RIYADH: Saudi Arabia’s annual inflation slowed to 2.2 percent in May, from 2.3 percent in April, driven by food and beverages, and transport, according to the latest data released by the General Authority for Statistics.

Given that these sectors have high relative importance in the Saudi basket, May inflation has slowed down, GASTAT said.

On a month-on-month basis, general consumer price indices, or CPI, increased 0.1 percent, the GASTAT data showed.

Both headline year-on-year and month-on-month inflation numbers are lower than the expected 2.5 percent and 0.4 percent a Bloomberg poll had revealed earlier.

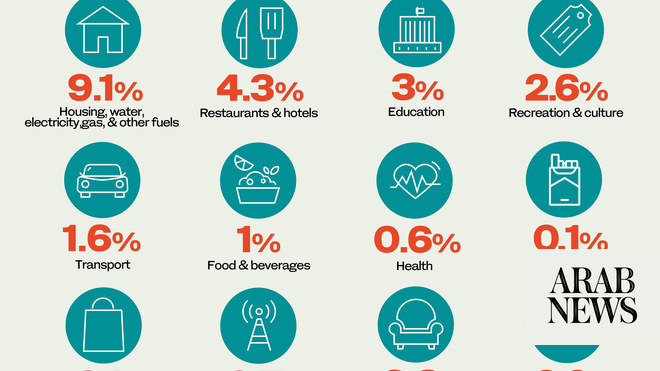

Sectors that drove the change in headline inflation

While looking at the breakdown of sector relative contribution to annual inflation, housing, water, electricity, gas and other fuels sectors witnessed faster growth in the price index, with the rate having quickened to 0.5 percent from 0.2 percent in April.

But this increase was offset by slower growth in the transportation sector which grew at 4.1 percent against 4.6 percent recorded in April.

At the same time, the effect of a faster deflation in clothing and footwear to -1.7 percent from the previous -0.7 percent was offset by restaurants and hotels where prices growth quickened to 4.1 percent from 3.2 percent in April.

The resulting dampening effect on the headline annual inflation figure for May came in from a slower growth in the price index for miscellaneous goods which has a 13-percent weight in the CPI basket. In May the growth rate slowed to 2.2 percent from 2.8 percent in April.

As for sector-by-sector contribution to month-on-month inflation, the dampening effect almost entirely resulted from a slower rate of growth in the price index for food and beverages, which fell to 0.2 percent in May from 1.7 percent in April.

The combined push upwards from price growth in the housing, water, electricity, gas and other fuels as well as home furnishings and equipment was partly offset by the slowdown in transport prices to zero percent in May compared to 0.7 percent in April.

Saudi Arabia is an energy-rich country that subsidizes its energy products as a direct way of redistributing the government income from oil and natural gas to the population. They are also considered part of the social contract.

According to Mazen Al-Sudairi, head of research at Al-Rajhi Bank, “The fuel prices paid by the electricity producers represent a minor fraction of the international prices, reflecting a substantial government subsidy aiming at reducing the final consumer electricity bill.”

Al-Sudairi also added that the Saudi consumers are also partly shielded from the higher impact of oil prices after the government put a cap on petrol prices when oil breaches $70 to contain inflation.

Jadwa ups its inflation forecast

Saudi-based investment firm Jadwa, which raised its 2022 inflation estimate to 1.7 percent from the previous 1.2 percent in February, now expects 2022 inflation at 2.4 percent.

The investment firm upped its inflation forecast further in April due to the increased risk of faster price growth in China. That’s because China has a 20-percent share in the Kingdom’s total imports. The upward revision in inflation is also due to an increase in prices for housing, water, electricity, gas and other fuels.

However, in view of the possibility of further hikes by the end of 2022, the firm expects the value of the Kingdom’s currency to rise, which is to “help insulate the Kingdom’s import costs somewhat during the year.”