Hunt says free childcare offer from age of nine months will cut childcare costs for families by nearly 60%

Hunt ends with a final childcare announcement.

He says the government will offer 30 hours of free childcare for every child from the age of nine months, where all adults in the household work.

He says this will reduce childcare costs for families by nearly 60%.

UPDATE: Hunt said:

So today I announce that in eligible households where all adults are working at least 16 hours, we will introduce 30 hours of free childcare not just for 3-and-4 year-olds, but for every single child over the age of 9 months.

The 30 hours offer will now start from the moment maternity or paternity leave ends.

It’s a package worth on average £6,500 every year for a family with a two-year-old child using 35 hours of childcare every week…

… and reduces their childcare costs by nearly 60%.

Because it is such a large reform, we will introduce it in stages to ensure there is enough supply in the market.

Working parents of two-year-olds will be able to access 15 hours of free care from April 2024, helping around half a million parents.

From September 2024, that 15 hours will be extended to all children from 9 months up, meaning a total of nearly one million parents will be eligible.

And from September 2025 every single working parent of under 5s will have access to 30 hours free childcare per week.

Early evening summary

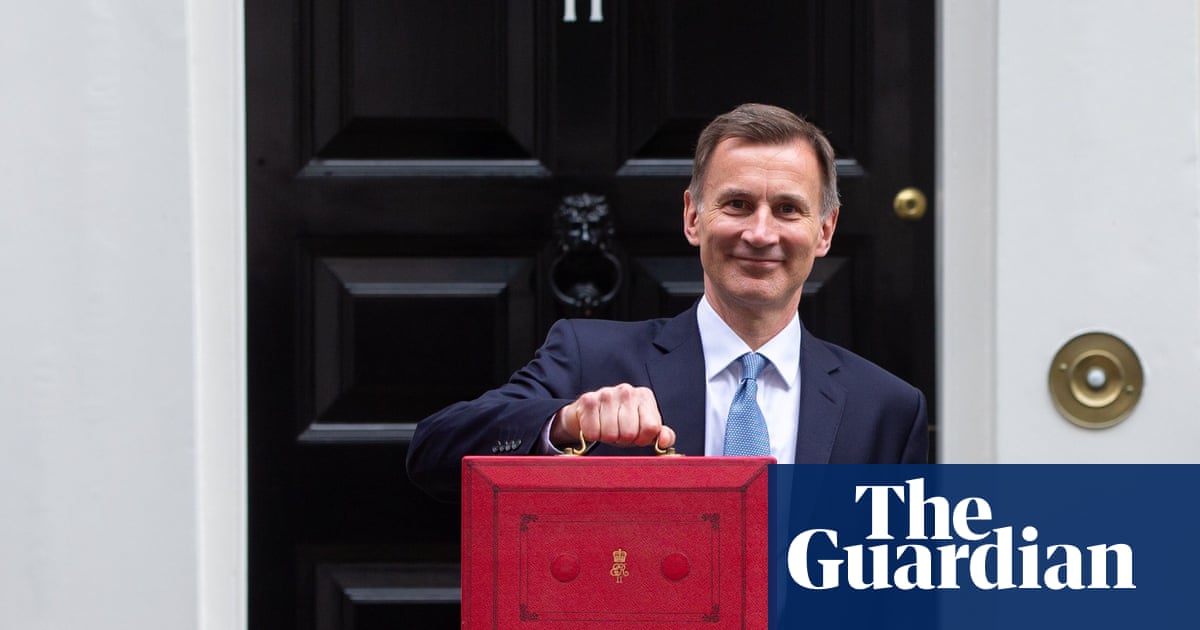

Jeremy Hunt has said he is “proving the doubters wrong” as he used a stronger than expected economic performance to help fund new tax breaks for business investment and a drive to get people back into the workforce. Here is our at a glance summary of what was in the budget.

Here is an analysis by the Guardian’s economics editor, Larry Elliott.

Here is an extract.

To be sure, the chancellor will be relieved that the independent Office for Budget Responsibility now thinks the economy will just about avoid the two consecutive quarters of falling output that would denote a technical recession, and that growth will be stronger in the likely pre-election year of 2024 than predicted last November at the time of his autumn statement.

But doing less badly is not the same as doing well. Hunt said he was delivering a ‘budget for growth’ – a refrain that has been heard many times by Conservative chancellors over the past 13 years. The reality is that the UK is battling against three powerful headwinds: rising interest rates, rising taxes and a cost of living crisis. It could certainly do without the added pressure of a credit crunch caused by bank failures. Despite the chancellor’s bullish performance, living standards are on course for their biggest two-year fall since the mid 1950s while taxes as a share of national income will be at their highest since the second world war by 2027-28.

