicated that, although 2020 was a "positive year" for venture capital investment in the Kingdom,

It added that 2021 has been witnessing higher capital inflows with the value of startup investments during the first six months of this year equaling around 94% of the total value of investment in Saudi emerging ventures during last year.

The report was sponsored by the Saudi Venture Capital Company (SVC) of the General Authority for Small and Medium Enterprises “Monshaat”.

According to MAGNiTT"s bi-annual report, the Kingdom has jumped from the third spot to the second place in the venture capital market in the Middle East and North Africa (MENA) region, with the value of half-yearly capital raised in the first half (H1) 2021 accounting for 14% of MENA VC funding and 21% of the region’s VC transactions.

The first half of 2021 witnessed a growth in VC investment in Fintech startups by 1,700% compared to last year with Fintech, food and beverage startups together accounting for 44% of the investments, while about three-quarters of the investors in Saudi startups during the first six months of 2021 were from the Kingdom, the report said.

Monshaat Governor and Chairman of Board of SVC Eng. Saleh Bin Ibrahim Al-Rasheed voiced the authority"s keenness to support entrepreneurs, startups and SMEs and enhance their competitiveness to help them maintain sustainable and inclusive growth through stimulating the financing environment and addressing all obstacles related to financing gaps.

For his part, CEO of SVC Dr. Nabeel Koshak explained that the Kingdom is witnessing a growth in the volume and quality of startup investments coupled with an increase in the number of VC funds and angel investor groups, adding that a number of new initiatives have been launched lately to stimulate the sector in line with the Saudi Vision 2030.