Kingdom ranked fourth globally in terms of largest producers of reduced iron and 20th in terms of production capacity, said head of Federation of Saudi Chambers

Saudi Arabia has 41 factories with a production capacity of 14 million tonnes, employing 15,000 workers

JEDDAH: Saudi Arabia aims to create a comprehensive map of iron and steel manufacturers across the Kingdom and the Arab world, as top leaders have gathered in Riyadh to discuss the latest sector developments.

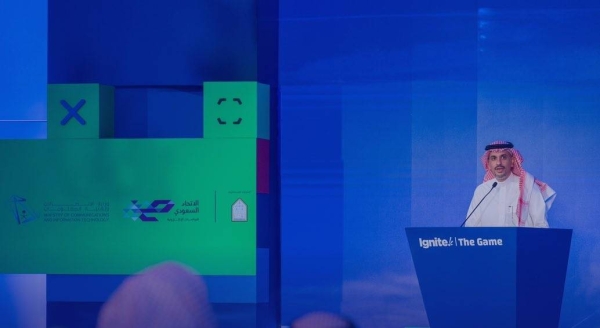

Speaking during the first Saudi International Iron and Steel Conference, Walid bin Hamad Al-Arenan, secretary-general of the Federation of Saudi Chambers, said that the Kingdom’s steel industry is one of the most crucial economic sectors.

The country’s efforts to advance its mineral and mining industry are part of Saudi Arabia’s broader strategy to diversify an economy that has long been dependent on oil.

The event is especially significant in light of ongoing domestic and global developments shaping the vital sector, a cornerstone of economic growth.

Under the patronage of the Minister of Industry and Mineral Resources, Bandar Alkhorayef, the three-day event began on Sept.16 at the King Faisal International Conference Hall, according to the Saudi Press Agency.

Organized by the Federation of Saudi Chambers through the National Committee for Steel Industry, the event featured a range of local and international industry leaders and experts.

Al-Arenan said that an important objective of the private sector is to increase the gross domestic product from 40 percent to 65 percent, adding: “This is a significant target, reflecting both the role of the private sector and the support provided by the government.”

Presenting data on the industry within the Kingdom, Al-Arenan said: “We have 780 million tonnes of reserves, and we are ranked fourth in the world in terms of the largest producers of reduced iron and 20th in terms of production capacity.”

He added that the country has 41 factories with a production capacity of 14 million tonnes, employing 15,000 workers.

He further said the steel and iron event will be held quarterly to support the sector.

Bandar Al-Sulaim, chairman of NCSI, said that the forum aims to discuss local and global updates in the steel sector.

He added that the committee represents 70 percent of steel producers in the Kingdom and is working on creating and disseminating a map of steel manufacturers in Saudi Arabia and the greater region, in addition to being a member of global and Arab steel associations.

Participants voiced concerns over the decline in manufacturing in regions like the EU, where raw steel production dropped to a record low of 126 million tons in 2023. In contrast, India, the second-largest steel producer, and the US have reported positive growth rates.

The Kingdom is ranked 12th worldwide in terms of production capacity for steel billets and slabs. The market size for long and flat steel products is 18 million tons.

Saudi Arabia’s iron and steel industry generated a production value of $5.4 billion in 2023, representing 7.2 percent of the total production in the Middle East and North Africa region, highlighting the nation’s significant role in regional industry and its growing influence in the sector.

This is based on a May 2023 report by London-based market research company Euromonitor International on Saudi Arabia’s basic iron and steel industry, following the International Standard Industrial Classification of All Economic Activities.

The industry’s export share rose to 27 percent of total production output, indicating an increasing focus on international markets. The growth in exports is contributing to the sector’s improved profitability, which stood at 22.9 percent, making it the ninth highest in the region. This indicates that the industry is performing efficiently compared to its regional counterparts.

In terms of market structure, the number of companies decreased to 300, reflecting a trend toward industry concentration. The top five firms alone accounted for 57.1 percent of total production value, demonstrating the dominance of a few large players in the market, according to the analytical report.

Among them, Saudi Iron and Steel Co. emerged as the largest player, contributing 33 percent of the industry’s total production value.

The Kingdom’s market size for basic iron and steel reached $11.6 billion in 2023, making it the fifth largest in the region. Investments played a crucial role, accounting for 54.4 percent of total demand, driven by infrastructure and industrial projects, which are key growth drivers for the industry.