Closing summary: Weakness in the US jobs market

Hurricanes and the enormous strike at Boeing were always going to be temporary factors in the US economy, but there are nevertheless signs of a “slowing trend”, according to economists.

Samuel Tombs, chief US economist at Pantheon Macroeconomics, a consultancy, said the data “bolsters the case” for the Federal Reserve to lower interest rates at both its November and December meetings. After that, it depends on what happens on Tuesday...

Tombs said:

The muted rise in October payrolls is not merely due to strikes and the recent hurricanes.

A further slowing in the trend looks likely given that hiring intentions of small businesses remain depressed, large businesses still face a rise in their borrowing costs as low-rate corporate bonds mature, and job openings in the health and education sector have fallen.

August and September job gains were revised down by 112,000 jobs, and growth in job numbers slowed.

Preston Caldwell, chief US economist at Morningstar, said:

Even setting aside the October data, where the impact of temporary distortions is unknown, today’s jobs report was a bit bearish.

The data does point to an ongoing downtrend in job growth. […] There is nothing in the overall assemblage of labour market data to dissuade the Fed from cutting in next week’s November meeting and to loosen policy further over the next year.

The data overall points to a job market that has shed all of its post-pandemic tightness and excesses, and the data suggests enough downside risk to warrant nipping in the bud with monetary easing.

In other business news today:

The UK gilt market appeared to stablise after yields jumped on Thursday.

HSBC chairman Mark Tucker gave his support to Rachel Reeves’s budget.

The UK manufacturing industry fell into contraction in October as companies paused investments ahead of the budget, according to the closely followed purchasing managers’ index (PMI).

Rating agencies gave their UK budget verdicts. Moody’s said the UK government’s increased borrowing will give an “additional challenge” to the public finances, while S&P Global said the UK government will be “constrained” by its debt load.

UK house price growth slowed in October ahead of Wednesday’s budget, surprising economists who had expected faster increases, according to one of the key measures collected by a lender.

Oil prices rose after reports that Iran is preparing an attack on Israel.

You can continue to follow our live coverage from around the world:

In the UK, the Lib Dems say the budget could create a ‘lost generation’ of farmers

In the US, Kamala Harris and Donald Trump campaign in key swing states in final stretch of race

In the Middle East, Israeli strikes kill 25 in Gaza and 13 in Lebanon

Thank you for following this UK budget week. Please do join us next week as we strap in for the US election, and its fallout on financial markets. JJ

UK budget gains backing from HSBC chairman

The response from the business lobby to the UK budget was fairly negative, but criticism of the Labour government has not been universal.

Chancellor Rachel Reeves has gained the backing of some senior bankers – perhaps cognisant that Labour is likely to be in power for at least five years.

Mark Tucker, chairman of HSBC, said:

This is a budget which lays the foundations for necessary investment within a framework of clear fiscal rules. The overall package strikes a balance between tax, spending and borrowing to finance public services, alongside a focus on delivering economic growth.

Patrick Thomson, JP Morgan’s chief executive of asset management in EMEA, said:

The market reaction compared to the Truss mini-budget has been relatively muted and should count as a success considering the ambition of the Budget. It was helpful that there were few surprises, given that it was so well telegraphed ahead of time.

Having raised taxes for much-needed investment in public infrastructure and services, the market will be waiting to see that the money is spent wisely in actually fixing any underlying problems in the economy to have long term impact. Ultimately, we all want to see how this translates into growth, and so the City will look to the forthcoming Mansion House speech for further detail on the proposed investments.

British banks with big motor finance arms have had a dire week on stock markets since a court ruling that could cost them billions of pounds.

The latest lender to join the procession of warnings was Secure Trust Bank. It had already said that it was looking at the ruling, but on Friday it worried the market further with a profit warning.

Its share price is down by 17% today, adding to a dire run that has driven its valuation to its lowest since floating in 2012. The share price dropped from above £8 a week ago to £4.70 today.

The bank said that it was taking longer than expected to recover money from people who had defaulted on loans, meaning that profit before tax would “fall materially below market expectations by between £10m and £15m”.

