In an unassuming two-storey former chicken shed in a business park near Cambridge, a four-limbed creature performs an elaborate dance. Versius, the first UK-built surgical robot, is used in the NHS and hospitals around the world, typically to perform abdominal, urological and gynaecological procedures. A surgeon can sit in front of its 3D screen and operate the robot by manipulating two joysticks.

“Cambridge is a good place to do technology,” says Luke Hares, the chief technology officer at CMR Surgical, the company behind Versius. CMR has grown rapidly since its foundation in 2016 and now employs 750 people. As it ramps up exports, with dozens of its $1m-$1.5m (£750,000-£1.1m) robots lined up and awaiting shipment at the firm’s headquarters, it has just announced it will open another factory in nearby Ely to more than triple manufacturing capacity.

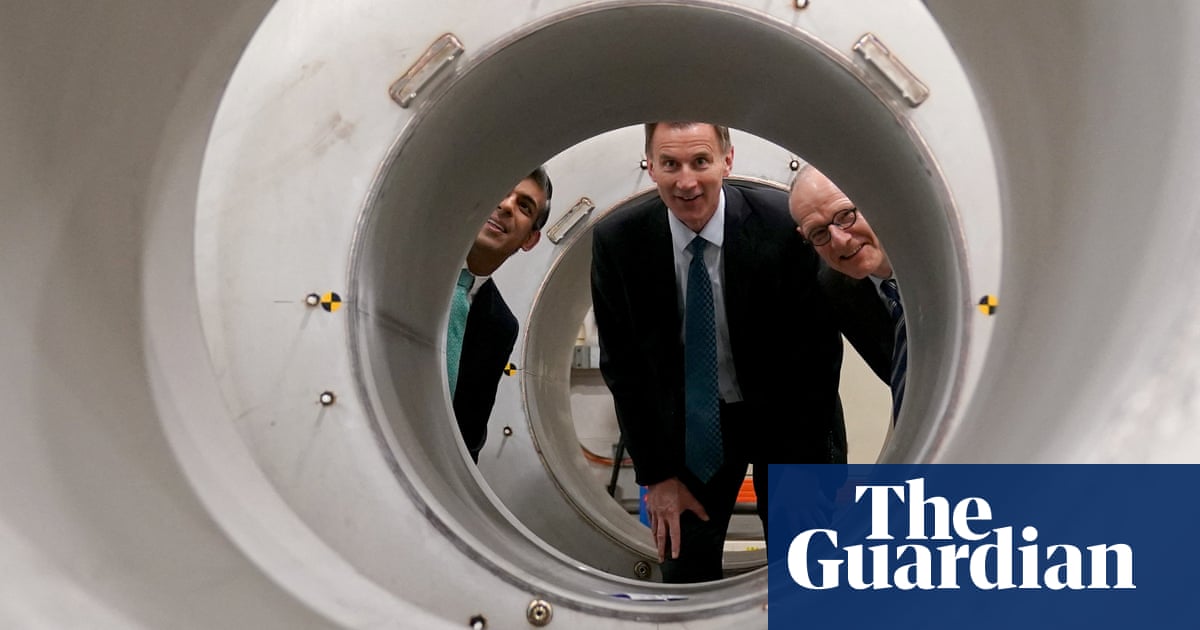

This is just the sort of business that the chancellor, Rishi Sunak, was referring to in his Conservative party conference speech in Manchester this month, when he said: “We are going to make this country not just a science superpower … we’re going to make the United Kingdom the most exciting place on the planet.”

Hares says he built a wooden single-arm model of Versius in a weekend but it took 18 months to develop a four-arm prototype. Finding financial backers was even trickier. He stresses the “importance of luck in the chain of events”, referring to a chance meeting with CMR’s first backer, the Norwegian investor Per Methi, at a patent lawyer’s office. Methi remains a main shareholder and a board member of the company. “It was either going to be massive or it was going to fail. There’s a level of serendipity that is important,” Hares says.

What sets Versius apart from other surgical robots, according to CMR’s chief executive, Per Vegard Nerseth, is that it can deploy up to four arms that move independently of each other, rather than coming out of one boom. Each one holds an instrument as it might a pen, and moves like a human wrist. Unlike heavier robots, Versius can be moved easily between operating theatres, lowering the cost per procedure for hospitals. It is typically used on a subscription basis.

Versius is targeting a booming market: analysts predict that the global medical robotics market will grow to $20bn by 2025, from $6bn today. Martin Frost, a CMR co-founder and serial entrepreneur, has talked of the company’s ambition to get into the top tier of the global medical devices industry. The company raised $600m recently, which it says is the largest ever private financing round in the sector worldwide.

