The criminal trial of the former cryptocurrency mogul Sam Bankman-Fried began on Tuesday, with jury selection getting under way in a Manhattan federal court.

Bankman-Fried, who founded the cryptocurrency exchange FTX and associated hedge fund Alameda Research, is facing trial on finance crimes stemming from the shocking collapse of FTX. Before its sudden downfall last year, FTX was valued at around $32bn.

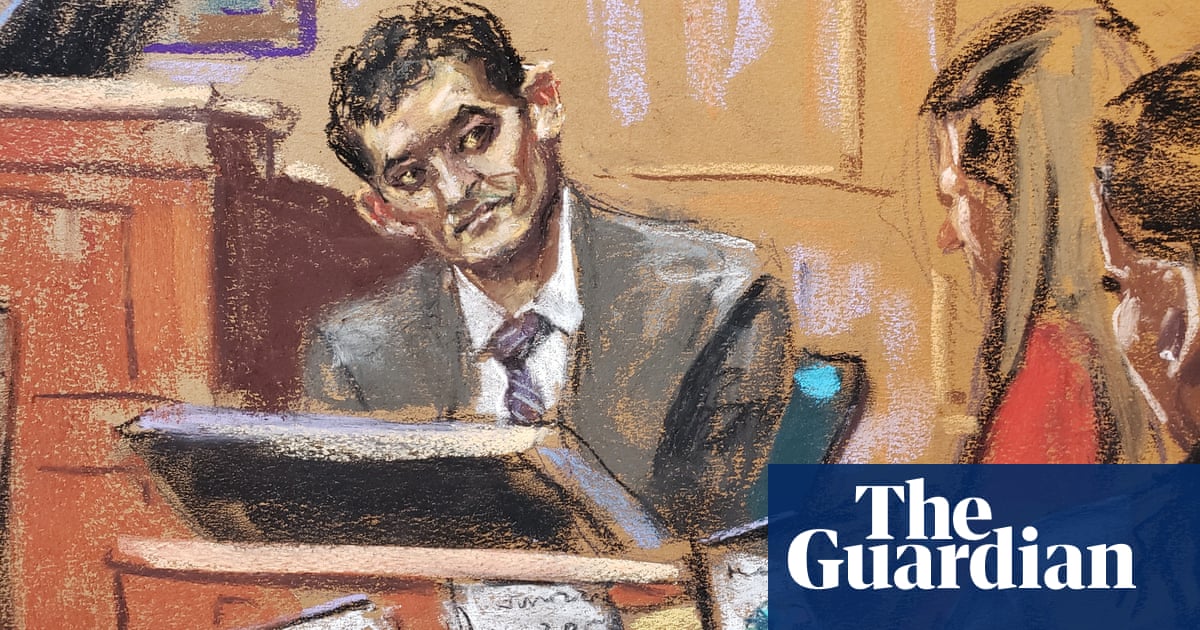

Bankman-Fried entered the courtroom just before 10am. His signature look of baggy shorts and ill-fitting T-shirts had been replaced with a gray suit, and his usually unkempt hair was trimmed down. He nodded to his lawyers and took his seat.

The trial caps off nearly a year of free fall for 31-year-old Bankman-Fried, who had become the face of the crypto industry and a burgeoning political power broker. Bankman-Fried and FTX doled out millions in campaign donations, bought A-list celebrity endorsements and marketed the cryptocurrency brokerage as the future of finance.

After reports last November questioned the financial stability of FTX and Alameda, a run on deposits in the exchange exposed that FTX could not deliver customers their funds and forced the company to declare bankruptcy. Bankman-Fried was arrested in the Bahamas the following month, as the saga decimated public trust in the cryptocurrency industry.

Bankman-Fried faces seven conspiracy and fraud counts for allegedly siphoning billions of dollars in investors’ money into risky trades and other unlawful purposes. The Manhattan US attorney’s office has also accused Bankman-Fried of using customer funds to foot the bill for swelling loan expenses at Alameda, as well as buying up high-priced real estate, funding his pet philanthropy projects and making extensive political donations. If convicted, he could face life in prison.

The trial is expected to last about six weeks, and federal judge Lewis Kaplan will oversee the proceedings. Prosecutors stated during the opening hours of the trial that they had made no offers of a plea deal. Several of Bankman-Fried’s deputies and executives at the exchange, including the former head of Alameda and his on-again, off-again girlfriend, Caroline Ellison, are expected to testify in the trial.

Bankman-Fried appeared alert as the jury selection began, powering up his laptop in front of him and at one point smiling at his lawyer. Despite potentially facing decades of imprisonment, he projected an upbeat demeanor.

On the morning of the trial, about 20 photographers and a few reporters lingered outside the courthouse – a small number for what has been a much anticipated case. Bankman-Fried’s trial began the same day as Donald Trump’s appearance at his civil fraud trial, which drew a much larger media circus nearby.

Trump’s trial caused the proceedings to start late after Bankman-Fried had problems getting from the jail where he is being held to the courtroom on schedule.

