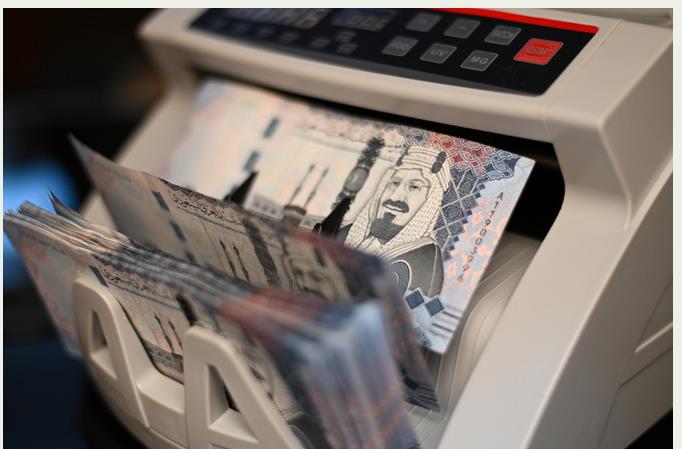

The savings round of Saudi Arabia’s first Shariah-compliant and government-backed sukuk (Sah) for the month of February came to end with a total volume of requests reaching SR861 million ($229.5 million).

A total of 35,000 Saudis turned out to gain the government bond that was first floated for public subscription on Feb. 4. The government sukuk product was fully allocated for Saudi individual applicants on Tuesday, Feb. 13.

Sah offers an attractive return of 5.64 percent for February, with a full-year maturity date set for February 2025. The second savings round of Sah is scheduled to begin on Sunday, March 3, according to the calendar announced by Sah. The window will be opened for the participants through the digital channels provided by their respective financial institutions.

The Saudi Ministry of Finance and the National Debt Management Center (NDMC) recently launched the Sah product, which comes within the initiatives of the Financial Sector Development Program, one of the Kingdom’s Vision 2030 programs. Sah is aimed at raising savings rates among individuals by motivating them to deduct part of their income periodically and set aside it for saving.

The product is allocated for individuals with lucrative returns that are offered on a monthly basis, in accordance with the issuance calendar. The saving period is for one year with a fixed return and the accrued yields are disbursed at the end of the sukuk’s term (maturity date).

Sah is for Saudi citizens only, who are over the age of 18 years, provided the subscriber has an account with either SNB Capital, AlJazira Capital, Alinma Investment, SAB Invest or Al Rajhi Capital. The date set for the allocation was Feb. 13 while the redemption period will be on Feb. 18-21 and the redemption amounts will be paid on Feb. 25.

Sah is the first subsidized savings product intended for individuals that is compatible with Islamic Shariah in the form of sukuks within the Kingdom’s local sukuk program in Saudi riyals. The purpose of issuance of Sah is enhancing financial planning for the future and increasing individuals’ savings rates by motivating them to periodically deduct a portion of their income and allocate it to savings, in addition to increasing the supply of savings products.

Its advantages include Shariah compliant, annual returns, easy subscription, no fees for subscribers, and no restrictions on redemption. The Sah bonds will be issued through participating financial institutions and there are no fees for subscribers. The nominal value of Sah is SR1000. The value and return of Sah are fixed for each issue.

The minimum subscription rate of Sah is SR1000, which is equivalent to the nominal value, while the maximum subscription limit is SR200000 for the total number of issues per individual during the program period.