Elon Musk’s visit to China has reportedly reaped immediate rewards with a deal for Tesla to use mapping data provided by web search company Baidu, a big step in introducing driver assistance technology in the world’s largest car market.

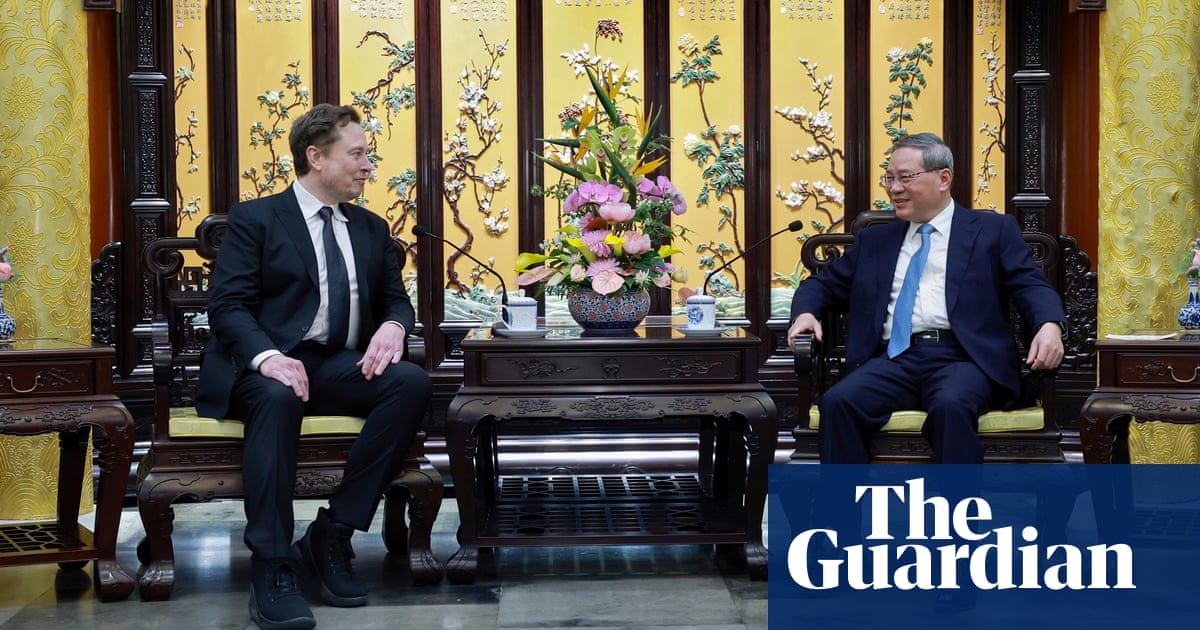

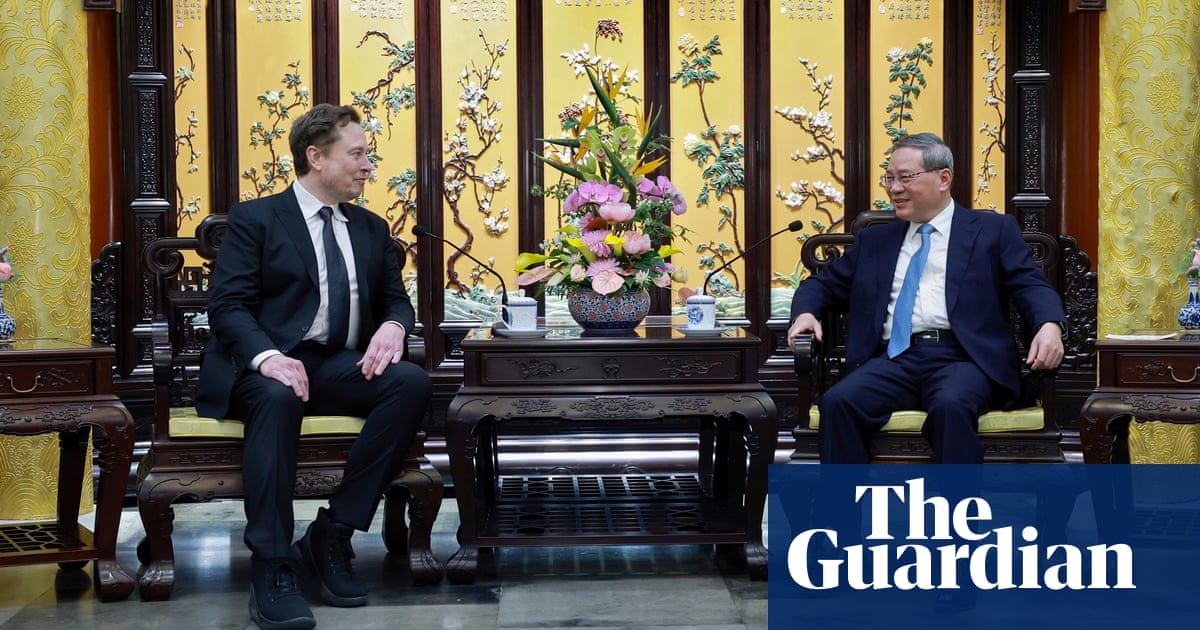

Musk made an unannounced visit to China over the weekend. The billionaire posted a picture of his meeting with the Chinese premier, Li Qiang, on X, the social network he took over in 2022.

Baidu, which dominates web search in China, will provide mapping and navigation functions to help Tesla operate its driver assistance technology, which it calls “full self-driving”, or FSD, according to sources cited by Bloomberg News. Mapping services – crucial to driver assistance technologies – are strictly controlled by China’s government.

Despite its name, FSD does not provide autonomous driving abilities: it requires a driver who has “hands on the wheel and is prepared to take over at any moment”. However, launching it in China could help Tesla in the fierce competition for market share in the country, and provide more income. It costs $8,000, or $99 (£80) a month, although it is not available in many countries.

Musk is often combative in his dealings with politicians, such as strident criticism of the US president, Joe Biden, or a standoff in Brazil against a government he claims is censoring X, formerly known as Twitter. However, he adopted a more emollient tone towards China’s second most powerful politician, saying he was “honoured” to meet Li.

Musk has a tangled relationship with China because of his various business interests. X is blocked by China’s government – which has rigid censorship. China’s government has also complained to the UN about close encounters between its space station and satellites launched by SpaceX, Musk’s rocket company.

However, Tesla runs a factory in Shanghai, and its Model Y was the third bestselling electric or plug-in hybrid car in China in March 2024, according to Clean Technica. BYD, a Chinese manufacturer that vies with Tesla to be the world’s biggest seller of electric cars, boasts the two top-selling models.

The visit and report of the Baidu deal was greeted with excitement by Tesla investors, many of whom are counting on potential autonomous driving abilities to justify Tesla’s position as the world’s most valuable carmaker. Tesla’s share price rose by 6% in trading before the New York markets opened.

Dan Ives, a tech analyst at Wedbush, an investment bank, wrote in a note to clients: “This is a watershed moment for Musk as well as Beijing at a time that Tesla has faced massive domestic EV competition in China along with softer demand. While the long-term valuation story at Tesla hinges on FSD and autonomous, a key missing piece in that puzzle is Tesla making FSD available in China which now appears on the doorstep.”