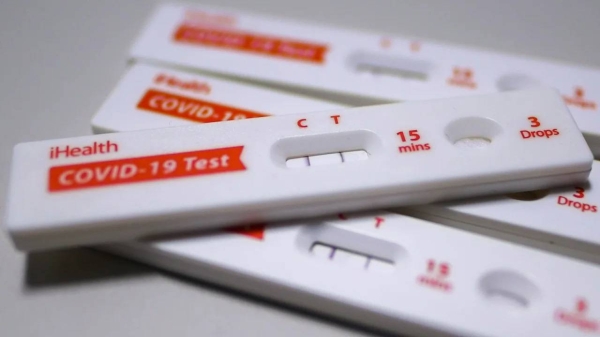

Nov 26 (Reuters) - London copper prices fell on Friday as a newly identified COVID-19 variant in South Africa and expectations of faster-than-expected U.S. rate hikes fuelled concerns of an economic slowdown.

Three-month copper on the London Metal Exchange dipped 0.6% to $9,741 a tonne by 0250 GMT. The most-traded January copper contract on the Shanghai Futures Exchange fell 1.2% to 71,050 yuan ($11,115.63) a tonne.South African scientists have detected a new COVID-19 variant in small numbers and are working to understand its potential implications. The new variant announcement prompted Britain to introduce travel restrictions on South Africa and five neighbouring countries. read more

Minutes of the U.S. Federal Reserve"s last policy meeting showed a growing number of policymakers being open to speeding up the central bank"s tapering programme. read more

An early rate hike could trim liquidity in financial markets and slow recovery in the world"s biggest economy. Copper is often used as a gauge of global economic health.

FUNDAMENTALS

* LME aluminium eased 0.4% to $2,706.5 a tonne, nickel was down 0.3% at $20,615 a tonne, and lead traded 0.4% higher at $2,280.5.

* LME tin was unchanged on the day, having scaled a record peak of $40,680 a tonne on Thursday amid tight supply. read more

* ShFE aluminium fell 0.4% to 19,355 yuan a tonne, nickel was down 2% at 151,550 yuan a tonne, lead gained 1% to 15,365 yuan a tonne, zinc dipped 0.7% to 23,605 yuan a tonne and tin shed 1.3% to 286,170 yuan a tonne.

* Communities in Peru"s Ayacucho region say they will resume protests against the mining sector if the government of leftist President Pedro Castillo breaches what they call a signed agreement to shutter mines, local leaders told Reuters. read more

* For the top stories in metals and other news, click or

MARKETS NEWS

* The safe-haven yen rallied and the South African rand tumbled on Friday as investors turned cautious after Britain raised the alarm over a newly identified coronavirus variant spreading in the African nation.

* Stocks fell and headed for their largest weekly drop in nearly two months, while safe haven assets such as bonds and the yen rallied as a new virus variant added to swirling concerns about future growth and higher U.S. interest rates. read more

($1 = 6.3919 Chinese yuan)