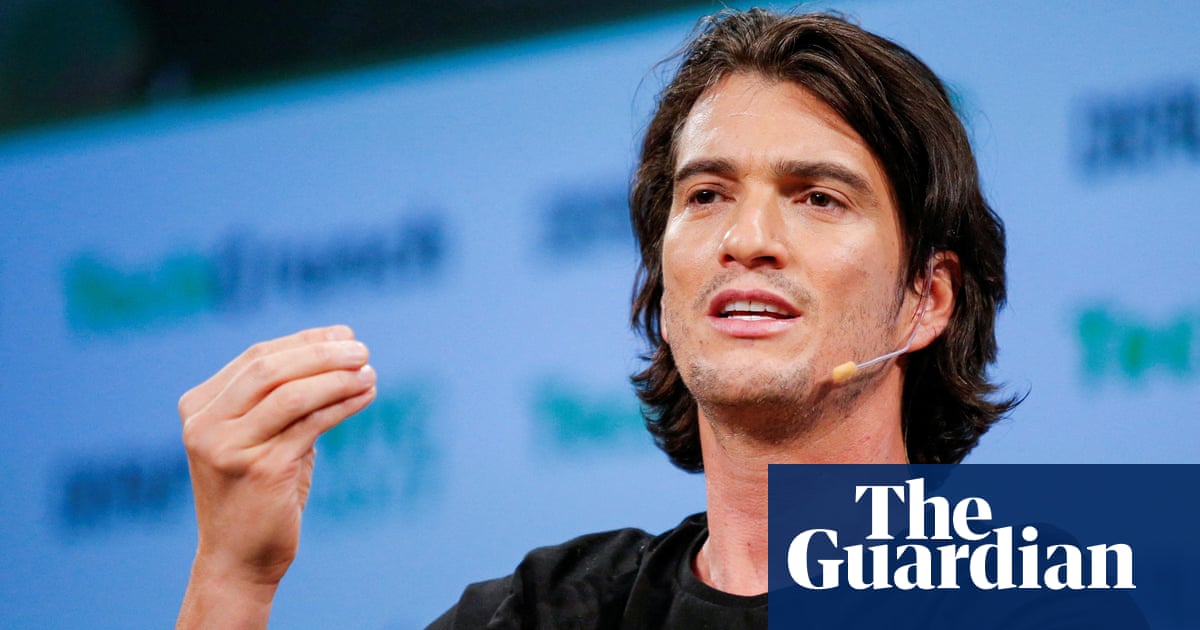

The WeWork co-founder Adam Neumann described reports the shared office provider is preparing for bankruptcy as “disappointing” after trading of its shares was suspended.

Neumann, who built the business into one of the world’s most highly-valued private companies, left four years ago in the wake of a botched bid to take it public, and concern over his management style.

Watching WeWork struggle has been “challenging”, Neumann said on Monday, expressing confidence that it could “emerge successfully” from a reorganization.

Trading in the struggling company’s stock was halted ahead of the opening bell on the New York stock exchange. WeWork, which said last week the company does not comment on speculation after the Wall Street Journal reported it was planning to file for Chapter 11 bankruptcy protection, did not respond to a request for comment.

Neumann built WeWork into a feted start-up, valued at $47bn at its peak on the private market as he pitched it as a technology company, rather than a traditional real estate enterprise. But questions were raised about the company’s fundamentals ahead of its planned stock market debut in 2019, and its valuation fell drastically.

The beleaguered company, which ultimately went public in 2021, has endured a 98% decline in its share price this year, leaving it with a capitalization of less than $50m. In August, it raised “substantial doubt” that it could continue to operate as it grappled with $2.9bn in net long-term debt and more than $13bn in long-term leases.

WeWork has never quite recovered from its crisis in 2019, and the subsequent remote work revolution triggered by the onset of the coronavirus pandemic.

Its attempt to list the company on the New York Stock Exchange as the We Company in 2019 included the filing of a revealing prospectus with the Securities and Exchange Commission that raised questions of the business’s long-term viability, profitability and leadership. The company would not go public for another two years, eventually merging with a “blank cheque” vehicle. Neumann received a $445m payout package on his exit.

Founded in 2010, the company’s business involves taking long-term leases on office buildings and selling short-term memberships to offices geared towards co-working. The company was once valued at $47bn on an investment of $12.8bn, primarily from Japanese multinational SoftBank. After the publication of its S-1 prospectus, however, analysts valued the company at $10bn.

On Monday Neumann, 44, said: “As the co-founder of WeWork who spent a decade building the business with an amazing team of mission-driven people, the company’s anticipated bankruptcy filing is disappointing.

“It has been challenging for me to watch from the sidelines since 2019 as WeWork has failed to take advantage of a product that is more relevant today than ever before. I believe that, with the right strategy and team, a reorganization will enable WeWork to emerge successfully.”

WeWork shuttered dozens of its co-working spaces in response to pandemic lockdowns, when remote working came to dominate co-working. Its commercial real estate portfolio remains vast, however, with about 777 locations across 39 countries as of June. These housed 906,000 desks, according to the company. (Guardian US leases space from WeWork.)

WeWork raced to adapt to a post-Covid world, seeking to position itself as a specialist provider of flexible office space as businesses and their employees weighed how, and where, to work. It remained deep in the red, however, and lost $696m in the first half of this year.

Neumann has already started a new venture. Flow, which raised $350m from the Silicon Valley venture capital firm Andreessen Horowitz last year, is focused on residential real estate.