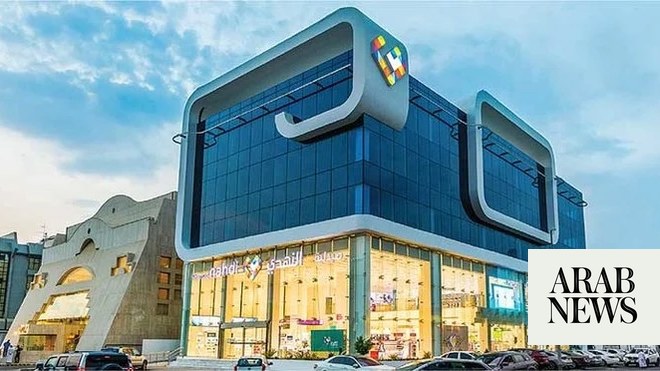

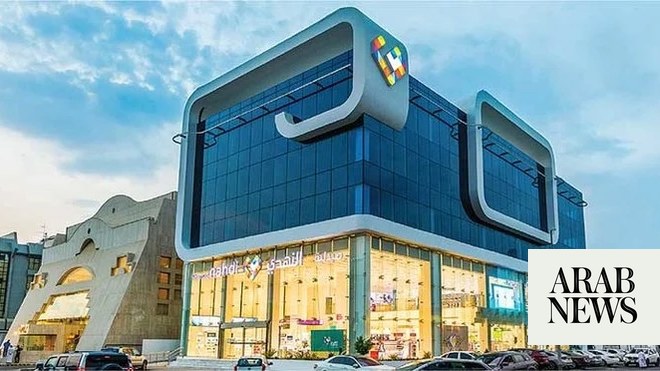

RIYADH: Nahdi Medical Co., one of Saudi Arabia’s leading retail pharmacy chains, posted SR888 million ($236.40 million) in net profit for the fiscal year 2022, recording a 9.3 percent rise over the previous year.

The company recorded revenue of SR8.6 billion for 2022, representing a 6.8 percent increase over the previous year.

Nahdi’s gross profit for 2022 increased by 6.5 percent to reach SR3.52 billion, compared to last year. This helped the company deliver a gross margin of 40.9 percent maintaining the same level in 2021.

During last year, Nahdi maintained a zero-debt position and strong cash generation, with cash and cash equivalents sitting at over SR1 billion as of year-end.

Nahdi’s board of directors also declared a 30 percent cash dividend for the second half of 2022, at SR3 per share, the company said in a statement to Tadawul.

According to the company’s CEO, Nahdi’s growth was primarily driven by the strong performance of the pharma segment and other strategic initiatives.

Speaking to Arab News Yasser Joharji said: “2022 was a special year in the history of this company. We reached a very important milestone when we got listed on the Saudi Stock Exchange (Tadawul). It was also a very important year because it was the first in our five-year strategy. We have managed to really score well and sometimes even exceed our five-year key performance indicators and strategy.”

He said Nahdi has been able to grow its pharmacy business by serving its guests everywhere in Saudi Arabia with world-class products and solutions.

“We have enhanced the shopping experience we provide guests by building more than SR1 billion private label business and by adjusting our expansion plan to make it a better hybrid model between brick and mortar and online, which we call the omnichannel,” he explained.

According to Joharji, Nahdi’s online business exceeded the SR1 billion mark. In addition, the company continued opening bigger pharmacies that provided its guests with a better experience while closing the smaller boxes that were in neighborhoods.

“This move enriched the experience of our guests, and they voted back for us by higher net promoter score and customer or guest satisfaction,” he added. “That definitely reflected into share gain in most of the sectors we are operating in.”

“We also added a new revenue stream to the business by providing our guests with global products delivered to their doorsteps through a program called Global Nahdi Service,” he continued. “And this is something that we believe is going to have a very important strategic role in the future for the business growth.”

Joharji explained that all of the above gave Nahdi enough ammunition to invest in new growth drivers like omnihealth. “A few years ago, we decided we wanted to get into omnihealth and we want to be the gateway for the primary healthcare in Saudi Arabia with a development of a mix that is a blend between polyclinics, which is brick and mortar, and digital services,” he said.

He added: “Basically our core pharmacy business is doing very well. We are focused on the guest. We continue to add beats to our guests" lives. We are investing in what will enable us to have higher profitability.”

With regard to investment, Joharji continued that Nahdi is also “invested in the omnihealth, which is the future.” In addition, he added that the company is investing in the supply chain and digital capabilities that will enable it to continue growing.

“Even our brick-and-mortar traditional pharmacies have been empowered with digital solutions to serve our guests better,” he explained.

“Last but not least, in our type of businesspeople are the key most important pillar for success, Joharji concluded. “So, we continue investing in building our people’s capability, attracting talent, and continue providing them with the best culture and environment to work and prosper.”