RIYADH: Residents of Saudi Arabia will be able to increase their savings rates with the announcement of a new product by the Ministry of Finance.

Launched in collaboration with the National Debt Management Center, the “Sah” program is the first savings product intended for individuals and supported by the government.

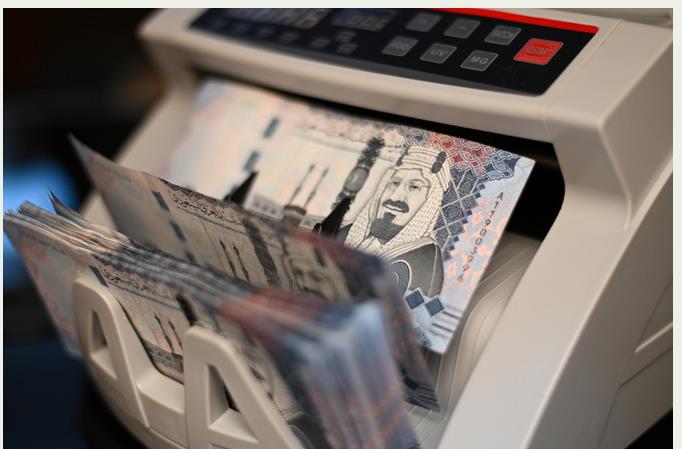

The product will come in the form of subsidized sukuks within the Kingdom’s local sukuk program, denominated in riyals and are Shariah compatible.

The Chairman of the Steering Committee at the Ministry of Finance, Abdul Aziz bin Saleh Al-Furaih, explained in a release by the organization that the initiative aims to raise saving rates among individuals by motivating them to deduct part of their income periodically and allocate it, according to a release by the body.

In addition to increasing the supply of savings products, it hopes to enrich financial culture and raise awareness of the importance of saving and its benefits for planning future goals.

The CEO of the National Debt Management Center, Hani Al-Medaini, explained in the release that the sukuk will be issued on a monthly basis according to the announced calendar of issuances for the “Sah” product, indicating that “this initiative represents an incentive for the private sector to cooperate and participate in developing and launching a number of savings products for specific goals for different categories of individuals, whether through banks, fund managers, financial technology companies, etc.”

The initiative will be offered through the digital channels of several financial institutions, namely Saudi National Bank, AlJazira Capital, and Alinma Investment, as well as Al Awwal Capital, and Al Rajhi Capital.

The subscription period for the first version of the “Sah” product is scheduled to begin in February 2024, and will be released on Feb. 4 until Feb. 6.

Sukuk will be offered on a monthly basis according to the issuance calendar, with a savings period of one year until returns. Users will see profits at the end of the instrument’s life, at its assigned maturity date.

Al-Furaih, explained that the launch of the “Sah” product comes within the initiatives of the Financial Sector Development Program, which is one of the Saudi Vision 2030 programs.