Rupert Murdoch’s News Corp should seek a $7bn (£5.7bn) spin-off of its online property businesses to help increase its market value, according to an activist investor.

The hedge fund Starboard Value, which has been building a stake in News Corp, said that the $12.6bn valuation of the company “does not make sense” and management should look at breaking up the business.

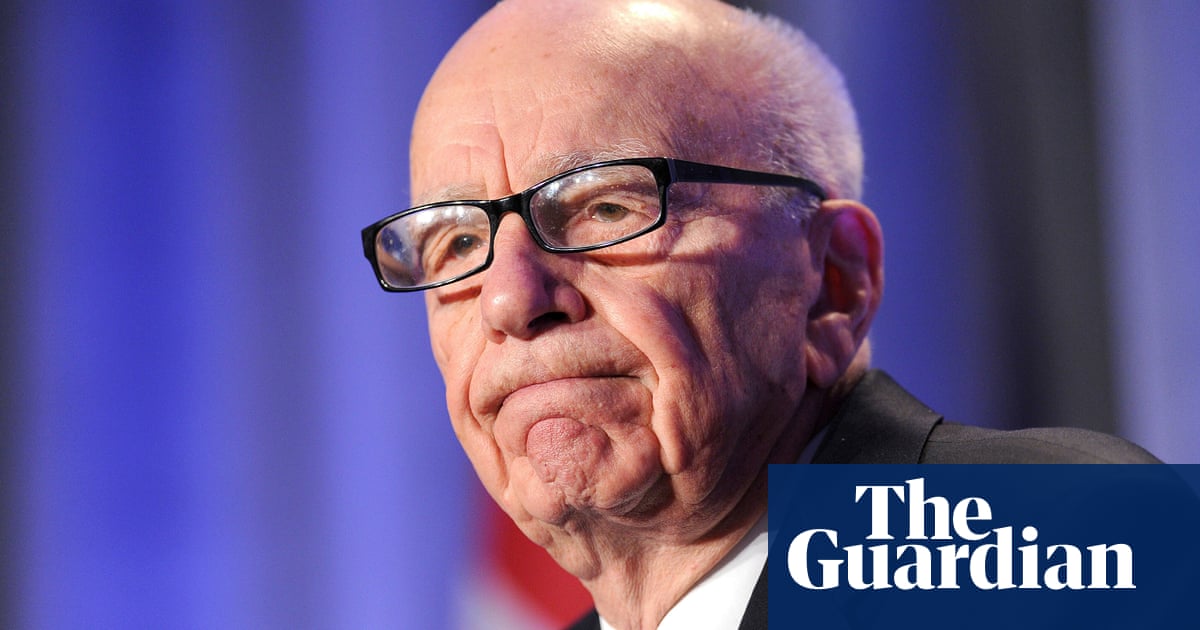

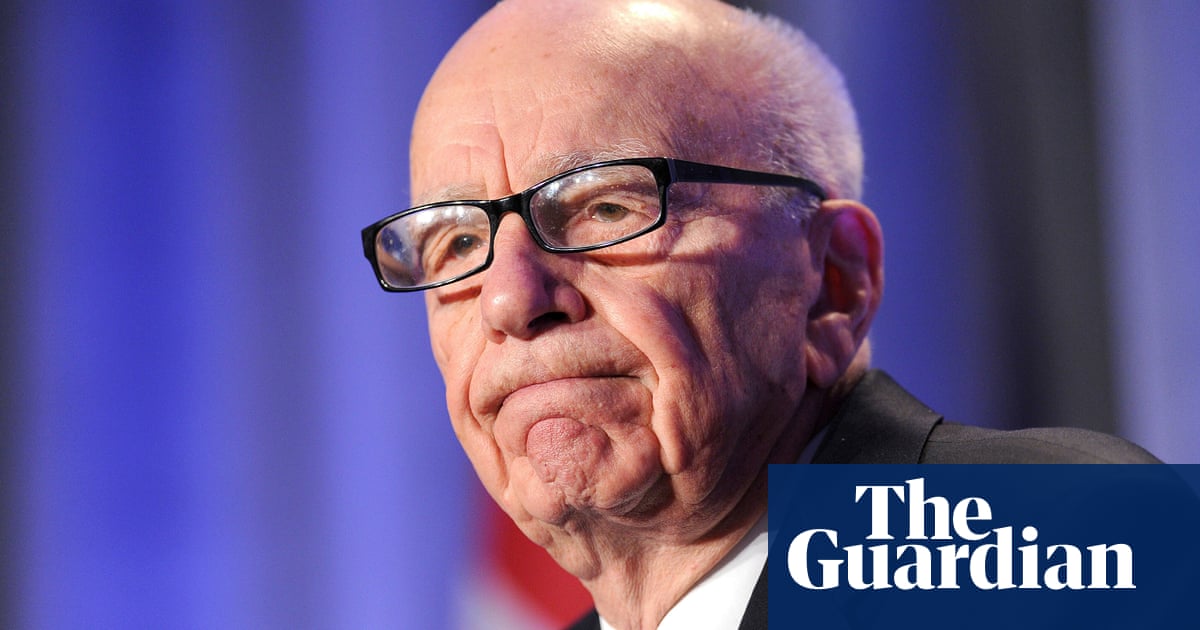

The call comes less than a month after Murdoch announced his retirement from the media empire he built up.

“If News Corp separates the digital real estate assets through a tax-free spin [off] … shareholders will see significant appreciation in the company’s share price,” said Jeff Smith, chief executive of Starboard, speaking on Tuesday.

Starboard estimates that a spin-off of the highly profitable real estate assets – which include Move Inc, the owner of Realtor.com, in the US and an interest in REA Group in Australia – could provide a $7bn windfall for News Corp.

“Our belief is they’re going to want to … separate the digital real estate assets to be able to highlight this beautiful business for what it’s worth,” said Smith, who said he has discussed the plan with News Corp.

After the scrapping in January of Rupert Murdoch’s plan to recombine News Corp and Fox – the businesses were separated a decade ago in the wake of the phone hacking scandal – the company briefly looked at a potential $3bn sale of Move Inc to CoStar Group.

“We have always maintained an active and engaged dialogue with our investors and are committed to driving shareholder value,” said a spokesperson for News Corp. “We remain focused on executing our strategic plan, which has helped us set records in profitability over the past three years. We are proud of our rapid digital transformation and bright prospects for long-term growth and value creation.”

The Murdoch family trust, which is run by Rupert, controls 40% of the voting rights in News Corp and Fox, making activist-led change a very difficult proposition.

In November, Irenic Capital Management said that it valued News Corp at potentially as much as $23bn, with the Wall Street Journal publisher worth as much as $10bn in its own right.

However, the underperforming parts of News Corp drag down its current market value to $12.6bn.

“It’s a great business, a great asset, it’s just too cheap,” said Smith.

He pointed out that News Corp’s news division, which includes the Australian and the New York Post, trades at four times earnings compared with its competitor the New York Times, which trades at 15 times.

He added that the real estate assets trade at eight times earnings.

Lachlan Murdoch, Rupert’s eldest son who took over the running of Fox and News Corp last month, made the company’s first investment in the highly successful REA business in Australia two decades ago.