WASHINGTON: Ratings agency Fitch placed the US’ credit on watch for a possible downgrade on Wednesday, raising the stakes as talks over the country’s debt ceiling go down to the wire, and also adding to the jitters in global markets.

Fitch put the country’s “AAA” rating, its highest rank, on a negative watch in a precursor to a possible downgrade should Congress fail to raise a $31.4 trillion cap on government borrowing, a move that could trigger economic calamity and panic on global financial markets as early as next week.

A downgrade could affect the pricing of trillions of dollars of Treasury debt securities. Fitch’s move revived memories of 2011, when S&P downgraded the US to “AA-plus” and set off a cascade of other downgrades as well as a stock market sell-off.

Fitch’s announcement came after the managing director of the International Monetary Fund, Kristalina Georgieva, tried to strike an optimistic tone on Wednesday. She said she was confident the US would avoid a debt default.

On Thursday, stocks in Asia fell as investors remained wary of risky assets due to the hit the global economy will take if the US government defaults. Treasury bills maturing around June 1, the so-called X-date when the government runs out of money, have been under pressure for weeks and came in for further selling, pushing yields on securities to 7.63 percent.

“It’s not entirely unexpected given the shambles that is the debt ceiling negotiations,” said Tony Sycamore, an analyst at IG Markets in Sydney. “This is not a great sign.”

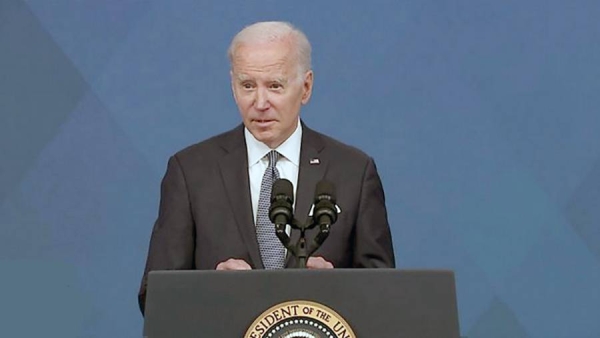

President Joe Biden’s administration and congressional Republicans are at an impasse over raising the $31.4 trillion debt ceiling, and Fitch said its rating could be lowered if the US does not raise or suspend its debt limit in time.

“Fitch still expects a resolution to the debt limit before the X-date,” the credit agency said in a report.

“However, we believe risks have risen that the debt limit will not be raised or suspended before the X-date and consequently that the government could begin to miss payments on some of its obligations.”

Fitch said that the failure to reach a deal “would be a negative signal of the broader governance and willingness of the US to honor its obligations in a timely fashion,” and would be unlikely to be consistent with a “AAA” rating.

A US Treasury spokesperson called the move a warning and said it underscored the need for a deal. The White House said it was “one more piece of evidence that default is not an option.”

Speaking at the Qatar Economic Forum in Doha, the IMF chief was hopeful the White House and Capitol Hill would strike a deal.

“History tells us that the US would wrestle with this notion of default ... but come the 11th hour it gets resolved and I have confidence we will see that play again,” Georgieva said.

Finance ministers from Saudi Arabia and Qatar, who joined Georgieva for the panel discussion, agreed that a resolution was needed sooner rather than later.

“I hope wisdom will prevail and prevail sooner (rather than later)... it is not easy to play with the international markets, and when they catch a cold, everybody will sneeze,” Saudi Finance Minister Mohammed Al-Jadaan said.

Georgieva said that the US dollar is likely to remain a global reserve currency despite increasing discussion on moves by countries to reduce their reliance on the greenback, known as “de-dollarization.”

“We don’t expect a rapid shift in (dollar) reserves because the reason the dollar is a reserve currency is because of the strength of the US economy and the depth of its capital markets. Don’t kiss your dollars goodbye just yet,” Georgieva said.

Rating watch

Fitch’s “rating watch” indicates that there is a heightened probability of a rating change.

Fitch now predicts that the US government will spend more than it earns, creating a deficit of 6.5 percent of the country’s total economy in 2023 and 6.9 percent in 2024.

Among the other credit rating agencies, Moody’s also has an “Aaa” rating for the US government with a stable outlook — the highest creditworthiness evaluation Moody’s gives to borrowers.

S&P Global’s rating is “AA-plus,” its second highest. S&P stripped the US of its coveted top rating over a debt ceiling showdown in Washington in 2011, a few days after an agreement that the agency at the time said did not stabilize “medium-term debt dynamics.”

Moody’s previously said it expects the US government will continue to pay its debts on time, but public statements from lawmakers during the debt ceiling negotiations could prompt a change in its assessments.