Favorable performance of several sub-indices supported the ongoing expansion

Non-oil sector business cycle peaked post-COVID-19 at the end of 2022

RIYADH: Corporate stability fueled consistent growth in Saudi Arabia’s private sector in the second quarter of the year, with levels expected to remain steady through year-end, according to a government analysis.

The Ministry of Economy and Planning reported in its Private Sector Business Cycle Composite Index, or MEPX, that the favorable performance of several sub-indices has supported the ongoing expansion.

The ministry said that the Saudi non-oil sector business cycle peaked post-COVID-19 at the end of 2022, with gradual rebalancing beginning since then.

Launched in 2022, MEPX monitors the performance of the Kingdom’s private sector by tracking 10 economic factors across four categories, including consumers, firms, finance, and trade.

MEPX analyzes the business cycle using advanced econometric techniques and provides valuable insights for policy and decision-makers.

The ministry expected MEPX to remain stable over the next four months, barring major disruptions.

In a release, the ministry said that strong consumer-related indicators continued to boost the index’s value, adding that the points of sale and payments via the centralized SADAD system showed healthy annual growth of 5.9 percent and 9.7 percent, respectively.

The ministry also said that the 6.7 percent year-on-year increase in the money supply indicated gradual improvement in financial conditions, despite the expected delay in interest rate cuts this year.

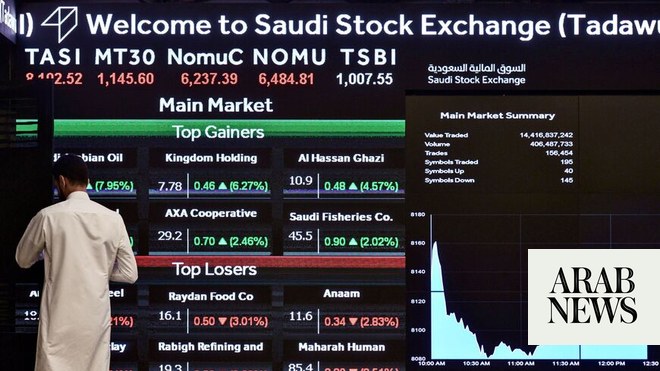

Firm-related indicators have moderated due to a declining purchasing managers’ index and a slowing Saudi stock market index value, the report said, adding that trade-related indicators performed poorly, as reflected in the negative growth of new letters of credit for imports.

The Kingdom has launched several economic reforms to foster a supportive business environment and improve the quality, efficiency, and digitization of services provided to the private sector.

Numerous programs, initiatives, funds, incubators, and accelerators have been established to help the private sector overcome challenges and position it as the main driver of the Kingdom’s economy.

Investments by the country’s Public Investment Fund in local companies have opened up new non-oil sectors, creating significant opportunities.

As the government continues to cultivate an enabling environment for the private sector and its partners, Vision 2030 is poised to fulfill the Kingdom’s aspirations and shape its future.