David McCreadie, Secure Trust Bank’s chief executive, said:

We are disappointed that it will take longer than expected to recover value from the excess level of defaulted vehicle finance balances, and the recent court of appeal decisions have added additional uncertainty on the benefits to be realised in 2024.

US stocks are all up by more than 1%, after weak jobs data appeared to remove any lingering chance of the Federal Reserve leaving interest rates on hold next week.

The S&P 500, the Nasdaq and the Dow Jones industrial average indices are all up by more than 1% in morning trading in New York.

What have we learned from the US jobs numbers? It’s tricky to say.

Lara Castleton, US head of portfolio construction and strategy at Janus Henderson Investors, said it was “an underwhelming and muddying jobs report just five days before an election”. There was no clear signal because of the hurricanes.

There will likely not be much influence from this report on the results of next week nor on the Fed’s interest rate decision later in the month, which will likely be 25-basis-points cut amidst this backdrop.

James Knightley, chief international economist for the US at ING, an investment bank, said the number was “depressed by strike action and hurricane disruption”.

Nonetheless, the trend in hiring is obviously slowing and with the inflation backdrop looking less threatening, the Federal Reserve clearly has scope to move policy closer to neutral.

Given the inflation backdrop is less threatening and the Fed is putting more emphasis on jobs, today’s report cements expectations for a 25bp Fed rate cut next week. We expect that to be followed up by another 25bp rate cut in December.

Wall Street has opened higher. Share prices were likely helped by expectations of looser monetary policy from the Federal Reserve after surprisingly weak jobs numbers.

Here are the opening snaps, via Reuters:

S&P 500 UP 23.42 POINTS, OR 0.41%, AT 5,728.87

NASDAQ UP 93.71 POINTS, OR 0.52%, AT 18,188.86

DOW JONES UP 199.46 POINTS, OR 0.48%, AT 41,962.92

London tube engineer strikes called off after improved pay offer

Back in the UK, the RMT union has suspended tube strikes due to start today after what it called a “significantly improved offer” from Transport for London.

Engineering staff represented by RMT were due to stop work for 24 hours from 6pm today.

However, the separate Aslef union has not called off its action. Train operators and managerial employees are due to strike on 7 and 12 November.

An RMT spokesperson said:

Following intense negotiations with London Underground management and a significantly improved offer, we have suspended the strikes scheduled to start this evening.

London Underground have sensibly abandoned their proposed changes to pay structures which now means all our members will receive the same value in any pay award.

Further discussions will take place next week regarding the pay offer but progress has been made which would not have been possible without the fortitude and industrial strength of our 10,000 members on London Underground.

*This post has been updated to reflect the fact that Aslef has not called off its strike action.

The jobs numbers prompted a rapid fall in the yield on US Treasury bonds. The yield on the 10-year benchmark dropped 10 basis points (0.1 percentage points) in the immediate aftermath of the data.

Perceptions of a weaker US economy will make the Federal Reserve more likely to lower interest rates next week. That would boost the relative value of bonds. (Yields dropping means prices are rising.)

It’s something of a side issue given the context of the US election, but the drop in yields has also affected UK debt. The yield on 10-year gilts has dropped below 4.4% – wiping out all of Thursday’s post-budget move.

The US dollar has weakened after the shock drop in non-farm payrolls.

The dollar is down by 0.3% against a trade-weighted basket of currencies after initially climbing over the course of today. The pound is now up 0.5% today against the greenback, while the euro is up 0.1%.

You can see the immediate reaction on this chart showing the performance of the dollar basket today:

