(Adds dropped word ‘pandemic’ in paragraph 1)

* Futures off: Dow 0.06%, S&P 0.03%, Nasdaq 0.07%

Sept 3 (Reuters) - Wall Street futures fell on Friday as a sharp slowdown in jobs growth last month gave the strongest signal yet that a post-pandemic economic rebound was losing steam, while banking stocks tracked a jump in bond yields.

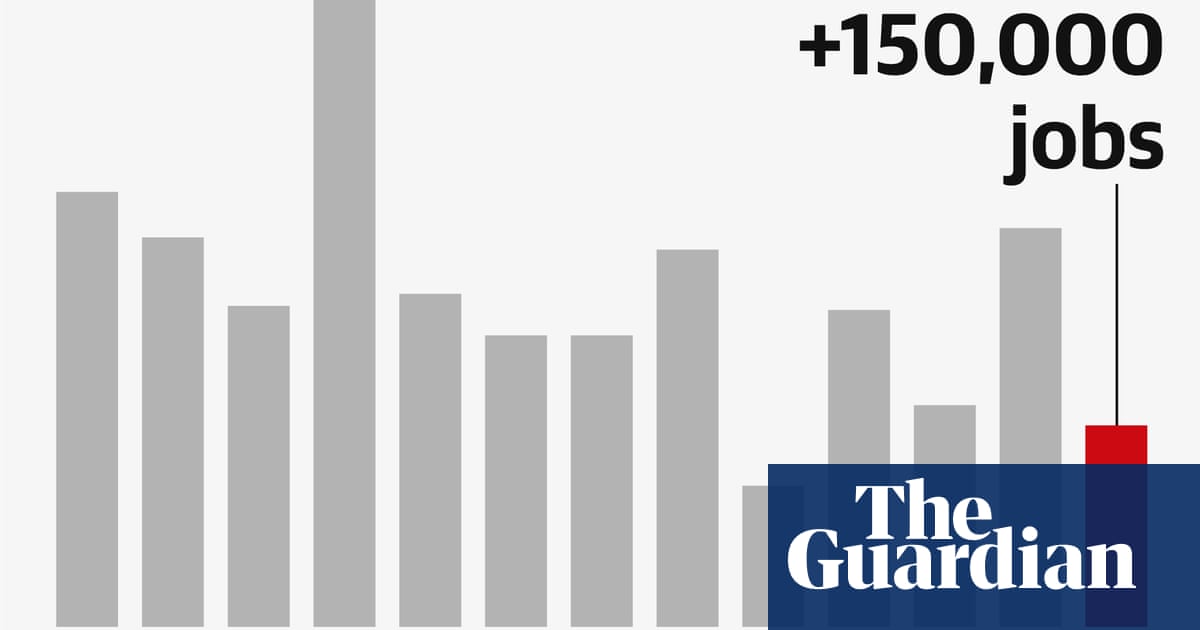

The Labor Department’s closely watched report showed nonfarm payrolls increased by 235,000 jobs in August, widely missing economists’ estimate of 750,000. Payrolls had surged 1.05 million in July.

Economically sensitive industrials Caterpillar Inc, 3M Co and Boeing Co slipped as much as 0.4%, while banks including Goldman Sachs and JP Morgan rose slightly.

“It’s a disaster. It came way under estimates,” said Peter Cardillo, chief market economist at Spartan Capital Securities in New York.

“It doesn’t put pressure on the Fed to make a taper announcement, but judging from what I see, it’s an impact of resurgence of COVID and the service sector. People are staying at home and this will change.”

The S&P 500 and Nasdaq have scaled all-time highs over the past few weeks on support from robust corporate earnings, but investors have grown cautious recently on hawkish signals from the Fed and a jump in infections.

The labor market remains the key touchstone for the Fed, with Chair Jerome Powell hinting last week that reaching full employment was a pre-requisite for the central bank to start paring back its asset purchases.

Separately, the Institute of Supply Management’s non-manufacturing PMI data, due to be released at 10:00 a.m. ET, is expected to show slowing business activity in the services industry.

At 8:43 a.m. ET, Dow e-minis were down 21 points, or 0.06%, S&P 500 e-minis were down 1.25 points, or 0.03%, and Nasdaq 100 e-minis were down 10.5 points, or 0.07%.

Technology heavyweights, which tend to perform better in a low interest-rate environment, including Apple, Alphabet, Tesla Inc and Facebook rose as much as 0.3%.

Chinese ride-hailing firm Didi Global gained 4.5% after a media report that the city of Beijing was considering moves that would give state entities control of the company.

Biotechnology firm Forte Biosciences slumped 80.8% to be among the top decliners across U.S. exchanges after its experimental treatment for eczema, a skin disease, failed to meet its main goal. (Reporting by Shashank Nayar in Bengaluru and Stephen Culp in New York; Editing by Saumyadeb Chakrabarty, Sagarika Jaisinghani and Arun Koyyur)