Precisely Why A Wichita Community Was Pushing Back Against A Name Debt Company

In early 2016, locals of Wichita’s City Council District 1 got together to go over exactly what companies they desired to witness occupy at 13th and Oliver.

The Walmart community marketplace here had simply closed; thus met with the QuikTrip across the street.

But community watched those losses as the chance to bring in new business organisations that would perk the region.

“We don’t like it to be a liquor store,” explained then-council member Lavonta Williams. “We don’t want it to be whatever’s an entertainment region. “And we all don’t want it to be a payday financing facility.”

But, practically 5yrs eventually, that’s what came: In December, subject optimum transported in to the previous projects by Crawford rose shop from the southwest part belonging to the intersection.

“It’s just unpleasant to experience that thereon spot,” claimed council affiliate Brandon Johnson, that symbolize region 1.

Payday and title financial enterprises offer small-scale financial products – in Kansas, up to $500 funds – often at highest percentage of interest. In this article, it’s 391% each year; in a few reports, it’s about 600percent. A 2016 document from Pew charity Trusts discovered that 12 million folks in the U.S. remove loans each year.

Johnson says this town usually functions to limit new pay check creditors through a zoning concept called a “protective overlay” — essentially restricting exactly what do transfer to a specific developing. But also in this example, label Max fit the zoning obligations and didn’t have to go prior to the city for affirmation.

“This one could work-out with the property owner an understanding to acquire that house and start shop,” Johnson claimed. “And a lot of locally happen to be significantly upset by that.”

Label Max’s mom business, TMX funds, rejected to feedback, saying it can don’t react to news question. But Johnson states trulyn’t regarding this one businesses.

“We will certainly continue delivering focus to in addition business, but just a as a whole and exactly how poor it is,” they mentioned.

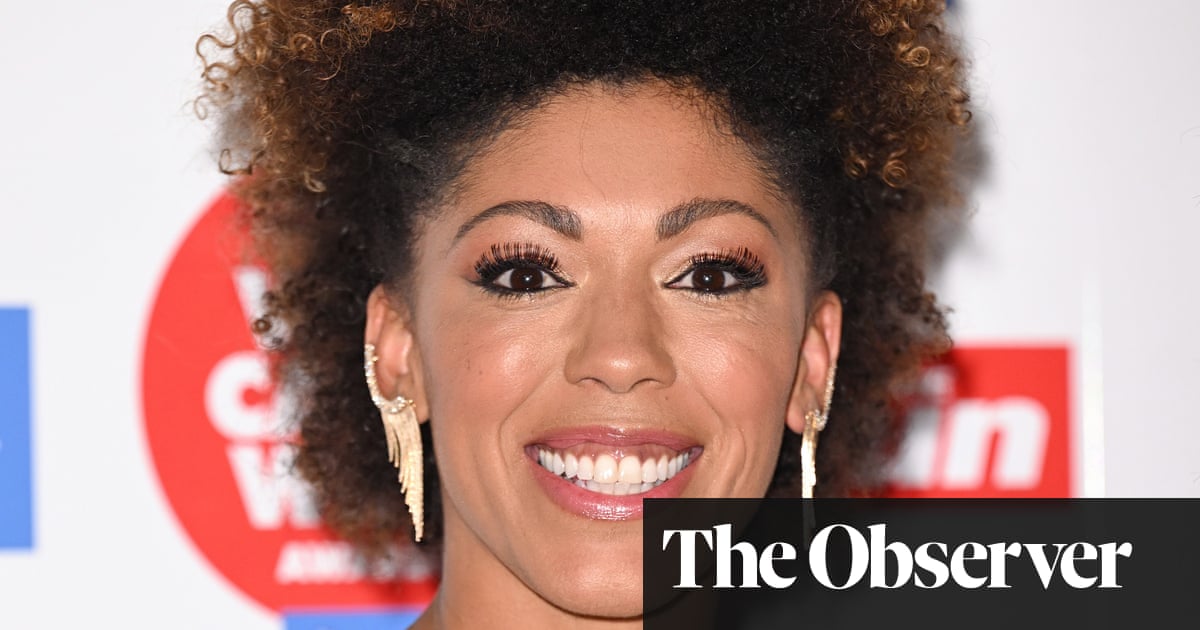

Area activist Ti’Juana Hardwell resides nearby from the new headings optimum; when this broad heard it had been opening up, she structured a protest at the company.

She claims payday lenders tend to capitalize on low-income occupants, especially in neighborhoods which happen to be bulk charcoal. She’s watched first-hand exactly how individuals will get jammed in a lending capture.

“merely thinking of your mothers, you know, needing to unfortuitously remove a mortgage, and she’d continue on to the next one and she’d require reborrow in order to shell out that debt,” Hardwell said.

“On paycheck . which was a thing that most people achieved: all of us received in the car, and she’d move from one to an additional, paying these people so to reborrow immediately after which going to the following that one in order to carry out the ditto, merely to be able to cover lease and statements.

“and that is certainly poisonous. You will not get ahead that way.”

She and Johnson are also cooperating with hometown lawmakers along with other supporters on procedures getting released in the following period in Topeka. Hardwell claims regulation is required to limit the amount of payday financial institutions in a place, and interest levels they’re allowed to recharge.

“The general changes goes in its option,” she stated. “That’s a product that recognize happens to be our very own priority with making certain there’s some control of these employers whom often prey on Ebony and brown and the indegent as a whole.”

Right now, Hardwell desires to teach folks about other guides intended for individuals in want. During the protest last period, she passed out details on spots like joined technique and ICT group refrigerator.

“i believe that sometimes men and women to generally choose places like pay day loans and concept loan companies simply because they dont discover some other sources which could exists that might encourage them to their own subsequent commission,” Hardwell mentioned. “Weare looking for methods to have the option to make sure that individuals have the means that they want just before actually evaluate an online payday loan or a subject loan provider.”