A growing number of people are committing fraud such as cheating on their council tax or trying to reclaim money on lost gambling bets, research has found.

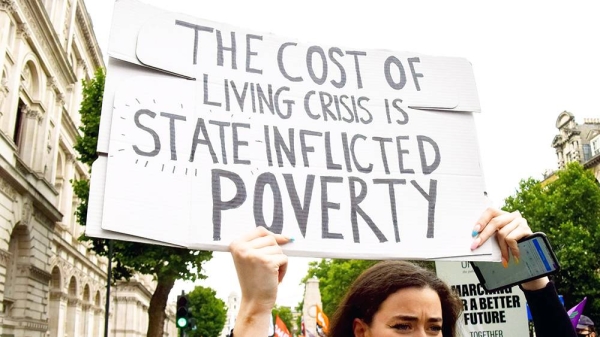

The cost of living crisis has led to a rise in “first-party fraud” where people give false information, or misrepresent themselves, in order to make money, according to the fraud prevention service Cifas.

It says the most frequent offences are claiming for single person’s discount on council tax, and gambling chargeback fraud, where money is claimed back from a bank on legitimate lost bets.

Two years ago, one in 12 people claimed to have committed one, or more, first-party frauds in the previous year. This has now risen to one in eight, according to a Cifas survey.

Its chief executive, Mike Haley, says people may feel that they have no way to avoid fraud as a result of the pressures of the cost of living crisis, but could face severe consequences as a result.

“What might seem like a harmless act, or lie, can have long-lasting consequences for perpetrators, including having their bank account closed, being unable to access financial products and credit, difficulty in finding a job, and, in some cases, a criminal record,” says Haley.

“In the current cost of living crisis we recognise that some individuals may feel that they have no choice but to commit fraud if they want to pay bills or repay debts. Others might feel they are entitled to additional benefits, or that their actions are somehow justified, or become involved with organised crime gangs based on the promise of making extra money.”

Serpil Hall, head of fraud prevention at D4t4 Solutions, a technology firm that deals with fraud and scams, says companies are noticing an increase in first-party fraud as a result of the combination of “desperation and perceived ease”.

It is especially the case with chargeback fraud, or “friendly fraud”, where money is claimed back from a bank on items bought online.

This could be where someone claims they did not receive the goods, even though they did, and subsequently ask for a refund.

“Chargebacks were designed as a consumer protection mechanism, allowing individuals to dispute unauthorised transactions or cases of fraud. However, an alarming trend is emerging, where individuals are exploiting the systems for personal gain,” she says.

The survey found there was a large acceptance of some types of fraud, such as asset conversion, where a vehicle bought on a finance agreement is sold on before the end of the loan.

Other frauds that were thought to be “reasonable” by a significant number of people were “money muling” and falsifying a CV.

Earlier this year, it emerged that a growing number of people aged in their 50s and 60s were acting as “money mules” by allowing their bank accounts to be used to move money illegally.

“[This is] seen as ‘reasonable’ by a fifth of all respondents, but it is a key cog in the wheel of organised crime, [but] facilitating the most insidious criminality, including drug dealing, people trafficking and human slavery,” says Haley.

Hall says that because the crimes typically take place online, there can be “illusion of anonymity and distance from the consequences of these actions, making it easier for some to rationalise such behaviour”.

Cifas wants more to be done so that the public is educated about the serious consequences of committing fraud and to eradicate the perception that it is a victimless crime.

Last month, the banking trade association UK Finance said criminals stole £580m in the first six months of the year, suggesting households are set to lose more than £1bn to fraudsters during 2023.

ID theft, where criminals use their victim’s personal information to either take over existing accounts or to apply for credit cards, saw the biggest increase – up more than 50% to £33m for the six months.