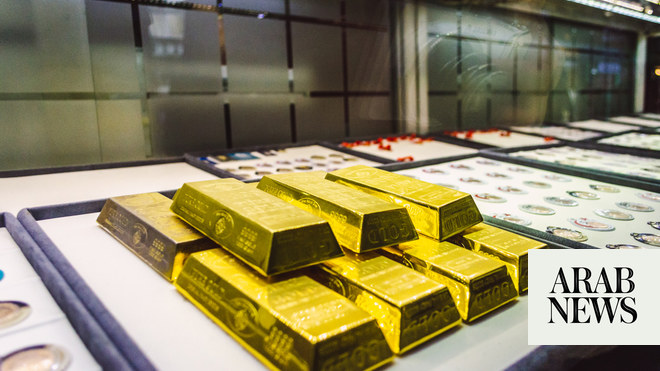

Gold prices inched higher on Friday but were set for their first weekly decline in three as rising inflation fuelled bets of quicker interest rate hikes and dented bullion"s appeal.

FUNDAMENTALS

* Spot gold rose 0.2% to $1,861.43 per ounce by 0241 GMT, but was down 0.1% so far in the week. U.S. gold futures also gained 0.2% to $1,864.00.

* U.S. Federal Reserve policymakers are pencilling in the possibility of earlier interest rate hikes than they thought would be needed just a few months ago, as inflation continues to soar and the economy picks up speed. read more

* Chicago Fed President Charles Evans, one of the U.S. central bank"s most reliable policy doves, said on Thursday he was "open-minded" to adjustments in monetary policy next year if inflation continued to stay high. read more

* Higher interest rates raise the non-interest bearing metal"s opportunity cost, reducing bullion"s appeal.

* The prospect of earlier interest rate hikes also helped the dollar rise, further reducing gold"s appeal by raising the metal"s cost to buyers holding other currencies.

* Japan is set to compile on Friday a record $490 billion spending package to cushion the economic blow from the COVID-19 pandemic. read more

* The number of Americans filing new claims for unemployment benefits fell close to pre-pandemic levels last week, though a shortage of workers remains an obstacle to faster job growth. read more

* Switzerland exported more gold to mainland China in October than in any month since June 2018, according to Swiss customs data that also showed shipments of gold to India falling slightly from September.

* Spot silver rose 0.4% to $24.88 per ounce but was on track for its first weekly fall in three.

* Platinum rose 0.95% to $1,058.05 and palladium gained 0.5% to $2,143.66.