RIYADH: Foreign investments in Saudi Arabia grew 2 percent in 2022 to SR2.4 trillion ($640 billion) compared to SR2.36 trillion in 2021, reported the Saudi Central Bank, also known as SAMA.

The SAMA report pointed out that foreign direct investments accounted for 42 percent of the total foreign inflow in the Kingdom, equivalent to SR 1.01 trillion.

It further revealed that portfolio investments constituted SR822.8 billion in 2022, while others stood at SR572.3 billion.

The Kingdom has been witnessing a steady rise in foreign investments since the launch of Vision 2030 in 2016, a program aimed at diversifying the Kingdom’s economy which has been dependent on oil for several decades.

In 2016, foreign investments in the Kingdom were worth SR1.26 trillion and within six years, the figure has almost doubled, which strongly indicates the growing investor appetite in the Kingdom.

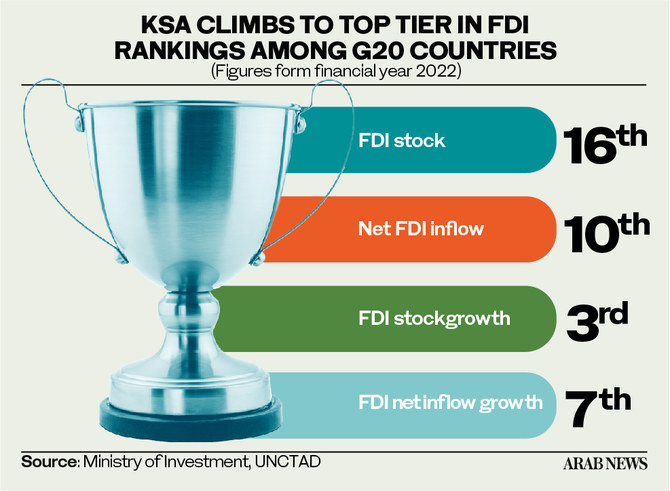

Earlier this month, Saudi Arabia bagged the third spot in the Middle East and sixth globally in the Emerging Markets ranking of the 2023 Foreign Direct Investment Confidence Index released by Kearney, affirming the high investor confidence in the Kingdom.

The study noted that the Kingdom procured good scores in the index due to its strong and growing technological and innovation capabilities, a highly collaborative approach to public-private investment, the sustained fiscal windfall from solid oil revenue and the recovery of the tourism sector following the significant pandemic-induced disruption.

In March, Saudi Arabia’s Minister of Investment Khalid Al-Falih said that multinational companies relocating their headquarters to Saudi Arabia in 2023 to secure government contracts could get tax exemptions.

Al-Falih further clarified that the operations of multinational firms outside Saudi Arabia would be taxed in those entities’ country of operations and would not be intermingled or mixed with the regional headquarters in the Kingdom.

“We realized that we had to do everything we can through policy and regulation to ensure that the companies will not incur additional risks or costs from the alternative jurisdictions for managing their regional operations and the biggest one, of course, is taxation,” he said.