The Bank of England has chosen the former head of the US Federal Reserve to lead an in-depth review into forecasting errors that have seen Threadneedle Street persistently underestimate both inflation and growth.

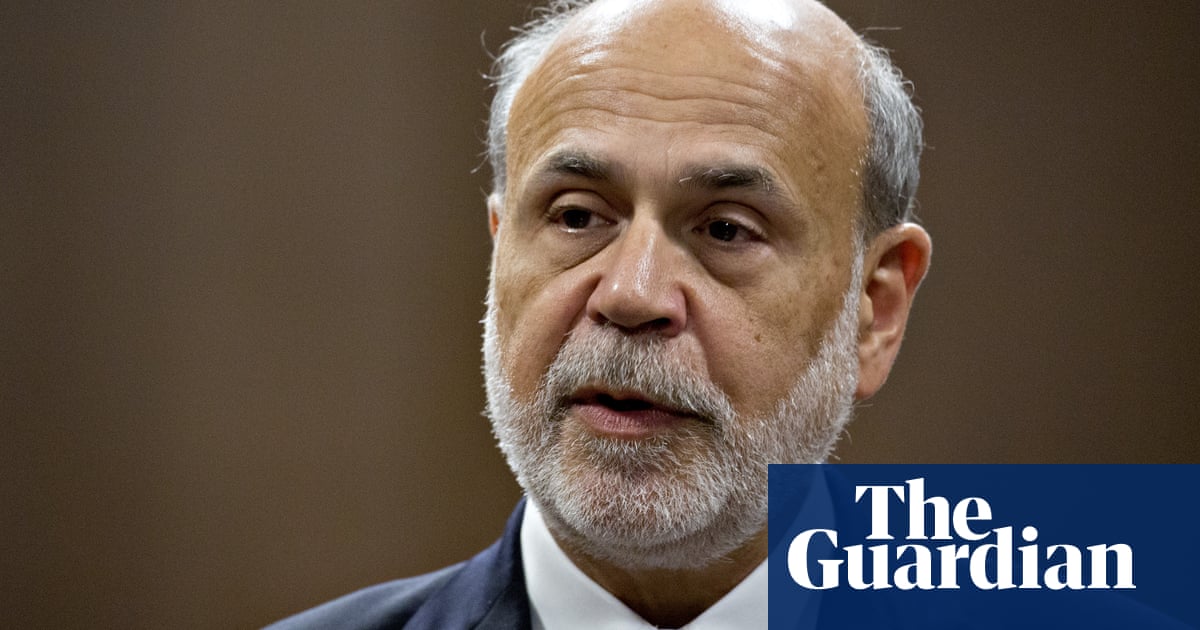

In a sign of the growing pressure on the Bank following 13 successive interest rate increases since December 2021, its governing court has picked Ben Bernanke, one of the biggest names in central banking, to lead a review that was first announced last month.

Andrew Bailey, the Bank’s governor, has faced mounting pressure – including from the all-party House of Commons Treasury select committee – to explain why forecasts have been so wide of the mark.

Announcing Bernanke’s appointment, Bailey said the Nobel prize-winning former Fed chair was a “renowned and award-winning economist whose distinguished career makes him the ideal person to lead this review”.

“The UK economy has faced a series of unprecedented and unpredictable shocks,” he said. “The review will allow us to take a step back and reflect on where our processes need to adapt to a world in which we increasingly face significant uncertainty.”

Bernanke said: “Forecasts are an important tool for central banks to assess the economic outlook. But it is right to review the design and use of forecasts and their role in policymaking, in light of major economic shocks. So I am delighted to be leading this work for the Bank.”

Bernanke was chair of the Federal Reserve from 2006-2014, a period that was dominated by the global financial crisis of 2007-09 in which the US central bank took the lead by slashing interest rates and creating money through the process known as quantitative easing.

The BoE quickly followed suit and – like the Fed – adopted the same course when the global pandemic struck in early 2020. But Threadneedle Street’s forecasting record, particularly since the UK came out of lockdown, has been poor.

In November 2021, a month before it raised interest rates from 0.1% to 0.25%, the Bank said it expected inflation in the fourth quarter of 2022 to average 2.2%, but instead by October last year it had risen to a 40-year high of 11.1%.

A year later, in November 2022, it was predicting the longest recession in 100 years, a downturn lasting seven quarters, but has since said it no longer expects a recession at all.

The Bank’s monetary policy committee will announce its latest decision on interest rates on Thursday, when the financial markets expect a further quarter-point increase in borrowing costs to 5.25%.

Bernanke is expected to publish his report next spring. David Roberts, chair of the Bank’s court, said: “It is crucial that the Bank continuously learns and adapts as an organisation.”