While some banks are scrapping passbook savings accounts amid suggestions they are past their sell-by date, other providers have reported an increase in their usage as people turn to cash to help them manage the cost of living.

Newcastle building society said that in 2023 it issued about three times as many passbooks as it did in 2021, and that it is getting new customers on the back of decisions by rivals to axe them.

Meanwhile, Yorkshire building society has issued research showing that while passbooks might be associated with older savers, more than a quarter of those aged 18 to 34 have one.

Savings passbooks – which record the money paid in and withdrawn, plus interest earned – have been around for generations.

They first appeared during the 18th century, and at one time, millions of people held popular passbook accounts such as Liquid Gold, an account offered by Leeds Permanent building society (later swallowed up by the Halifax) and promoted in the 1980s by TV adverts featuring the wheeler-dealer Arthur Daley from the TV series Minder.

However, as online banking took off, many savings providers stopped offering them.

At Lloyds Banking Group (which includes Halifax), new passbooks have not been available to customers since 2015.

It is understood to be withdrawing more than 3m passbooks, the bulk of which involve Halifax accounts – including Liquid Gold, plus others such as Monthly Saver and Passbook Saver.

A Lloyds Banking Group spokesperson said it started talking to customers last year to help them get familiar with how accounts operate without passbooks, then wrote to people between the end of October and mid-December to give them two months’ notice of the change.

Virgin Money told us it was in the process of removing passbook accounts from its range. This means that about 100,000 people will no longer be able to use them to pay in or withdraw cash. The bank has indicated that affected customers can typically keep the account they have and operate it as a statement-based account instead of using a physical passbook.

Nationwide no longer offers new passbook accounts.

It would appear that some of those having their passbooks taken away are crossing the road and signing up with a rival bank or – more likely – building society that still has them.

Michael Conville, the chief customer officer at Newcastle building society, said: “We’ve seen where banks on our high streets have either closed or stopped offering savings passbooks, new customers will join the society because they know we’re committed to offering both digital and in-person financial services.”

Almost six in 10 of the society’s members hold an account with a passbook or passcard, and it is seeing almost half a million transactions a year across its 31 branches.

The Newcastle said: “The greater trend has been toward our members making deposits [using a passbook or passcard] rather than an increase in withdrawals.”

This week, Yorkshire building society said its data showed that 550,000 of its members used passbooks for their savings accounts at a branch last year.

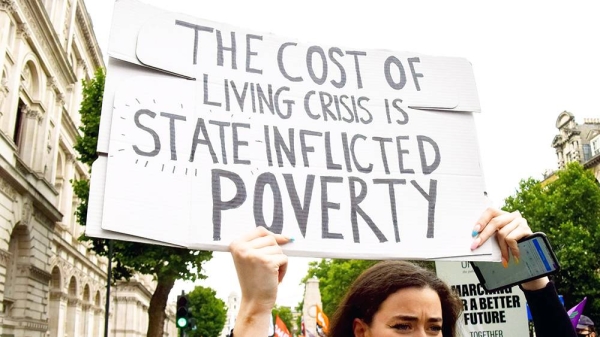

The cost of living crisis has prompted many people to turn back to “tangible” physical money to help them budget, the banking body UK Finance said in September.

Similarly, the accountancy firm KPMG said last year that Britons were turning to bank branches to help them manage their rising living costs, adding that “depositing and withdrawing cash [were the] key drivers for visiting a branch more often”.

All of the Newcastle’s branch-based savings accounts offer passbooks. They include Newcastle Double Access Saver (Issue 3), which pays 4.5% interest if two or fewer withdrawals are made in a year (the rate is 2.9% for three or more withdrawals), and Newcastle Easy Saver (Issue 5), which pays 3%.

Yorkshire building society accounts that come with passbooks include Rainy Day Account Issue 2, paying up to 5%, and Access Saver Plus Issue 7, which pays 3.45%.