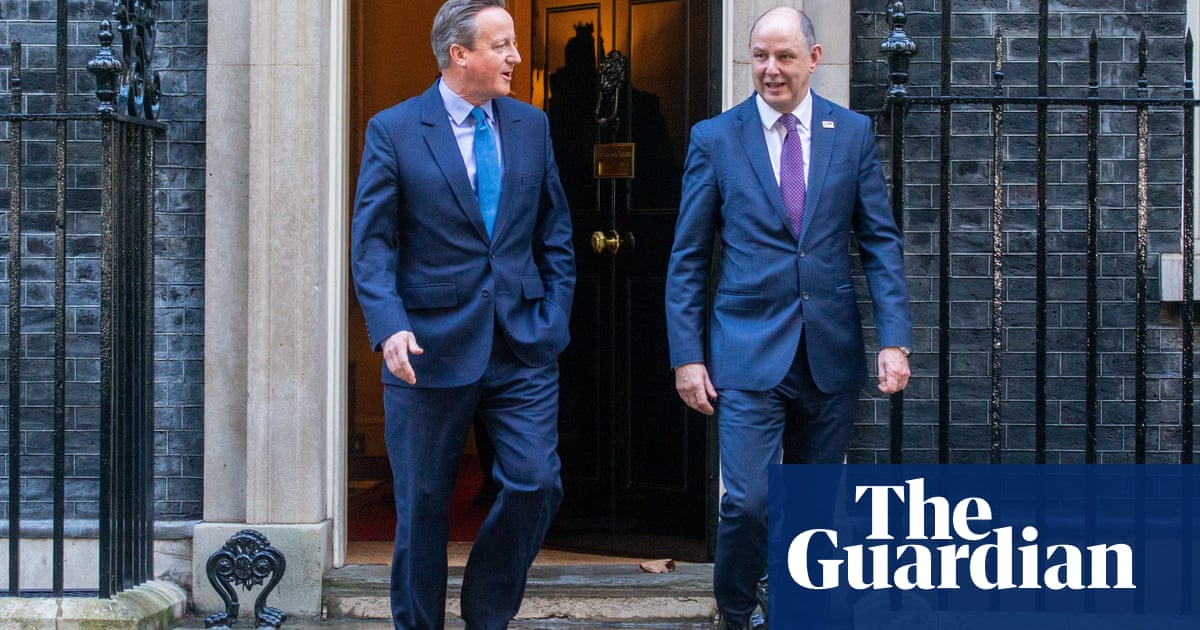

David Cameron’s surprise return to the cabinet as foreign secretary comes just two years after a parliamentary inquiry found he had shown a “significant lack of judgment” over a lobbying campaign for a bank in which he held a personal economic interest.

The former prime minister launched the intensive round of text messages to ministers and high-ranking civil servants at the height of the Covid pandemic on behalf of Greensill Capital, which collapsed the following year.

The Treasury select committee said in July 2021 that it was inappropriate of the ex-prime minister to send 62 messages to former colleagues pleading for them to help the controversial bank, for which he worked and in which he owned stock options that could have been worth tens of millions of pounds.

Cameron, who joined Greensill as an adviser and lobbyist a little more than two years after he left No 10 – placing him just outside the period former ministers are banned from leaving public service – sent ministers and officials dozens of text messages asking for Greensill to be allowed access to the government’s coronavirus loan support scheme.

He sent:

Nine WhatsApp messages to the then chancellor, Rishi Sunak.

Two WhatsApp messages to Richard Sharp, then adviser to Sunak.

Twelve texts to Sir Tom Scholar, the then permanent secretary to the Treasury.

A dozen texts, emails, phone calls and other messages to the ministers Michael Gove, Matt Hancock, Nadhim Zahawi, John Glen and Jesse Norman.

Cameron often signed off the messages “Love Dc” or with a simple thumbs-up emoji.

