RIYADH: Pre-arrival clearance accounted for 33 percent of all customs transactions in Abu Dhabi for the first quarter of the year – up from 23 percent in the same period of 2022.

The General Administration of Abu Dhabi Customs announced the figures, which also showed that at airports 45 percent of the clearances were pre-arrival, with 31 percent at land ports and 9 percent at seaports.

The pre-arrival clearance rate for shipments out of the country in the first quarter reached 47 percent of the total registered exit data, compared to 38 percent in the same period last year.

Pre-arrival processing involves the electronic submission of the relevant goods or cargo declaration data to the customs authorities before import or export of goods.

“The growth of pre-arrival clearance transactions since the beginning of 2023 is a product and reflection of the strategic transformation journey at the level of Abu Dhabi Customs,” said Mubarak Matar Al Mansoori, executive director of the Customs Operations Sector.

Masdar achieves financial close on three solar projects in Uzbekistan

Abu Dhabi Future Energy Co. has announced it has reached financial close on three solar photovoltaic projects it is developing in Uzbekistan.

Construction will begin imminently on the plants, which will have a combined capacity of around 900 megawatts – the largest solar development program in the region.

FASTFACT

Pre-arrival processing involves the electronic submission of the relevant goods or cargo declaration data to the customs authorities before import or export of goods.

The Asian Development Bank, Asian Infrastructure Investment Bank, the European Bank for Reconstruction and Development and the European Investment Bank are financing the projects.

“Reaching this milestone for all three projects is a proud moment for Masdar and a key stage for Uzbekistan’s clean energy journey,” said Niall Hannigan, the chief financial officer of Masdar.

National Bonds books 15% growth in 2022

UAE savings and investment firm National Bonds registered a 15 percent growth to 13.7 billion dirhams ($3.7 billion) in 2022.

According to the state news agency WAM, the company maintained competitive earnings last year by offering up to 5 percent returns in 2022, among the highest rates in the UAE.

The strong growth in 2022 was attributed to several of its initiatives, such as the Golden Pension Plan, Global Savings Club and Sukuk Al Waqf.

Khalifa Al Daboos, chairman of National Bonds, said: “The growth in savings, during the last years, has demonstrated a remarkable shift in the culture of saving to become a daily practice, with more than 196 thousand transactions made so far.”

Since its inception in 2006, National Bonds has created 206 millionaires and distributed approximately 2.47 billion dirhams in returns, including over 731 million dirhams as the total value of prizes.

Al Ansari shares open 16% higher in debut trading

UAE’s Al Ansari Financial Services’ shares opened over 16 percent higher on its debut at the Dubai Financial Market on Thursday following an initial public offering in which the exchange house raised 773 million dirhams.

Shares opened at 1.20 dirhams compared with the IPO price of 1.03 dirhams per share. It is currently trading at 1.21 dirhams.

Earlier on Thursday, the company said it had appointed BHM Capital Financial Services as a liquidity provider for its shares on DFM.

UAE based investment platform signs MoU with UNWTO

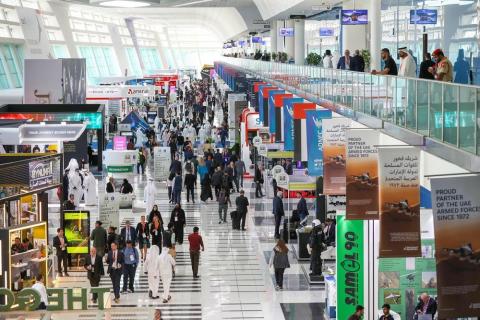

The UN World Tourism Organization signed a memorandum of understanding with the business platform Annual Investment Meeting to strengthen cooperation around shared interests in investments.

The two parties will work together to harness the power of tourism to drive global development and accelerate the implementation of the 2030 agenda and the Sustainable Development Goals.

The collaboration aims at investment facilitation and promotion to disseminate knowledge regarding investment policies among stakeholders and networks and maximize foreign direct investments’ positive economic impact on the sector.

The partnership will also spearhead the Tourism Investment Forum on the framework of the upcoming AIM Global 2023 in Abu Dhabi on May 8-10.