Yet for all Sunak’s hype and Frost’s ambition, there is a particular British illness that stands in the way. About six miles away on the other side of Cambridge is the headquarters of Arm, the chip designer that was bought by the Japanese conglomerate SoftBank for $32bn in 2016 and is being sold to America’s Nvidia. Britain is increasingly known as a place that spawns promising startups but sells out too early, leaving (typically) foreign buyers to get them to mega-company stage.

The latest example is GW Pharmaceuticals, the Cambridge-headquartered pioneer in cannabis-based medicines, which was bought by a US firm for $7.2bn in February. “As soon as these companies show a glimmer of success, they get acquired by much larger companies,” says Paul Cuddon, a life sciences analyst at Numis Securities. “The more successful companies can’t have a long enough shot at building a bigger business.”

CMR’s Nerseth mentions the lack of automation in the UK, which is holding back manufacturing. Other small entrepreneurs cite the problems of raising startup finance and having to do the “friends and family round”, which is only really an option for the wealthy.

In a 2018 speech entitled “hub no spokes”, the Bank of England’s then chief economist, Andy Haldane, talked about the small number of top-performing companies in the UK and the long tail of under-performing companies. Referring to research and development, he said: “The UK does R well, as a world-leading innovation hub. But it does D poorly.”

Haldane identified a number of factors including slow adoption of new technologies, weaker management skills and fewer financing options for smaller firms than in, say, Germany. The UK has set up its own equivalent of Germany’s Fraunhofer institutes, called catapult centres, to create a new innovation infrastructure, but there are far fewer of them.

Experts including Cuddon say early-stage funding has improved in recent years. The UK and Ireland attract far more venture capital funding than the rest of Europe – €14.6bn (£12.3bn) in the first six months of 2021, as much as the 2020 total, according to figures from PitchBook.

The latest crop of successful UK life science firms includes the DNA and RNA sequencing company Oxford Nanopore, whose market value jumped to almost £5bn on its London stock market debut in late September. A day later Exscientia, which uses artificial intelligence to develop drugs, spurned London and floated on Nasdaq in New York at $2.9bn, ending the day worth $3.5bn.

Analysts say there is more willingness from investors in the US to support fledgling biotech companies on an often bumpy road, with clinical trial setbacks along the way. “Investors are very hesitant when it comes to clinical stage risk,” says Cuddon.

Another problem is that British R&D spending, which totalled £38.5bn in 2019, is among the lowest in OECD countries as a percentage of GDP. The UK business secretary, Kwasi Kwarteng, recently set out a plan to help the UK “keep pace in the global innovation race”. This includes raising annual public investment in R&D to £22bn, from nearly £15bn in 2021-22. The government aims to increase public and private R&D investment to 2.4% of GDP by 2027, from 1.7% in 2019.

The Nanopore float could be a turning point, as it “effectively sends a signal that you can list in the UK and get support,” says Adam Barker, a life sciences analyst at Shore Capital. “The UK can certainly develop, but it might take reforms.”

Britain’s big life science companies

AstraZeneca The Anglo-Swedish drugmaker successfully resisted a £70bn takeover approach from its US rival Pfizer in 2014, and last year bought the US rare diseases specialist Alexion for $39bn. AZ’s market value has soared to £136bn, nearly twice the size of its UK rival GSK.

GSK Created from the 2000 merger of SmithKline Beecham and GlaxoWellcome, GSK is the UK’s second biggest drugmaker. It plans to split its consumer health arm from the main pharma and vaccine business next June.

Vectura The asthma inhaler maker agreed to a controversial £1.1bn takeover by the cigarette company Philip Morris International in September.

GW Pharmaceuticals GW was acquired by the US firm Jazz Pharmaceuticals for $7.2bn in February. It developed the world’s first cannabis-based medicine, a multiple sclerosis drug called Sativex, and another drug called Epidiolex to treat childhood epilepsy.

BTG The London-based firm, known for its Varisolve varicose veins product, snake venom antidotes and cancer portfolio, was sold to Boston Scientific for $4.2bn last November.

Shire Known for its ADHD hyperactivity drug Adderall and its rare diseases portfolio, in 2018 it agreed to a £46bn takeover by Japan’s Takeda, one of the biggest pharmaceuticals deals ever.

Celltech Slough-based Celltech was sold to Belgium’s UCB for £1.5bn in 2004, at a time when it was Britain’s biggest biotechnology firm. It is best known for its Zyrtec hayfever tablet.