Jeremy Hunt’s plans for pre-election tax cuts have received a setback after higher spending on benefits and lower tax receipts pushed government borrowing above £20bn last month.

The Office for National Statistics (ONS) said the budget deficit – the gap between public spending and tax receipts – was £1.5bn higher than a year earlier and the fourth highest for an April since records began.

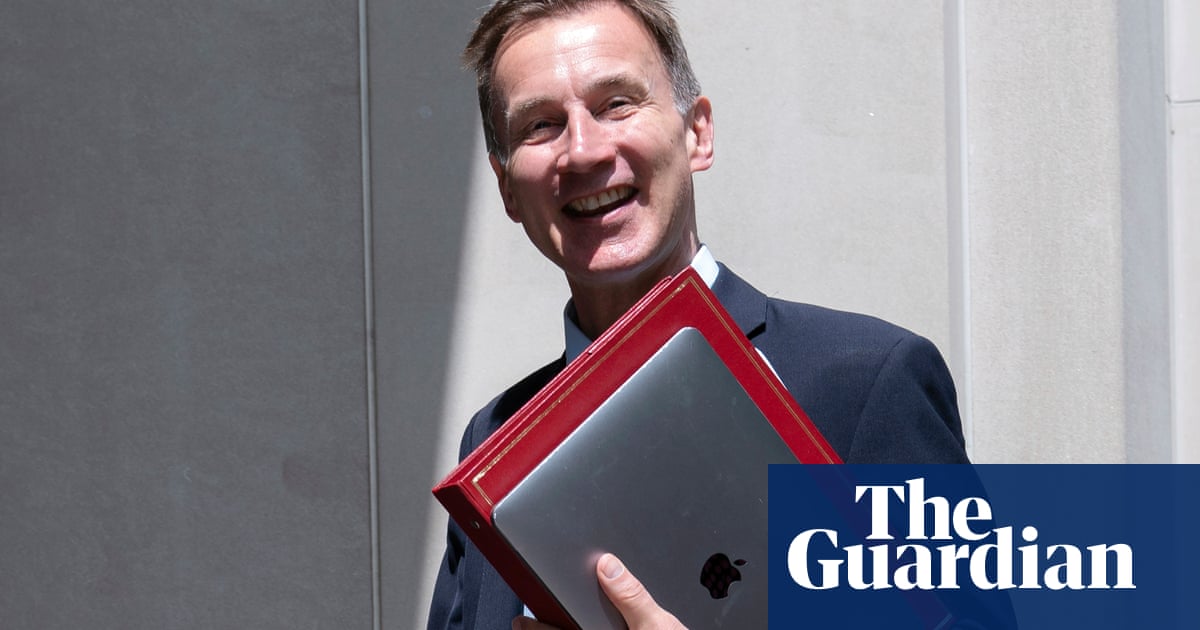

Hunt is relying on an improvement in the public finances to justify tax cuts before voters go to the polls, but the latest figures show them to be in a worse state than forecast at the time of the March budget.

The Office for Budget Responsibility (OBR) said April’s deficit was £1.2bn higher than it had predicted, with the overshoot caused by higher Whitehall spending, benefit increases and weaker tax revenues.

Last month marked the introduction of Hunt’s second cut in national insurance contributions (NICs). The OBR said it had also revised up its estimate of the 2023-4 deficit by £0.8bn.

The ONS chief economist, Grant Fitzner, said: “While central government spending and income overall both rose on this time last year, a large drop in NICs meant receipts did not grow as fast as spending.

“Here, falls in expenditure on energy support were offset by increases in benefit spending from the annual uprating.”

Debt as a share of national income stood at 97.9% in April and stood at its highest level since the early 1960s after rising by 2.5 percentage points over the past year.

Analysts said the April public finances data further eroded Hunt’s already limited scope for tax cuts without breaking his self-imposed rule that debt should be falling as a share of national income within five years.

Rob Wood, chief UK economist at Pantheon Macro, said: “The headroom to cut taxes doesn’t exist, but chancellor Hunt seems likely to go ahead anyway in a pre-election autumn statement, probably in September.

“Spending demands overshooting forecasts is likely to be an ongoing theme for the public finances, with Hunt planning implausibly weak expenditure to generate his tax-cutting room.”

Peter Arnold, chief economist at EY UK, said he saw April’s under performance continuing through the rest of the 2024-5 financial year. Yields on government bonds and official interest rates were likely to be higher than the assumptions used in the OBR’s March forecast, implying higher-than-expected debt servicing costs.

“Some of this impact looks likely to endure to the end of the OBR’s five-year forecast horizon, cutting the already-slim headroom against the government’s main fiscal rule,” Arnold said.

On Tuesday, the International Monetary Fund warned Hunt against pre-election tax cuts and pointed to a looming £30bn hole in the public finances.

A Treasury spokesperson said: “We rightly protected millions of jobs during Covid and paid half of people’s energy bills after Putin’s invasion of Ukraine sent bills skyrocketing – but it wouldn’t be fair to leave future generations to pick up the tab.

“That’s why we must stick to the plan to get debt falling.”