RIYADH: Saudi Arabia’s non-oil sector is projected to grow at a rate of 4.8 percent in 2024, driven by the Kingdom’s growth-oriented fiscal policy, according to an analysis.

In its latest report, Riyad Capital stated that the sector will accelerate further in 2025, with a projected expansion rate of 5.2 percent.

“We project continued solid growth for non-oil activities, fostered by a growth-oriented fiscal policy with a focus on increased investment spending, which will spur growth in the coming years,” stated Riyad Capital.

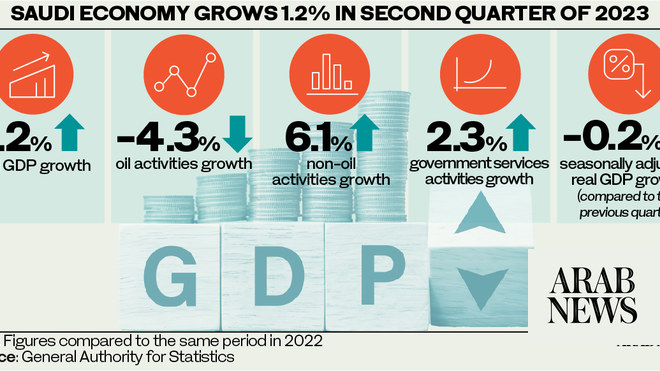

This follows a trend where non-oil activities experienced a rise of 5.6 percent and 4.4 percent in 2022 and 2023, respectively.

Developing the sector is crucial for the Kingdom as it steadily pursues its Vision 2030 goals to reduce dependency on oil.

According to the report, Saudi Arabia"s overall economic growth is poised to rebound in the coming years, with the nation"s gross domestic product expected to expand by 2.3 percent in 2024 and accelerate to 5.8 percent in 2025.

The analysis projected that the Kingdom’s fiscal deficit could shrink to 3 percent and 1.8 percent of GDP in 2024 and 2025, respectively.

“After a surplus of 3.2 percent of GDP in 2023, we expect the current account balance to rise again to 3.7 percent of GDP in 2024. It will further expand to 4.9 percent of GDP in 2025 on the back of notably higher projected oil export revenues next year,” said Riyad Capital.

On the other hand, the inflation rate in the Kingdom is expected to decline to 2 percent in 2024 and witness a moderate acceleration to 2.4 percent in 2025.

Riyad Capital also expects Saudi Arabia’s oil production to reach more than 10 million barrels per day over the next 18 months.

“We expect oil production to expand again above 10 mbd in the course of the next 18 months, with the better part of this increase taking place in 2025. Therefore, the oil sector GDP contribution will still be mildly negative in 2024 with –2.2 percent, but record substantial growth of 8.7 percent in 2025,” said the report.

The analysis further pointed out that global oil prices are expected to remain volatile but at elevated levels, with Brent crude to fall in a range between $80 and $90 in 2024 and 2025.