Dec 20 (Reuters) - Australia"s Magellan Financial Group (MFG.AX) on Monday forecast a 6% decrease in its fiscal 2022 revenues after a UK-based wealth manager ended a contract with the company, sending its shares over 33% lower in their sharpest fall on record.

The fund manager said its asset management unit was notified of the termination of the mandate by St James"s Place (SJP.L) on Dec 17, when Magellan"s shares went into a trading halt.

The mandate, Magellan"s largest, accounted for an estimated 12% of its current annual revenues.

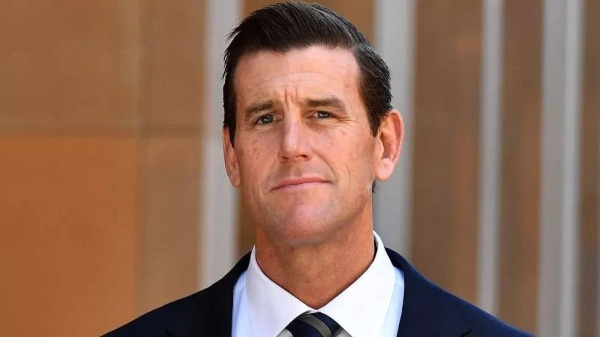

Earlier this month, Magellan announced the resignation of Chief Executive Officer Brett Cairns after 14 years with the group. The stock has lost 7% since the exit.

The company in a filing to the Australian bourse said the mandate was "not an investment in any of Magellan"s retail global funds."

Magellan"s global equities retail funds segment, comprising about 75% of the group"s funds under management, were restructured in December 2020 after their performance declined sharply.