Electricity demand in Saudi Arabia is undergoing unprecedented changes following the implementation of efficiency measures and energy price reforms, according to a study by the King Abdullah Petroleum Studies and Research Center (KAPSARC).

The Kingdom’s electricity demand is stagnating for the first time in decades, suggesting that consumer behavior has structurally shifted, raising uncertainties about the potential trajectory of long-term electricity demand.

KAPSARC projected the growth in total Saudi electricity demand to significantly decelerate over the coming decade compared with historical trends, to reach 365.4 terawatthours (TWh) by 2030.

The study predicted demand to grow more rapidly in the industrial and services segments than in the residential sector, accounting for the largest share of total consumption in 2030.

“We also simulate four additional scenarios for domestic electricity price reforms and efficiency policies,” said the study.

Aligning Saudi electricity prices with the average electricity price among G20 countries can reduce total electricity demand by 71.6 TWh in 2030, which could enforce efficiency policies that can reduce total electricity demand by up to 118.7 TWh.

“Moreover, alternative policy scenarios suggest that the macroeconomic gains from energy savings can alleviate some of the Saudi energy system’s burden on public finance,” said the study.

Projecting future demand for electricity is central to power sector planning, as these projections inform capacity investment requirements and related infrastructure expansions, it continued.

“Electricity is not currently economically storable in large volumes. Thus, the underlying drivers of electricity demand and potential market shifts must be carefully considered to minimize power system costs,” it explained.

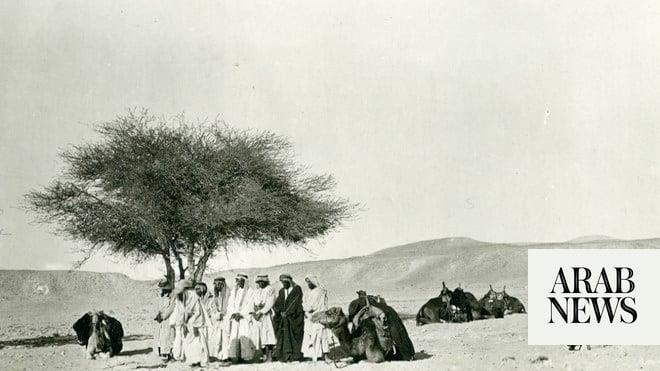

Demand for electricity in Saudi Arabia has multiplied since the development of the electricity sector in the early 1970s, driven by a rapidly increasing population, dynamic economic growth, and low regulated energy prices.

In 2018, total Saudi electricity demand reached 299.2 TWh.

The Kingdom is the 14-largest electricity consumer globally. Its consumption is similar to that of more populated countries like Mexico and to more advanced economies like Italy, whose 2019 GDP was $2,151.4 billion, compared to $704.0 billion for Saudi Arabia, according to The World Bank.

In recent years, the Saudi government has addressed the rapidly increasing fuel consumption of its power sector by expanding efficient gas plants. This step has reduced the country’s reliance on oil and refined products for power generation. Moreover, Saudi policymakers have also enacted some demand-side measures.

In 2010, the Kingdom began promoting several efficiency initiatives to rationalize energy consumption by establishing the Saudi Energy Efficiency Center (SEEC 2018). Additionally, the Saudi government implemented the first round of national energy price reforms (EPR) in 2016, with the second round in 2018.

The scale of these recently implemented EPR and efficiency measures are unprecedented in Saudi Arabia. Thus, these policies’ potential effects on future demand cannot be assessed based on past experiences.

The study emphasized the importance of enhancing the methodological aspects of energy demand projections.

“Using advanced analytical tools to capture market transformations, behavioral adjustments, and interdependencies across economic agents, we can better project electricity demand pathways,” it stressed.