And here are verdicts on the budget from a Guardian panel: Polly Toynbee, Miatta Fahnbulleh, Katy Balls, Frances Ryan, Louisa Britain, Rebecca Long-Bailey and Lucy Pasha-Robinson.

Hunt"s childcare plan includes "one of most severe distortions" likely to be found in a tax and benefit system, says IFS

The Institute for Fiscal Studies says the childcare proposals announced today will create “one of the most severe distortions you are ever likely to see within a tax and benefit system”.

That is because the abrupt cut-off means that the generous provision being made available abruptly stops if someone starts earning more than £100,000. In a briefing, the IFS explains:

A parent with a one-year-old and a three-year-old whose childcare provider charges England’s average hourly rate for 40 hours per week would, after these reforms, find that their disposable income (ie earnings net of tax and childcare outgoings) falls by £14,500 if their pre-tax pay crosses £100,000. Disposable income would not recover its previous level until pre-tax pay reached £134,500, meaning a parent earning £130,000 would be worse off than one earning £99,000.

For those with higher childcare costs the distortions are even more absurd. A similar parent paying average London rates for childcare, using 50 hours per week, would see a £20,000 fall in disposable income when their pre-tax earnings cross £100,000. Disposable income would not recover its previous level until pre-tax pay reached £144,500.

Welsh government criticises Hunt for putting "potholes and petrol" ahead of pay rises for teachers and nurses

The Welsh finance minister Rebecca Evans said the chancellor made a series of deliberate choices to prioritise “petrol and potholes” over investment in public services, pay and economic growth – and suggested he was saving more dramatic announcements for nearer the next general election. She said:

Today we saw a less than bare minimum budget, which misses the big picture, at a time when people’s financial situations are worsening.

It fell short of providing meaningful support – there were sticking plasters when we needed significant action. Potholes and petrol took precedence over pay rises for teachers and NHS staff.

The UK government has spent months telling the public sector it can’t pay them a pay rise but it’s spent £6bn on fuel duty, for example.

There was nothing in this to recognise the pressure on the NHS and nothing for social care which is one of the biggest pressures we’re facing.

It does seem the chancellor has more headroom than he’s using. I would suggest he’s looking to make more dramatic announcements, bigger hand-outs closer to the election rather than grappling with the problems right now.

Responding to the chancellor’s announcement of 30 hours of free childcare for children of working parents aged nine months and over from 2025 in England, Evans said:

We are already one step ahead in our support for childcare.

What we do know is it’s taken us quite a long time to get to the point where the capacity in the sector is able to expand. We’ve invested in the skills in the sector, increased the hourly rate and been enabling investment in the physical assets the sector needs. The UK government is going to find it needs to invest in that sense to deliver on its pledge. It takes time to expand on the sector.

Jeremy Hunt said his priority with the budget was growth. In its assessment of the impact of the budget policy measures on growth, the Office for Budget Responsibility says it has revised its growth forecast upwards more on the basis of the policy measures in this budget than it has done on the basis of policy measures in any previous budget since 2010.

But that only amounts to growth being 0.2% higher than it otherwise would have been, it says. It says:

Relative to our pre-measures forecast, our central estimate is that these policies, taken together, increase employment by 0.3 per cent (110,000) by 2027-28. But part of the employment impact on potential output is offset by lower-than-average hours and earnings among many of the new joiners, so the overall impact on GDP is around 0.2% in 2027-28. This is the largest upward revision we have made to potential output within our five-year forecast as a result of fiscal policy decisions taken by a government in any of our forecasts since 2010.

UK net migration to settle at 245,000/year, says OBR

Migration into the UK will settle at a higher level than previously expected, the Office for Budget Responsibility says.

In its new forecasts, net migration flows settle at 245,000 a year, rather than the 205,000 assumed in its November forecast. A year ago, net migration flows were settling at 129,000.

A larger population, due to increased net migration, will add 0.5% to the UK’s potential output in 2027, the fiscal watchdog says.

The OBR’s report explains that higher recent rates of inward migration can be attributed to:

• The resumption of international travel following the pandemic, especially among foreign students, with student visas reaching a record high of 490,000 in 2022;

• The post-Brexit immigration regime that began in 2021 and issued 800,000 visas in its first year of operation (only 50,000 of which were for EU citizens who did not require a visa under the previous regime); and

OBR says latest data hasn"t changed its view that Brexit will cut UK productivity by 4%

Ever since 2016 the Office for Budget Responsibility has been saying that Brexit would be bad for the economy. It has been assuming a 15% drop in imports and exports, compared to what would have happened if the UK had not left the EU, leading to a 4% fall in productivity over a 15-year period.