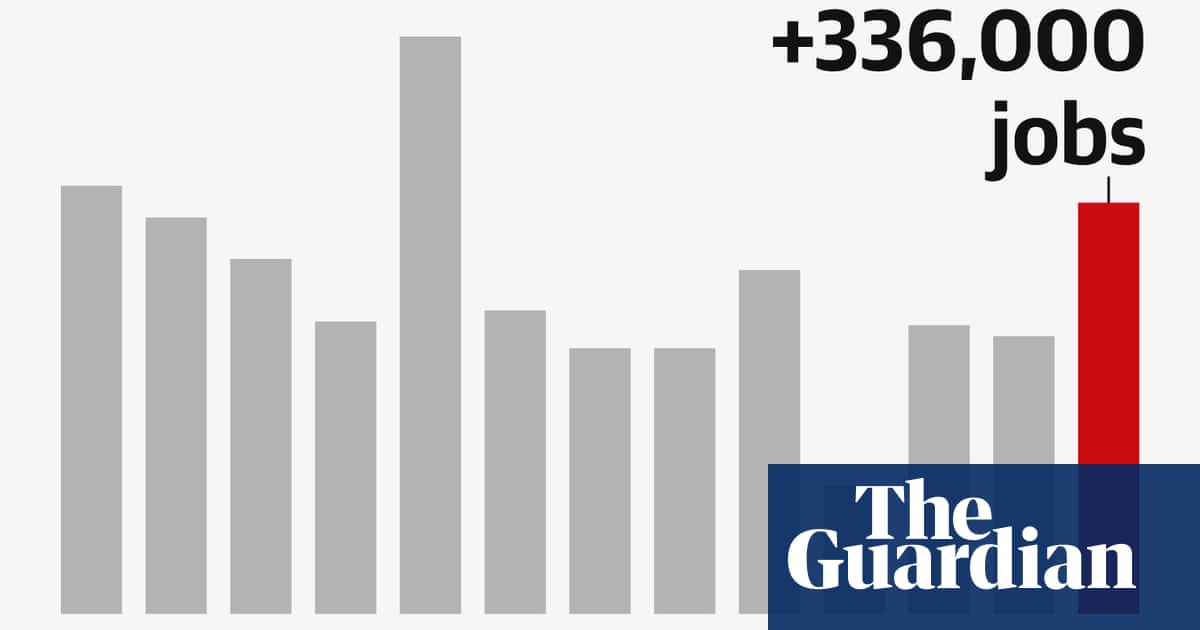

Economics professor Justin Wolfers of University of Michigan says that the underlying trend is of slower growth in jobs, but not a signal of a disastrous economic situation.

But the headline is nevertheless still a long way below any recent readings thanks to the strikes and hurricanes.

The US unemployment rate remained steady at 4.1%, but it is the non-farm payrolls number that will take up all the attention.

