Fallen crypto billionaire Sam Bankman-Fried entered a plea of not guilty on Tuesday to criminal charges that he cheated investors and looted billions of dollars at his now bankrupt FTX cryptocurrency exchange.

Bankman-Fried is accused of illegally using FTX customer deposits to support his Alameda Research hedge fund, buy real estate and make millions of dollars in political contributions, in what prosecutors have called a fraud of epic proportions.

Judge Lewis Kaplan set a trial date for 2 October.

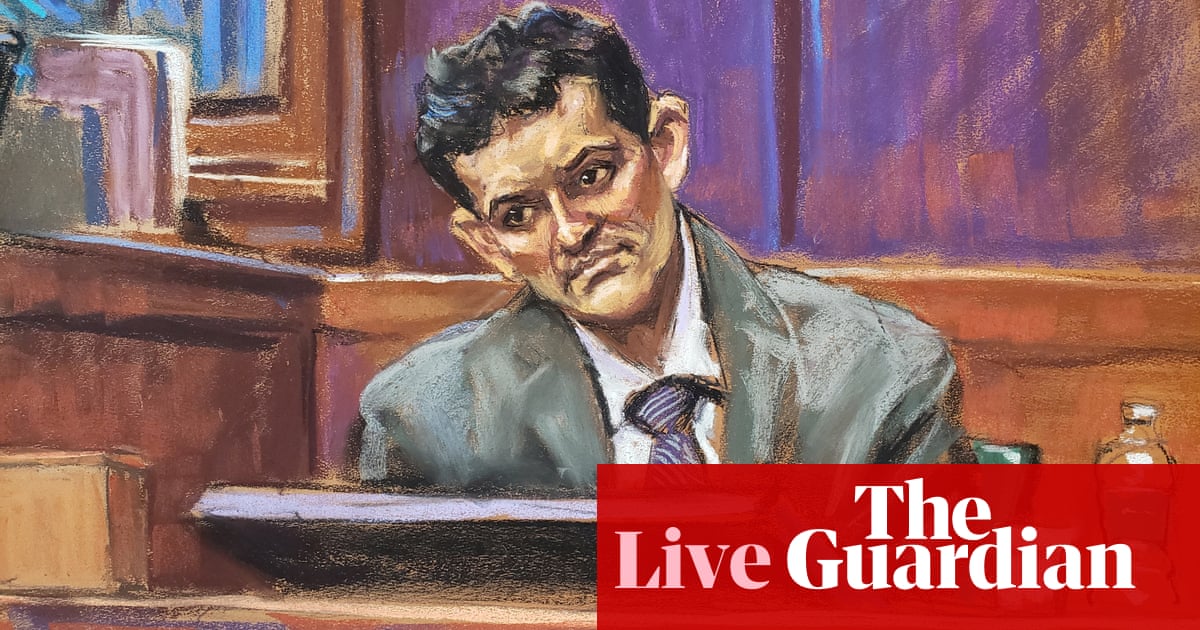

Bankman-Fried, eschewing his usual shorts and T-shirt for suit and tie, sat quietly through the short hearing in Manhattan, occasionally leaning over to talk to his lawyers.

It is not unusual for criminal defendants to initially plead not guilty. Defendants are free to change their plea at a later date.

Two senior co-workers, Alameda chief executive Caroline Ellison, and FTX co-founder Gary Wang, have pleaded guilty to criminal charges being slapped with civil and criminal charges alleging fraud and conspiracy.

The agreements indicate the pair have agreed to cooperate fully with the government. At a hearing last month, Ellison apologized to FTX customers and investors, saying she knew what she did was wrong.

“He has to plead not guilty in his first appearance in front of a district court judge,” said Jeffrey Lichtman, an experienced defense lawyer in New York. “It’s clear that the government is not going to be using him to cooperate against them, so he’s clearly working on something else. Why else would the government consent to a bail package for public enemy No 1?” Lichtman said.

Bankman-Fried has been free on $250m bond following his extradition last month from the Bahamas, where he lived and where the exchange was based. On Tuesday, Bankman-Fried’s lawyers asked the court to keep confidential the identities of two people of “considerable means” who have agreed to help secure his bail. The judge agreed but said he would revisit the decision if there were objections.

The judge also agreed to the prosecution’s request to extend Bankman-Fried’s bail conditions and ban him from accessing or trading any FTX or Alameda assets.

Prosecutors say that from 2019 through November, Bankman-Fried misled investors on the financial condition of Alameda, and defrauded the Federal Election Commission by funneling $70m in illegal contributions to political candidates.

A parallel civil complaint, filed by the US Securities and Exchange Commission, contends that Bankman-Fried used FTX customer deposits to Alameda as a “personal piggy bank” for investments, political donations and real estate purchases. The Commodity Futures Trading Commission has filed a complaint accusing Alameda and FTX of derivatives fraud.

Bankman-Fried was ordered to stay in his parents’ home in Palo Alto, California, as a condition of his release. He was also required to undergo drug and mental health counseling, and refrain from any business transactions over $1,000.

His negotiated release – by some estimation saving the government a protracted extradition fight in exchange for staying out of Brooklyn’s much-feared Metropolitan detention center – has infuriated victims of the alleged fraud.

Bankman-Fried has admitted to making mistakes running FTX but said he did not believe he was criminally liable.

In a series of rambling interviews, before he was detained and returned to the US by an FBI extradition team, he blamed the loss of funds on bad record-keeping and a bank-account issue that allowed Alameda to cover losses with FTX funds.

The 30-year-old crypto mogul rode a boom in the value of bitcoin and other digital assets to become a billionaire several times over and an influential political donor in the United States, until FTX collapsed in early November after a wave of withdrawals. The exchange declared bankruptcy on 11 November.

Bankman-Fried’s net worth, once estimated at $26bn, was largely wiped out when the exchange collapsed. He later said that he had $100,000 in his bank account.

FTX’s new chief executive, John Ray, known for his work on energy company Enron Corp’s bankruptcy, has said FTX was run by “grossly inexperienced” and unsophisticated people.

Ray has called FTX’s collapse one of the worst business failures he has seen complicated by an “unprecedented lack of documentation”.

He told a congressional committee that the problems at FTX were a cumulation of months or years of a company operating with little to no oversight. “Literally, there’s no record-keeping whatsoever … a multibillion-dollar company using QuickBooks.”