In a text message to Scholar on 6 March 2020, when the financial markets were in freefall at the start of the pandemic, Cameron said: “I am riding to the rescue with supply chain finance with my new friend Lex Greensill.”

Cameron also questioned the Bank of England’s response to the mounting crisis, saying that he “never quite understood how [interest] rate cuts help a pandemic”. He added that he hoped to “see you with Rishi’s for an elbow bump or foot tap. Love Dc.”

Greensill Capital specialised in supply chain finance, where businesses borrow money to pay their suppliers. Despite Cameron’s efforts, it never received any money from the Covid scheme and collapsed in March 2021. Its failure was in 2021 estimated by a parliamentary inquiry to have cost UK taxpayers up to £5bn. However, the final burden born by the taxpayer is not yet known.

Founded by Lex Greensill, an Australian banker from farming stock, Greensill drew controversy for its links to the steel and commodities trader Sanjeev Gupta, providing huge sums to his steel and energy empire, including £400m backed by taxpayer guarantees. The Gupta Family Group Alliance, a loose collection of companies headed by Gupta, has been under investigation by the Serious Fraud Office since 2021.

The former prime minister repeatedly refused to tell the committee how much his personal shareholding in Greensill was worth before the bank collapsed.

However, he reportedly told friends that he was granted stock options worth up to 1% of the company. Greensill was hoping to float on the stock market at a $7bn valuation, which would have put a 1% stake at $70m (£51m).

The Treasury committee’s investigation also revealed that Cameron used Greensill’s private jet for a number of flights to Newquay airport in Cornwall to visit his “third” holiday home nearby.

Cameron’s work for Greensill has included lobbying the chancellor, and going camping in the desert with Greensill and Mohammed bin Salman, the Saudi crown prince who was found by the US authorities to have approved the 2018 murder of the Washington Post journalist Jamal Khashoggi inside the Saudi consulate in Istanbul, Turkey.

Greensill is said to have boasted that Cameron helped him bond with Prince Mohammed. The trip to Saudi Arabia came soon after Cameron prompted public outcry with another visit to the kingdom for the October 2019 “Davos in the Desert” summit.

The trip came just days after SoftBank, the investment fund run by Japan’s richest man, Masayoshi Son, announced it was investing a further $655m in Greensill. Softbank’s Vision Fund was one of Greensill’s biggest investors, having invested about $1.5bn before the collapse. The biggest investor in the Vision Fund is Saudi Arabia’s sovereign wealth fund.

The Treasury committee’s report found that Cameron did not break lobbying rules, but said “that reflects on the insufficient strength of the rules”. It said Cameron’s behaviour in the saga highlighted a “strong case for strengthening [the rules]” to prevent former prime ministers from lobbying serving ministers in search of personal economic gain.

“Cameron’s use of less formal means to lobby government showed a significant lack of judgment, especially given that his ability to use an informal approach was aided by his previous position of prime minister,” the report said. “Cameron appears to accept that, at least to some degree, his judgment was lacking.”

At the time, Cameron said: “While I am pleased that the report confirms I broke no rules, I very much take on board its wider points. I always acted in good faith, and had no idea until the end of last year that Greensill Capital was in danger of failure.”

When he resigned as PM and a Conservative MP shortly after losing the 2016 Brexit referendum, Cameron promised he would not become a political “distraction”.

He would, he said, be too busy writing his memoirs in the £25,000 shepherd’s huts at his holiday homes in the Cotswolds and Cornwall.

His book, For the Record, was not a hit with the critics. It sold 65,000 copies in its first year, far below the 350,000 sales of Tony Blair’s book A Journey and less than the 91,500 copies of John Major’s autobiography, according to figures collated by Nielsen Book Research.

He also squeezed in a little public speaking at a rate of £120,000 an hour at the Washington Speakers Bureau.

Cameron also had an advisory role at the software company Afiniti, which he quit in November 2021 after a 23-year-old former employee accused the firm’s multimillionaire founder, Zia Chishti, of sexual assault. Chishti denies those allegations and claims the relationship was consensual.