In today’s report the OBR says that these forecasts are still holding up and that there is nothing in the latest data to suggest it is wrong. It says:

Overall, while net migration has been higher than we anticipated, investment growth has been significantly weaker than we expected before the referendum, and our assumption about the impact of Brexit on the UK’s trade intensity is broadly on track. As a result, we have not revised our view that productivity will be 4% lower in the long run than if the UK had remained in the EU.

The government was particularly keen to change the pension tax allowance rules because many senior doctors get to the point where, once they have reached their pension limit, they feel less incentivised to keep working. According to ITV’s political editor, Robert Peston, the Treasury considered restricting the changes to just doctors. But the savings would have been limited, he says.

In his speech Jeremy Hunt said:

I am launching the first competition for small modular [nuclear] reactors. It will be completed by the end of this year and if demonstrated as viable we will co-fund this exciting new technology.

In fact, this is not the first time a competition of this kind has been proposed. In 2015, when George Osborne was chancellor, his spending review and autumn statement proposed “an ambitious nuclear research and development programme” which would “include a competition to identify the best value small modular reactor design for the UK”. Arguably it is just a case of the policy arriving eight years late.

3.2m people dragged into paying basic rate tax, and 2.1m higher rate tax, due to allowance/threshold freeze, says OBR

One of George Osborne’s boasts as chancellor was that he was able to take low earners out of having to pay any income tax, by lifting the basic allowance. (It was a coalition policy, pushed originally by the Liberal Democrats, but then enthusiastically adopted by the Tories in their 2015 manifesto.) But in March 2021 Rishi Sunak, the then chancellor, announced that the allowance and higher rate threshold would be frozen for four years, and last autumn Jeremy Hunt said the freeze would be extended another two years, to 2027-28. This means, as people get annual pay rises, more and more of them clear the hurdle and get sucked into paying basic or higher rate tax. Economists call it fiscal drag.

The Office for Budget Responsibility says that by 2027-28 the six-year allowance/threshold freeze will have brought 3.2 million people into paying basic rate tax, 2.1 million people into paying higher rate tax and 400,000 people into paying the additional rate.

The IFS also says fiscal drag will mean basic rate taxpayers paying an extra £500 in 2023-24, and higher rate taxpayers paying an extra £1,000. (See 4pm.)

IFS"s Johnson: Money for motorists, but not for nurses, doctors and teachers.

Paul Johnson, director of the Institute of Fiscal Studies, has just released his verdict on the budget.

Johnson says it is “just as notable” what Jeremy Hunt didn’t announce – such as no higher pay for public sector workers, while freezing fuel duty again.

There was no funding to be found to improve the pay offer to striking public sector workers, where £6bn might have been enough to make an inflation-matching pay offer possible this coming year. That’s a political choice.

Money for motorists, but not for nurses, doctors and teachers.

Big personal tax rises planned for next month, via the freezing of income tax thresholds, will still go ahead, Johnson points out. That fiscal drag is hitting living standards:

That will mean an extra £500 in tax for basic rate taxpayers in 2023–24, and an extra £1,000 for higher rate taxpayers.

These tax rises may be necessary from a fiscal point of view, but they are an important part of the reason why household incomes are still expected to fall more over the current two-year period than at any point in living memory.

Johnson also points out that Hunt has been hemmed in by “his own poorly designed fiscal rule”, to have debt falling at the end of the forecast period.

And on childcare, the IFS says Hunt’s new funding should help “tens, but not hundreds, of thousands of parents into work” – provided that it is appropriately funded.

Johnson says:

The big expansion in the childcare offer to families with younger children, likely doubling spending on childcare, looks like it will take us close to completing a 25-year long journey during which a new arm of the welfare state has been created.

Hunt could have done "far more" for Scotland, says SNP"s John Swinney

The Scottish government will get another £320m over the next two years following the chancellor’s spending increases in England, including his pothole fund, with arts and communities project getting £9.6m dedicated funding.

In keeping with Conservatives’ post-Brexit strategy of spending UK government money in areas controlled by the Scottish parliament, Hunt announced that Edinburgh’s cash-strapped festivals would get £8.6m, while another £1m would be shared by five community projects such as Aberfeldy sports club and a community grocery shop and cafe in Kyle of Lochalsh in the Highlands.

Jeremy Hunt’s spring budget was less generous for the UK’s devolved governments than previous Westminster budgets, with no increases for the biggest spending Westminster departments such as health and education that drive Treasury bonuses for Scotland, Wales and Northern Ireland.

