The Post Office handled a record of almost £3.5bn in cash for customers in August, against a backdrop of bank branch closures and the cost of living crisis.

The £3.45bn in cash crossing Post Office counters in August was the highest total since it began recording volumes it handles through its 11,500 local branches five years ago. August is traditionally a quieter month for cash transactions at its branches.

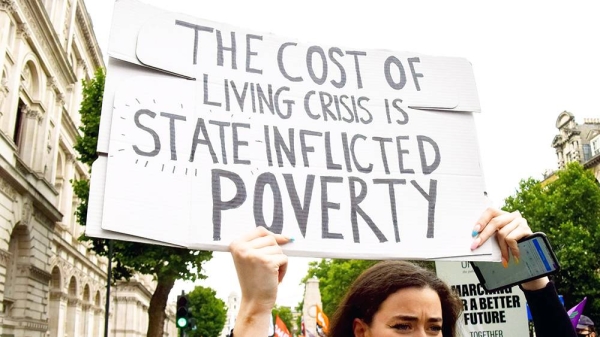

“Post Office attributes the continuing high levels of cash withdrawals to the ongoing closure of local bank branches with people turning to the Post Office to support them with their cash needs,” the company said. “As the cost of living begins to bite, people are also increasingly turning to cash to manage their budget on a week-by-week basis and often day by day.”

The Post Office expected September to be another record-breaking month for cash withdrawals and deposits. However, the bank holiday for the state funeral for the Queen, which meant that most branches were closed, led to a lower £3.35bn recorded.

The Post Office expects the trend of handling higher levels of cash to continue during the cost of living crisis as many people find it easier to manage budgets and monitor spending using notes and coins rather than making electronic transactions.

“We expect cash transactions to continue to exceed expectations in October and for the rest of the year,” the Post Office banking director, Martin Kearsley, said. Cash transactions include personal deposits and withdrawals from Post Office accounts, as well as for business use.

The company said personal cash withdrawals at its branches totalled £805m in August, up 0.5% compared with July, while personal cash deposits exceeded £1.4bn for the first time.

Since January, there have been more than 430 additional bank branch closures announced across the UK, according to Link.

The Post Office is running pilots of banking hubs – 25 locations have been identified so far – which will help communities whose access to cash has been restricted as a result of bank branch closures.

“We’re increasingly seen as the only place on the high street where everyday banking can be done,” Kearsley said.

However, over the long term using cash to make payments is expected to become increasingly rare. UK Finance, which represents the banking industry, says by 2031 cash will account for only 6% of all payments.

The use of notes and coins has fallen dramatically over the past decade, from 55% of payments in 2011 to 15% last year.