Economies have been slowly recovering despite the impact of pandemics, but strict lockdowns in China following a return of COVID-19, continuing high inflation and the conflict in Ukraine have negatively influenced global GDPs more than anticipated, with the Organisation for Economic Cooperation and Development releasing global annual growth forecasts of 2.2 percent.

Some GDPs, such as the UK’s, are predicted to at best flatten. Germany and Russia, unsurprisingly, are negative. However, the Middle East, India, China and Indonesia do show reasonable growth. Saudi Arabia is, according to the OECD, projected to grow its GDP by 6 percent.

Anthony Scaramucci, previously of Goldman Sachs and briefly director of communications under the Trump administration, agrees with this positive view of recovery in the East. In an interview with Arab News’ “Frankly Speaking,” he sees this as a positive time for the Middle East. His assessment is that while the macro-economic situation has slowed, the enthusiasm for investment, particularly from US investors in the Middle East, is short-term and over the next 10 to 15 years there will continue to be exponential growth in global investment in the region. When speaking of the UAE, he said that it “was an important crossroads of capital and an epicenter of innovation.”

Scaramucci highlighted the US Federal Reserve’s rapid rate increase of 500 basis points over 21 months, which the Fed chairman claims will end at 5.1 percent by December, lowering to 3.1 percent by 2025. In addition to this, uncertainty has made investors cautious. However, they are willing to invest as they see some safe returns, so a 3.5-4.5 percent return with no risk is favorable to a risk of investment collapse. But this has meant smaller, close-to-home investments. However, with the higher price of oil during the current conflict and with the proactive innovations that the GCC is taking while the rest of the world is recovering financially, the Middle East is likely to come out of this situation in a strong position and be ripe for investment.

By becoming both a business hub and an advanced, modern tourist hub, centrally located between Asia, Europe and Africa, the Middle East could ride this economic downturn well.

Dr. Bashayer Al-Majed

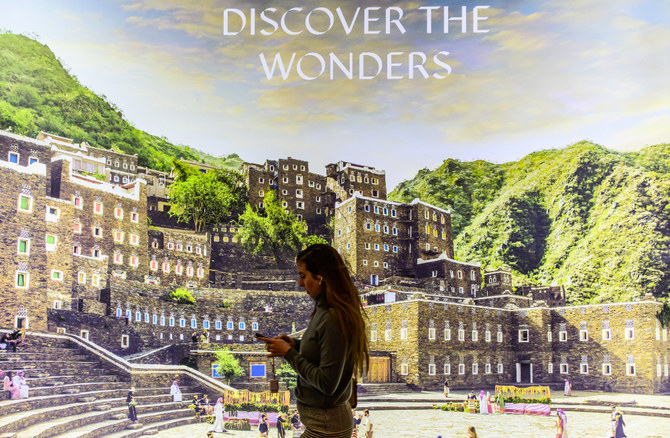

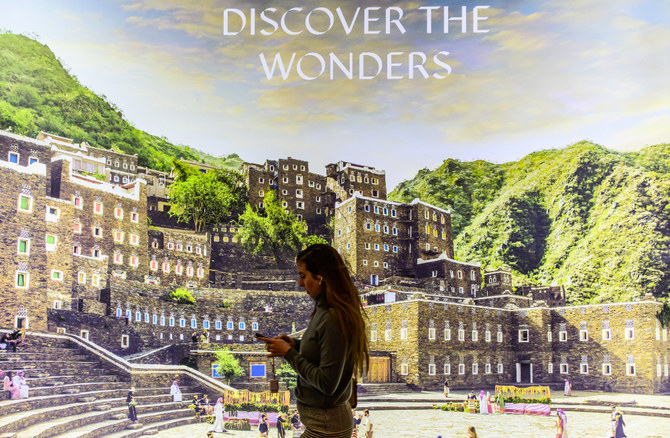

Scaramucci is obviously well versed in the Middle East and each country’s strategies to build and reform their economies. As well as speaking of the positive legal reforms, both social and environmental, he spoke with great interest and affirmation about the new focus on tourism and the showcasing of the wonderful cultural history of Saudi Arabia and the Middle East. Saudi Arabia is putting a lot of investment into restoration of its art, culture and history — in 2019 the Kingdom committed $25 million to UNESCO to gain World Heritage site status and contribute toward the UN’s sustainability goals. This is part of a general move by the UN among the G20 to encourage “more sustainable societies and economies” to re-establish tourism following the pandemic. Scaramucci sees how the Middle East is opening up to the world and also sees the value of schemes such as Shareek, which was activated at the start of this month, whereby the government actively supports the private sector to aid innovation and investment as a boost to the economy and to encourage economic diversification.

Scaramucci’s insight was that the best governments implement a simple model: Low taxation, an effective strategy to enable private enterprise, encouraging investment and innovation, and abiding by and enforcing the law. This provides a safe environment for foreign investors in which their investments are both encouraged and protected.

Regarding the tensions between the US and the GCC, he reminded the audience that governments need to put aside this recently acquired sense of “tribalism” and polarised thinking. Our countries do indeed have a lot to share and gain from one another. For the past 80 plus years we have worked together, liaising on intelligence, the economy and defense. In the long-term, we thrive better under a “spirit of cooperation (and are) more prosperous together.”

The Middle East has a strong chance to build and develop with international investment. By becoming both a business hub and an advanced, modern tourist hub, centrally located between Asia, Europe and Africa, it could ride this economic downturn well.

• Dr. Bashayer Al-Majed is a professor of law at Kuwait University and a visiting fellow at Oxford.

Twitter: @BashayerAlMajed