The US added fewer than expected jobs in October and the unemployment rate rose amid signs that the white-hot US jobs market is cooling.

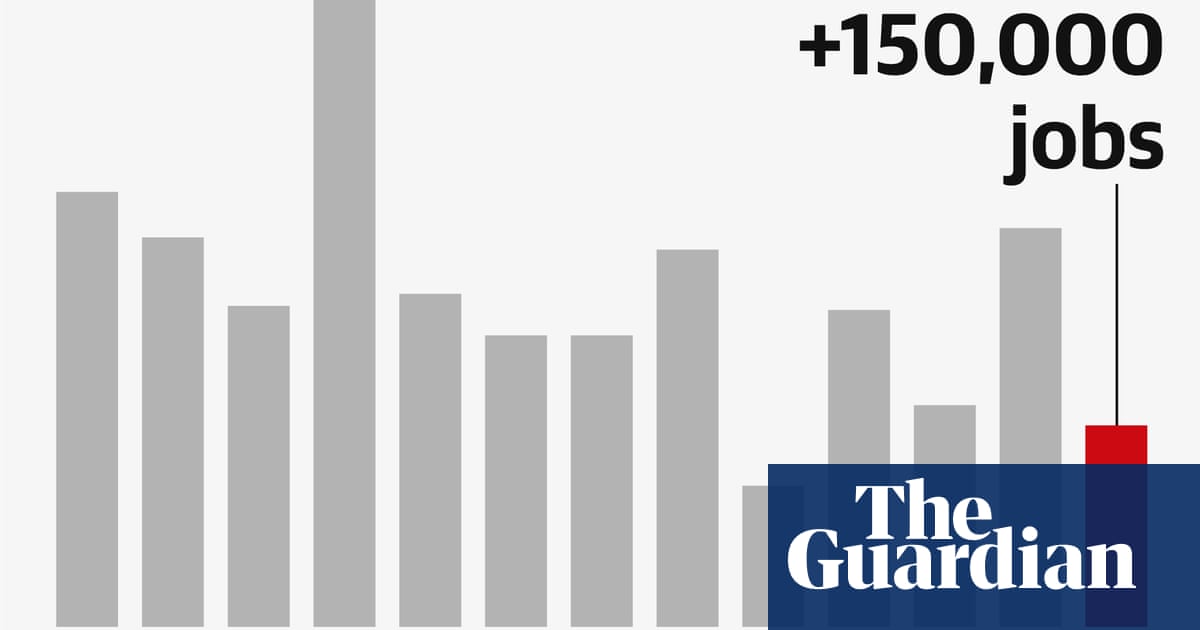

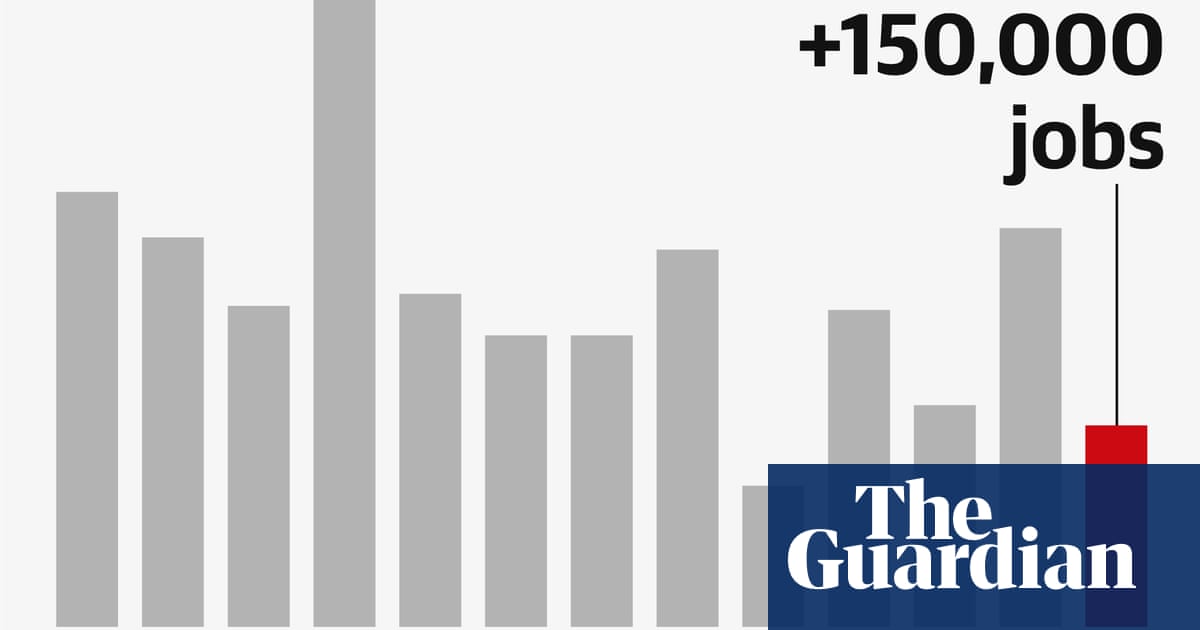

There were 150,000 jobs added last month, according to closely watched figures from the Bureau of Labor Statistics, which was below the 180,000 predicted by economists. The unemployment rate picked up to 3.9% from 3.8%.

The pace of job growth slowed sharply from September when the economy added 297,000 jobs – revised down from 336,000 but still an impressive figure and far higher than had been expected.

US stock markets rallied on the news, which was taken as a signal that the Federal Reserve might halt its aggressive series of interest-rate hikes aimed at bringing down inflation.

Since last year, Fed officials have raised rates to a 22-year high. The increases are designed to slow the economy by making borrowing more expensive, a move that should slow demand and bring down prices. The Fed chair, Jerome Powell, said this week that he hoped the US economy could achieve a “soft landing” – bringing down inflation without triggering large layoffs.

While the Fed and economists are wary of reading too much from one month’s jobs data, October’s jobs report suggested a soft landing might be possible. The unemployment rate ticked up to 3.9% but it remains close to a 50-year low, and has been at or below 4% for nearly two years – economists had expected the recent outsized gains in job creation to slow.

“It is difficult to believe that an economy with below-4% unemployment can sustain this pace of job growth,” Dean Baker, senior economist and co-founder of the Center for Economic and Policy Research, wrote in commentary this week.

The hiring news came in a week when both the Fed and Bank of England announced they were leaving interest rates unchanged, as inflation eases and the global economy slows.

Inflation is now running at an annual rate of 3.7% in the US, down from 9.1% in June 2022, but the Fed is determined to bring it back down to its target rate of 2%.

