Hundreds of thousands of Guyana citizens living at home and abroad will receive a payout of around £370 each after the country announced it was distributing its “mind-boggling” oil wealth.

The grant of 100,000 Guyanese dollars will be available to any citizen of the South American country over the age of 18 with a valid passport or ID card. Guyanese citizens who normally live abroad will be eligible but must be in Guyana to collect the payment.

The payout was originally planned as a 200,000 Guyanese dollar grant for each household in the country, but was reframed after concerns that some citizens, including young people who had not yet set up their own household, would be left out.

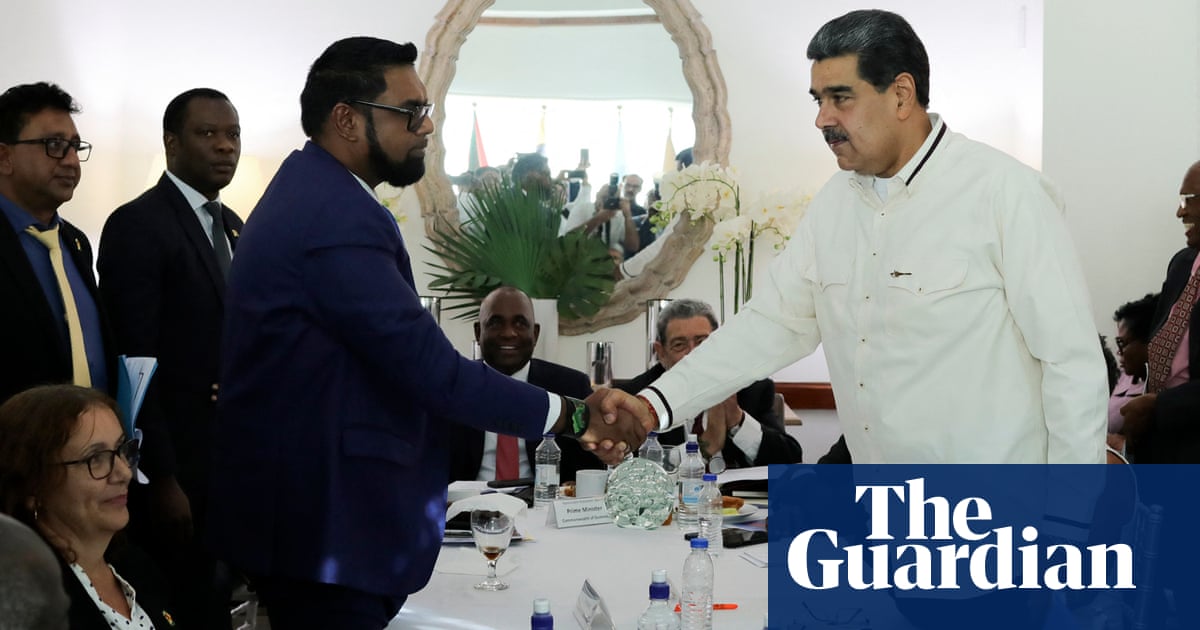

Announcing the new arrangement, Guyana’s president, Irfaan Ali, said: “Over the past week, thousands of Guyanese have engaged me and members of my cabinet, providing extremely favourable feedback on the measures announced last Thursday … several persons have indicated to my government the complications they foresee in the implementation of this much-welcomed benefit and the fear of being left out.”

The per-person allocation, he added, “also addresses the many concerns of young people who may not yet have a family but thought … that they will not benefit from the household allocations because they were not yet the head of the household”.

With an in-country population of 800,000 and a diaspora of some 400,000, the current arrangement is expected to result in a huge payout. But the country has been enjoying historic growth in its economy, which has tripled in size since it started crude oil extraction in late 2019.

Guyana’s GDP was for many years one of the lowest in the region, but after the 2015 discovery of a massive oil reserve off the country’s Atlantic coast, it has become one of the fastest-growing economies in the world.

“If you haven’t lived through what we lived through, you won’t understand what this mind-boggling growth means,” said Guyanese media analyst and entrepreneur Alex Graham. “While it is true that we still need time for this growth to translate to quality of life, we are starting to see economic growth turned into infrastructure, projects and systems that would allow citizens to enjoy an increasingly higher quality of life.”

Graham added that though the cash grant is likely to remain controversial, “there are a lot of people for whom it is a significant inflow into their difficult financial circumstances”.

“The grant will provide substantial support to families and Amerindian villages by offering a much-needed financial boost for essential projects and household needs,” said teacher Keanu Thomas, 25.

Thomas, who is also the toshao (chief) of the Indigenous people’s Tapakuma villages in Guyana’s Essequibo region, added: “For many families, the grant allows them to expand on agriculture-based initiatives, which are vital for both local food security and economic development within these communities.”

Richard Rambarran, a prominent economist and executive of the Georgetown Chamber of Commerce and Industry, has described the cash grant as “broadly” good for Guyana, notwithstanding concerns about the potential knock-on effect on inflation.

He added that “the fact that it is granted to every citizen in an unconditional sense is positive”, but its effectiveness is dependent on how wisely it is used by recipients.

“Some may see it fit to spend on consumer goods that serve little use value in the medium to long term. That may not necessarily be the best use of funds,” he said. Rambarran said ordinary Guyanese people would be best advised to invest the money or use it to invest in labour-saving appliances.

But Ganesh Mahipaul, an MP with Guyana’s opposition coalition party, APNU+AFC, argued that payment should be the first of many, in order to fairly share the £47bn windfall in oil revenue that the government announced in 2022.

“While we welcome the recent announcement of cash distribution, we believe our people deserve more. We will continue to advocate for increased direct cash transfers to benefit all Guyanese. Rather than a one-time distribution, we believe cash transfers should be predictable and supported by a permanent structure to ensure accountability and transparency,” he said.