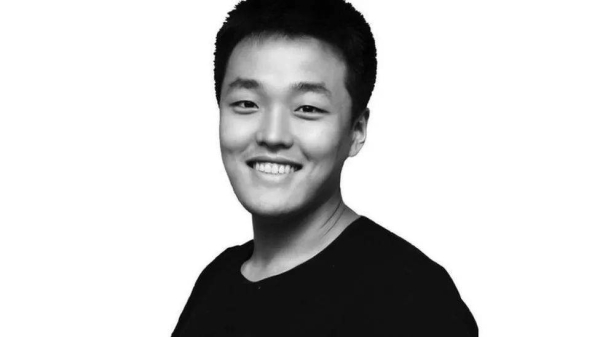

A man suspected of being the fugitive South Korean cryptocurrency entrepreneur Do Kwon, accused of orchestrating a multi-billion-dollar fraud that shook global crypto markets last year, has been arrested in Montenegro.

“Montenegrin police have detained a person suspected of being one of the most wanted fugitives, South Korean citizen, co-founder and CEO of Singapore-based Terraform Labs,” the interior minister, Filip Adžić, tweeted late on Thursday.

He said the suspect had been arrested at the airport in the capital, Podgorica, after being found carrying “falsified documents”. “We are waiting for official confirmation of identity,” Adžić added.

In a statement, Montenegro’s interior ministry said two suspects were detained trying to board a plane to Dubai at Podgorica airport after police found forged Costa Rican and Belgian passports.

South Korea asked Interpol in September to circulate a “red notice” for the 31-year-old across the agency’s 195 member nations.

Kwon and five others connected to Terraform are wanted for fraud and the implosion of its digital currencies in May 2022.

TerraUSD was designed as a “stablecoin”, which is pegged to stable assets like the dollar to prevent drastic fluctuations in prices.

However, about $40bn in market value was erased for the holders of TerraUSD and its floating sister currency, Luna, after the stablecoin plunged far below its $1 peg in May last year.

In February, the US Securities and Exchange Commission filed a civil lawsuit against Kwon and Terraform Labs in Manhattan federal court, accusing them of “orchestrating a multi-billion-dollar crypto asset securities fraud”.

Stablecoins are designed to have a relatively fixed price and are usually pegged to a real-world commodity or currency.

Many investors lost their life savings when Luna and Terra entered a death spiral, and South Korean authorities had opened multiple criminal probes into the crash.

Cryptocurrencies have come under increasing scrutiny from regulators across the globe following a string of recent controversies, including the high-profile collapse of the crypto exchange FTX.

FTX and its sister trading house, Alameda Research, went bankrupt late last year, dissolving a virtual trading business that had been valued by the market at $32bn.

The fall of FTX has caused major doubts about the long-term viability of cryptocurrency and heaped stress on further platforms and entities that rode the success of bitcoin and other currencies.

To add to its mounting woes, the digital currency sector has also been hit hard by the demise of US crypto lenders Silvergate and Signature amid a string of banking failures that have rattled global markets and sparked fears of future economic turmoil.