He said Scotland would also be offered at least one of the 12 investment zones he plans, a proposal likely to challenge the Scottish National party-led government in Edinburgh to set aside its ideological discomfort about low-tax enclaves.

John Swinney, Scotland’s acting finance secretary, said overall the budget was a “missed opportunity” to combat rising poverty, the cost of living crisis and invest in public services. He said:

The limited additional money for the Scottish government’s budget is welcome but will not go far enough and in the long-term our capital funding will fall in real-terms.

The Scottish government is doing what it can with its limited powers to ensure people receive the help they need, but the UK government could have done far more to ease the burden affecting so many, demonstrating yet again why Scotland needs the powers of independence.

Pension tax allowance changes "a massive inheritance tax loophole", says thinktank

A thinktank has described the changes to the pension tax allowance rules as a “massive inheritance tax loophole”. This is from James Browne, head of work, income and inequality analysis at the Tony Blair Institute.

And this is from Jeevun Sandher, head of economics at the New Economics Foundation, another thinktank.

Increasing the pension lifetime allowance is a massive giveaway to already very wealthy people. If the chancellor hopes this will help older people remain in work, it’s completely divorced from reality. Only around 1% of workers saved more than the old annual allowance and just 10% were hit by the lifetime limit of £1.1 million.

Increasing the annual and lifetime allowances won’t do much to help the vast majority of us save for retirement.

One group that are supposed to benefit from these tax changes are the GPs and NHS consultants who were forced to retire early due to pension limits. But this group is far more affected by the annual than the lifetime allowance, which is still far below its 2010 level.

Nick Macpherson, a former permanent secretary at the Treasury, has also criticised the proposal.

But the move has been welcomed by the wealth management industry. This is from Lee Clark, a financial planner at RBC Brewin Dolphin, an investment management company.

Effective retirement planning is a long-term game that requires long-term consistent pension policy from concurrent governments to reward hard working savers. Pension savers need certainty, not this see-sawing of policy. For example, would a future government reverse this move?

That said, the abolishing of the LTA [lifetime tax allowance] is fantastic news for many professionals that have had a disincentive to work and save because of the frozen lifetime pension’s allowance of £1.07m that had halved in real terms since 2012.

Inflation isn’t actually expected to return to the Bank of England’s 2% target until 2028.

As Jeremy Hunt explained in his budget statement, the OBR expects the annual inflation rate will fall sharply to 2.9% by the end of 2023, a more rapid decline than expected in November.

That fall will be partly driven by falling household energy bills. But, “stronger domestically generated” price pressures means inflation is expected to oscillate around zero in the middle of the decade. Back in November, the OBR had forecast inflation would turn negative.

The OBR adds:

Inflation returns to target in early 2028, with the offsetting effects of lower gas prices and increased domestically generated inflation leaving the consumer price level at the end of our forecast little changed from November.

Pension tax allowance changes will cost £70,000 for every person who stays in work as result, says Labour

Labour says changing the pension tax relief rules, which it describes as “the only permanent tax cut in the budget”, will cost the taxpayer £70,000 for every person who returns to the labour market (the rationale for the move).

This figure is based on the policy costing more than £1bn towards the end of the decade (see 2.59pm), and the OBR saying in its report that it expects the policy to result in an extra 15,000 people staying in work. The OBR says:

Changes to the lifetime allowance and annual allowance on pension contributions increase employment by around 15,000 by removing some financial disincentives to continuing in employment for those with large pension pots.

Relaxing pension tax allowance rules to cost more than £1bn by 2026-27, Treasury figures show

Here are the figures from the Treasury’s red book showing how much the two changes to pension tax allowances will cost the government. The lifetime allowance on how much people can save in their pension funds tax free will be abolished, and the annual allowance (the amount that can be put in the fund tax free) will go up from £40,000 to £60,000.

There is no cost in 2022-23 (the column on the left). But by 2026-27 and 2027-28 (the two final columns on the right) it is costing more than £1bn a year.

The UK’s tax burden is on track to hit its highest level since the second world war.

The OBR forecasts that taxes, as a share of GDP, will hit 37.7% in 2027-28 – news that will not please the tax-cutting wing of the Conservative party.

That would be 4.7 percentage points above where it stood before the pandemic, which drove up government spending and borrowing.

But the OBR does point out that the UK’s tax burden is lower than the average of other advanced economies.

The corporation tax burden will be the highest since the tax was introduced in 1965 by the Labour chancellor Jim Callaghan, the OBR says, as the rate is increasing from 19% to 25% despite opposition from the Tory back benches.

The ratio of public spending to GDP is expected to settle at 43.4%, its highest sustained level since the 1970s