Powell cautioned that the Fed’s campaign to bring down price growth has “a long way to go” and left the door open to further rate hikes. In the UK, the Bank of England governor, Andrew Bailey, said it was “much too early to be thinking about rate cuts”, after leaving rates at 5.25% for a second consecutive time.

The US labor department on Friday also revised the job growth figures for August and September, and said job gains had been a combined 101,000 lower than first reported.

The US’s wave of strike actions affected the October jobs figures. Manufacturing employment fell by 35,000 jobs as members of the United Auto Workers (UAW) union took industrial action against car giants Ford, General Motors and Stellantis. The UAW reached agreements with the auto manufacturers at the end of last month, and those workers will now be back on the job.

But October also saw declines in transportation and warehousing, information and finance, which were unaffected by strikes.

Andrew Hunter, deputy chief US economist at Capital Economics, said the jobs report was “another sign that the economy’s strength in the third quarter is likely to unwind in the fourth”.

He pointed to a slowdown in wage growth. Average hourly earnings rose 4.1% from a year ago, the department said, down from 4.3% in September.

“With wage growth also continuing to slow, it is increasingly hard to imagine the Fed hiking interest rates any further,” said Hunter.

Earlier this week ADP, the US’s largest payroll supplier, said private employers added 113,000 workers in October, lower than had been expected.

Wages rose by 5.7% from a year ago, according to ADP, the smallest annual gain since October 2021.

“Big post-pandemic pay increases seem to be behind us,” said ADP’s chief economist, Nela Richardson. “In all, October’s numbers paint a well-rounded jobs picture. And while the labor market has slowed, it’s still enough to support strong consumer spending.”