“We can thank the delay to what’s going on in the other courtroom nearby,” Kaplan told lawyers on the case as they waited for the defendant.

Prospective jurors were directed into the courtroom at about 10.37am. Bankman-Fried kept his hands in front of him as the first batch filed toward the jury box. After around 50 prospective jurors were sworn in, Kaplan went over the nature of the trial and began questioning those summoned on potential conflicts.

Several prospective jurors said that they had prior knowledge of the case, with one man telling the judge he had learned about it from Joe Rogan’s podcast. A woman who stated that she could be an impartial juror disclosed that her company had previously invested in Alameda and FTX, prompting Kaplan to ask if they made or lost money.

“Lose money,” she said.

Kaplan also addressed prospective jurors who faced scheduling conflicts. A woman who worked as an operations manager said that an event would prevent her from acting as juror in the trial, resulting in Kaplan asking where she worked.

“Ms Universe,” she said.

Kaplan pressed her on the issue. “Um, it’s the pageant,” she replied, adding that the job would require travel to El Salvador.

One man claimed that he couldn’t attend due to financial hardship. Specifically, the man said he “just bought a cello, I’m paying off $600 a month”.

As more prospective jurors entered the courtroom in the afternoon, Bankman-Fried repeatedly turned to watch them each file in. Opening arguments are set to commence later in the week after the jury selection process finishes.

The unraveling of a crypto empire

Bankman-Fried’s high-flying world started to unravel in November 2022 following a report in CoinDesk that Alameda held billions in FTX’s own cryptocurrency, FTT. Alameda allegedly used FTT as backing for large loans. A downward dip in FTT could undermine FTX and Alameda. Adding to the unease: FTT didn’t have value outside of FTX’s vow to buy tokens at $22.

Amid the revelations, the chief executive of top FTX competitor Binance, Changpeng Zhao, tweeted that his firm would sell its $50m in FTT. FTT spiraled and FTX clients pulled their money in the equivalent of a high-tech bank run.

As FTX reeled from a “giant withdrawal surge”, with users scrambling to remove some $6bn in crypto tokens over a mere three days, observers feared the fiasco could prompt an industry-wide collapse reminiscent of the 2008 real estate crisis. FTX filed for bankruptcy protection and Bankman-Fried resigned.

The collapse of FTX caused “billions of dollars in losses to its customers, lenders and investors”, Damian Williams, the Manhattan US attorney, said in December. “This was not a case of mismanagement or poor oversight, but of intentional fraud, plain and simple.”

Federal prosecutors allege Bankman-Fried and several co-conspirators diverted billions for his personal use. While head of FTX, Bankman-Fried had positioned himself as a political megadonor and philanthropist who vowed to save the world from disaster. He appeared on stage with the likes of former leaders Tony Blair and Bill Clinton, while courting lawmakers in Washington.

Federal prosecutors allege that Bankman-Fried and several co-conspirators – among them his sometimes girlfriend, Alameda CEO Caroline Ellison – diverted billions for his personal use.

Ellison, who in December pleaded guilty to her role in the alleged conspiracy, is expected to be the prosecution’s star witness at Bankman-Fried’s made-for-tabloid trial. The proceedings are also poised to provide bombshell details not only on FTX’s crash but also the murky inner workings of crypto trading.

If Ellison’s past statements are any indication, her testimony could well be damning for Bankman-Fried.

Prosecutors have indicated they will bring forward recordings of a 9 November Alameda staff meeting, in which Ellison tried to allay staff concerns.

“Starting last year, Alameda was kind of borrowing a bunch of money via open-term loans and used that to make various illiquid investments … Then with crypto being down, the crash, the – like, credit crunch this year, most of Alameda’s loans got called,” Ellison allegedly said during the meeting. “And in order to, like, meet those loan recalls, we ended up borrowing a bunch of funds on FTX which led to FTX having a shortfall in user funds.”

One employee asked: Who else knew about the exchange’s shortfall in customer money? She named Bankman-Fried. A worker pressed: “Who made the decision on using user deposits?”

“Um … Sam, I guess,” Ellison said.

Bankman-Fried, who remains jailed pending trial, has maintained his innocence. His representative did not comment on the case in advance of the proceedings.

One of the biggest questions hovering over the trial is whether Bankman-Fried will himself testify. It’s rare that defendants take the stand during their trials, as doing so carries the risk that they could incriminate themselves or leave jurors with a bad impression. But Bankman-Fried has been an unusual defendant, appearing to find it hard to stay silent and giving frequent statements to the media following his arrest.

Judge Kaplan ultimately revoked Bankman-Fried’s bail in August, on the grounds that his interactions with the media were an attempt to intimidate witnesses such as Ellison.

Before jury selection started, Kaplan advised Bankman-Fried of his right to take the stand in his own defense.

“You have the right to testify in your own defense in this case and decide whether or not to testify – it’s solely a decision for you,” Kaplan said. “Do you understand this?”

Bankman-Fried leaned forward in his chair, and said “Yes.”