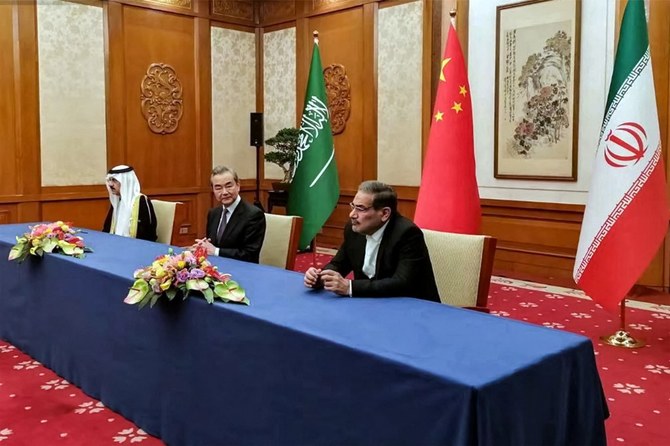

If the Iranian government continues to honor the agreement that it reached with Saudi Arabia this month, it has a great opportunity to improve the country’s economy.

Saudi Finance Minister Mohammed Al-Jadaan was last week asked how soon he thinks the Kingdom might start making investments in Iran and vice versa. He replied: “When people really stick to the principles of what was agreed, I think that could happen very quickly. Our aim, and I think this has been made very clear previously by our leadership, is to have a region that is stable, that is able to provide for its people, and prosper. And there is no reason for that not to happen.”

Foreign investments are critical for any country, particularly the Islamic Republic in these critical times as it seeks to boost its economy. According to ResearchFDI, foreign investment can “stimulate a target country’s economic development and create a more conducive environment for companies, the investor, and stimulate the local community and economy.” The Canadian market research firm added that FDI “creates new jobs and more opportunities as investors build new companies in foreign countries. This can lead to an increase in income and more purchasing power to locals, which in turn leads to an overall boost in targeted economies.”

The Iranian government is not opposed to foreign investments. In fact, Tehran has long attempted to attract foreign investments. For example, after the Joint Comprehensive Plan of Action nuclear deal was reached in 2015 and UN Security Council sanctions against Tehran were lifted, the Islamic Republic actively tried to facilitate foreign investments. Then-Minister of Industry, Mines and Trade Mohammad Reza Nematzadeh said: “The government (and) the parliament are trying to remove all the obstacles for free investment and for reducing interference of government in private investment.”

A report by Reuters at the time also stated that the Iranian government had “offered to sell state assets to foreigners, said it would cut the government’s role in the economy and pledged a tight monetary policy as it sought to attract billions of dollars of investment from abroad after over a decade of isolation.”

In fact, many foreign companies made business deals with Iran after the nuclear agreement. For example, French car manufacturer PSA Group signed a deal worth nearly a half billion dollars with Iran Khodro and Total signed a contract to buy 150,000 to 200,000 barrels of oil per day from Tehran. Once the nuclear deal was reached, foreign countries and companies appeared to be rushing to rekindle business with the Islamic Republic, which had effectively been cut off from global trade.

The Iranian government reciprocated this interest in conducting business with other countries in many areas, including technology, manufacturing, gas and oil. After the nuclear deal, several international oil companies, including Shell, BP and Eni, expressed an interest in returning to Iran’s oil market.

Among European countries, Germany and France were the first to rush to rekindle business with the Islamic Republic. Sigmar Gabriel, Germany’s economic minister and vice chancellor at the time, visited Iran in 2015 along with a business delegation.

Iranian leaders also planned to strengthen their airplane fleet. After the nuclear deal was reached, Mohammed Khodakarami, the director of Iran’s Civil Aviation Organization, stated that “Iran will buy a total of 80 to 90 planes a year from the two aviation giants (Airbus and Boeing) in the first phase of renovating its air fleet.”

Foreign investments are critical for any country, particularly the Islamic Republic in these critical times as it seeks to boost its economy.

Dr. Majid Rafizadeh

Iran has great potential for foreign investments. The first appealing sector in Iran is the energy sector: oil and gas. The Islamic Republic has the world’s fourth-biggest proven crude oil reserves and the second-largest natural gas reserves.

Additional enticing sectors are Iran’s consumer and technology markets. At more than 80 million, it has the second-largest population in the Middle East and is in the top 20 in the world. What is more intriguing regarding the consumer market is that more than 60 percent of the population are under 30 years of age. Iran also has a highly educated population but suffers from a high level of brain drain. Even under economic sanctions, Iranians spent more than $75 billion on food, more than $20 billion on clothes and $18.5 billion on tourism in 2012. Finally, the Islamic Republic of Iran is considered to be the world"s largest untapped emerging market.

If the Iranian government sticks to its new agreement with Saudi Arabia, it will enhance its legitimacy and bring the country out of isolation, offering great economic opportunities, particularly from foreign investments.

Dr. Majid Rafizadeh is a Harvard-educated Iranian-American political scientist. Twitter: @Dr_Rafizadeh