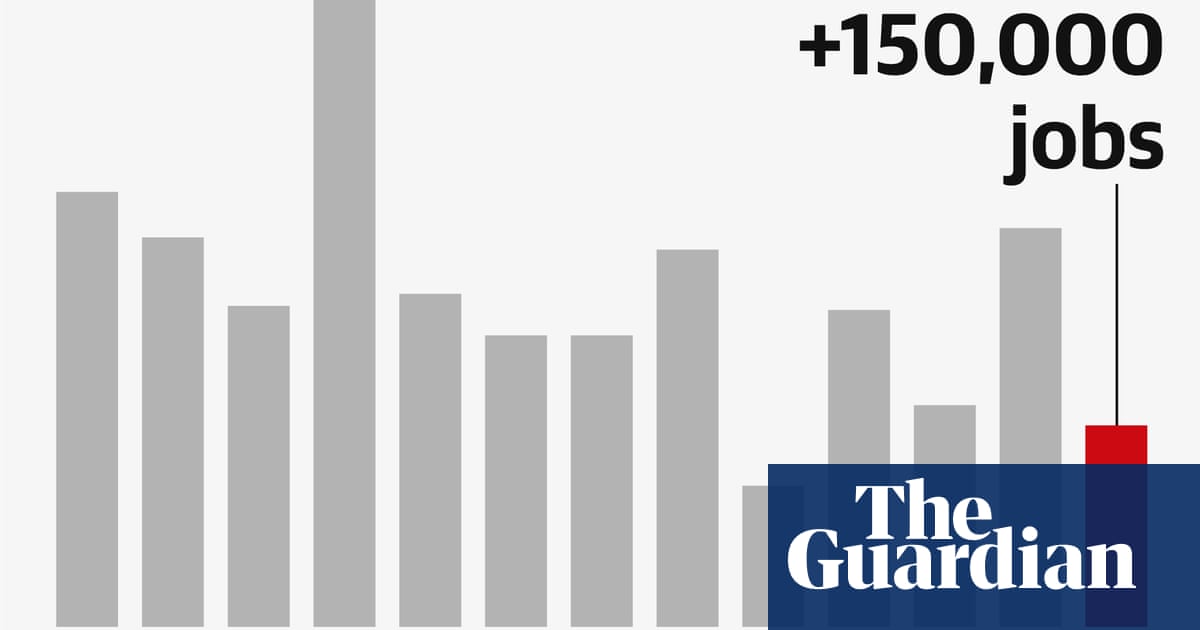

Only 12,000 jobs were added – which will surely be seized on by Donald Trump in the last few days of campaigning ahead of the presidential election. A miss in the forecasts of that magnitude – more than 100,000 jobs – is rare.

The US Bureau of Labor Statistics (BLS) added the important caveat that the jobs reading is the first since Hurricanes Helene and Milton hit the US. The BLS said:

It is likely that payroll employment estimates in some industries were affected by the hurricanes; however, it is not possible to quantify the net effect on the over-the-month change in national employment, hours, or earnings estimates because the establishment survey is not designed to isolate effects from extreme weather events. There was no discernible effect on the national unemployment rate from the household survey.

It also added that “Employment declined in manufacturing due to strike activity” – a reference to the ongoing strike at Boeing in particular.

US economy added only 12,000 jobs in October according to shock numbers

The US economy added far fewer jobs than expected in October, in a shock reading that will raise questions about its momentum days before the presidential election.

Only 12,000 jobs were added in the month, according to the Bureau of Labor Statistics, far below economists expectations of 113,000, and the 254,000 in September.

Tens of millions of Americans have already voted, but we will shortly receive the last big economic update before the US presidential election next Tuesday: non-farm payrolls.

The jobs numbers are a key measure of the US economy, but this month they could be affected by the huge strike at Boeing and the effects of a hurricane hitting Florida.

Whatever the noise, the figures will help to set the narrative for the next day or two as the election campaign enters its most frantic stage.

Bob Savage, head of markets strategy and insights at BNY Mellon, a US investment bank, said:

US October non-farm payrolls expected 110,000 after 254,000 with hurricane and strike noise. The unemployment rate expected steady at 4.1% and the average hourly earnings flat at 4% year-on-year.

Reuters’s poll of economists suggests that the reading will be 113,000, down from 254,000 in September.

A quick check-in on gilt markets: the Labour government will have been eyeing developments nervously after some movement this week, but so far on Friday things have been fairly steady.

The yield on the UK 10-year bond has dropped to 4.42%, down from a high of 4.51% during London trading hours and two basis points (0.02 percentage points) below yesterday’s close. Yields move inversely to prices, so falling yields is a sign of investors buying bonds, after Thursday’s selloff.

The 30-year yield has also dropped by a basis point, while the short-term two-year gilt is down four basis points in today’s trading.

The pound is up by 0.2% against the US dollar, and 0.3% against the euro.

Shreyas Gopal, a strategist at Deutsche Bank, said that the budget should be net positive for the pound, because it will likely make the Bank of England more hawkish – more likely to keep interest rates higher for longer.

Our economist’s base case for next week is that the BoE now retains its language around cuts being “gradual.”

Higher policy rates for longer, driven by a demand stimulus that lifts growth and inflation, ought to be positive for the pound in the current market environment.

America’s two oil giants reported combined profits of more than $13bn (£10bn) for the third quarter as higher production volumes made up for weaker prices.

ExxonMobil made $8.6bn, while Chevron made $4.5bn. Both beat analyst forecasts.

ExxonMobil said it had produced the most oil for a quarter in over 40 years, at 3.2m barrels per day. Chevron said its oil output rose 7% compared with last year thanks to record production in the US, including the West Texas Permian Basin.

Slower global economies have dragged down oil prices in recent months – despite the turmoil in the Middle East and Ukraine. That has hit oil company profits this year, but there is little sign of them slowing down.

Both companies and their rivals have expanded production in the face of warnings from forecasters such as the International Energy Agency that exploration for new oil and gas wells must cease if the world is to hit climate targets to limit global heating to 2 degrees Celsius.