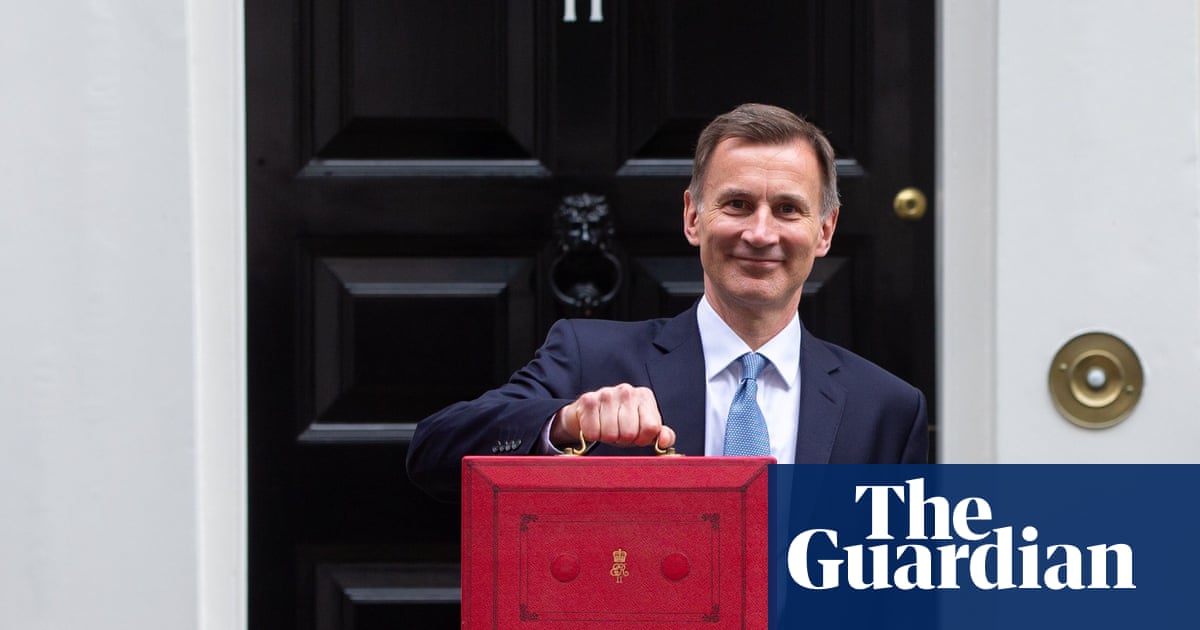

Jeremy Hunt is considering a boost for the pensions of middle-class professionals and more help with childcare for parents in next week’s budget, as he tries to get more people into the workforce.

The chancellor is likely to announce significant increases to pensions allowances in a bid to tackle the “pension trap”, which has led many workers to take early retirement.

The lifetime allowance (LTA) on tax-free pension savings will rise, as well as the £40,000 cap on annual pension contributions, the Daily Mail reported, citing Whitehall sources.

Two Whitehall sources also told the Guardian that the chancellor was thinking again about a bigger offer of more free childcare hours for one- and two-year-olds. The Treasury had commissioned work looking at the costs from the Department for Education but concluded it was too expensive. However, it is understood to have come back under consideration, given its possible benefits to the economy offsetting some of the costs.

However, the chancellor is most likely to act on childcare by making changes to universal credit to allow parents to claim back more cash on childcare expenses as a way of easing rising cost of living pressures. Some in the Conservatives believe he should go further to match or compete with Labour’s offer.

The Treasury declined to comment on the contents of the budget.

The reported increase on pensions, which could be revealed in the budget on 15 March, is intended to end the pension trap that can leave some professionals – such as doctors – facing higher tax charges if they stay in the workforce.

It has prompted many to consider early retirement or reducing their hours to avoid paying more tax on their pensions.

The British Medical Association had previously warned that the way taxation policy and the NHS pension scheme interacted had created a “perfect storm”, where “the most sensible course of action for many to not lose out financially is to reduce their work or even cease working for the NHS altogether”.

Some doctors and other workers stopped doing additional shifts or left the NHS because they were worried their extra earnings would increase their pension pot by more than the maximum allowance, triggering an extra tax charge.

Jason Hollands, the managing director at the wealth manager Evelyn Partners, said the reports ahead of Hunt’s first budget were “welcome news”.

“[The caps have] created a disincentive for continued pension saving among higher-earning professionals and is a factor driving early retirement decisions at a time when the economy faces the challenge of tightening labour market.

“In particularly, restrictions on pension allowances – which have been reduced over the years both in nominal and real terms – have created well-documented problems in the public sector, especially in the NHS, where generous defined benefit pensions remain in place, meaning that many professionals retire early or are reluctant to take on further work.”

He added: “If we have to have an LTA at all, it is certainly far too low, given that it stood at £1.8m just 10 years ago and that since then inflation means incomes and savings have soared.”

The LTA is currently £1,073,100, and the rate of tax charged on pension savings above this amount depends on how the money is paid out. It is 55% if it is paid as a lump sum, or 25% if it is handed out in another way, for example pension payments or cash withdrawals.

The annual allowance is the most a worker can save in their pension pots in a tax year before paying tax, and is set at £40,000 this year.