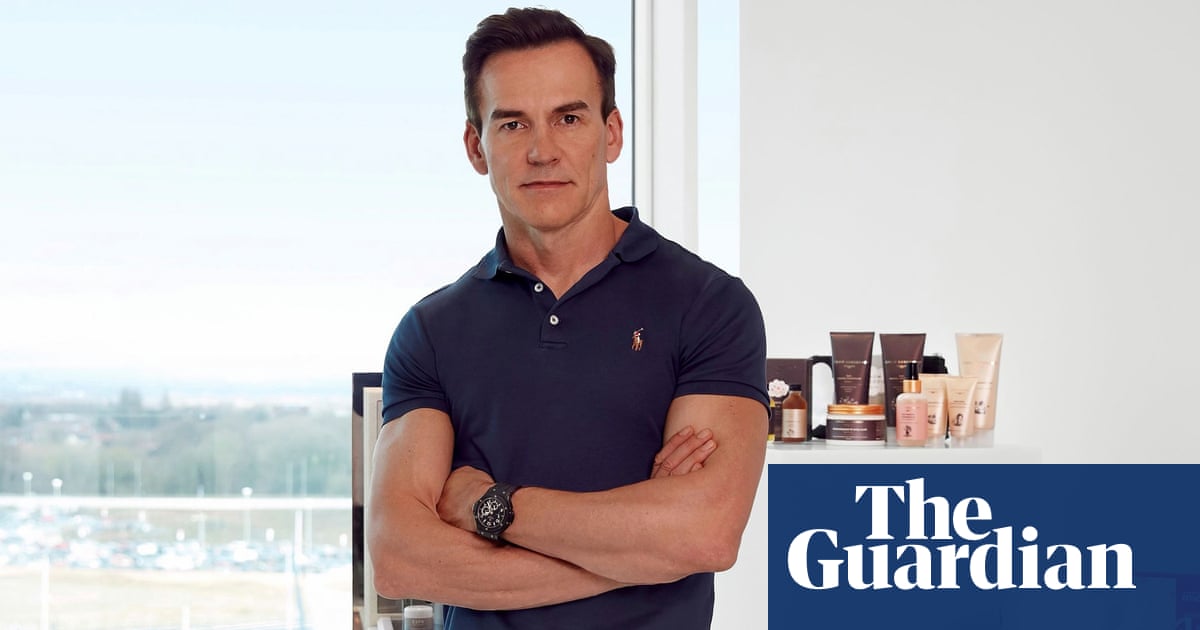

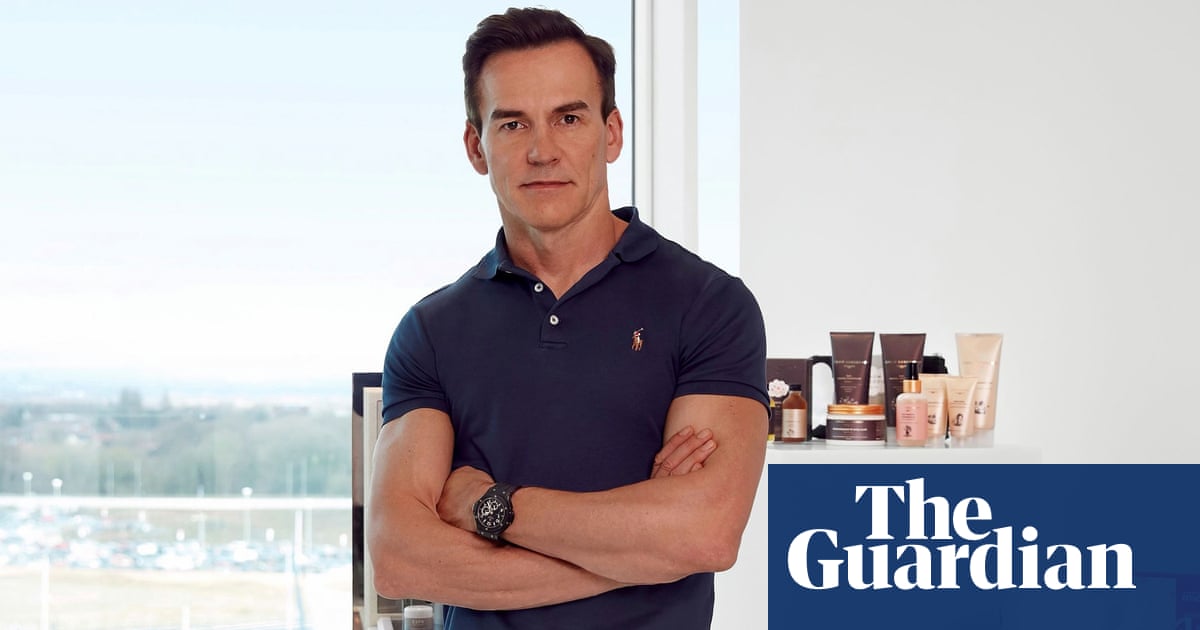

Matt Moulding, the founder and chief executive of the online retail platform THG, has given up his “golden” share allowing him to block any attempt to takeover the company, months after he was due to surrender it.

THG – formerly known as The Hut Group and the owner of retail sites LookFantastic, Glossybox, Zavvi and Coggles – first pledged to cancel Moulding’s controlling share in October 2021, after a disastrous investor presentation triggered a 35% one-day crash in its share price.

Before its annual investor meeting on Wednesday, THG said Moulding had “transferred” his special share that had given him power to veto hostile takeovers. The share will be cancelled by the company.

Moulding’s “golden” share had long been contentious, and the company had originally said it would be cancelled during 2022, “in furtherance of good corporate governance”.

The move came as Manchester-based THG, which also owns the MyProtein brand, forecast an increase in first-half profits thanks to a strong performance from the nutrition part of its business.

The company is now predicting adjusted pre-tax profit of between £44m and £47m for the first half, compared with £32.3m a year earlier.

THG’s shares rose 2% to 75p in early trading on Wednesday – but about 90% has been wiped off the company’s market value since it first listed in London in September 2020.

The 2021 announcement that Moulding would relinquish his controlling share was intended to pave the way for THG to apply to switch from a standard stock market listing to a premium one, as is usual.

THG said it still intended to move to a premium stock market listing, but added that the timing was dependent on the final outcome of the review by the financial watchdog, the Financial Conduct Authority, on reform of the listing regime.

The online retail platform said its nutrition division, which sells products including protein shakes, had had a “particularly strong start to the year”, adding that commodity prices would continue to ease, boosting its profit margins in the second half of the year.

THG said it expected to see sales of beauty products and makeup to increase in the second half, as beauty brands once again increased their production.

The company, co-founded in 2004 by Matt Moulding and fellow former Phones4u executive John Gallemore, initially became an investor favourite after floating in London at an opening valuation of £5.4bn.

However, amid continued underperformance, the market value has fallen below £1bn, to about £950m, and shares were recently knocked by THG’s announcement that it was ending talks about a possible takeover bid by Apollo.

The company said last month the private equity company’s offer provided “inadequate valuations” of the retail platform.