US employers added back far fewer jobs than expected in April in a sign interpreted as showing that many businesses are now struggling to find enough workers as the economic recovery strengthens.

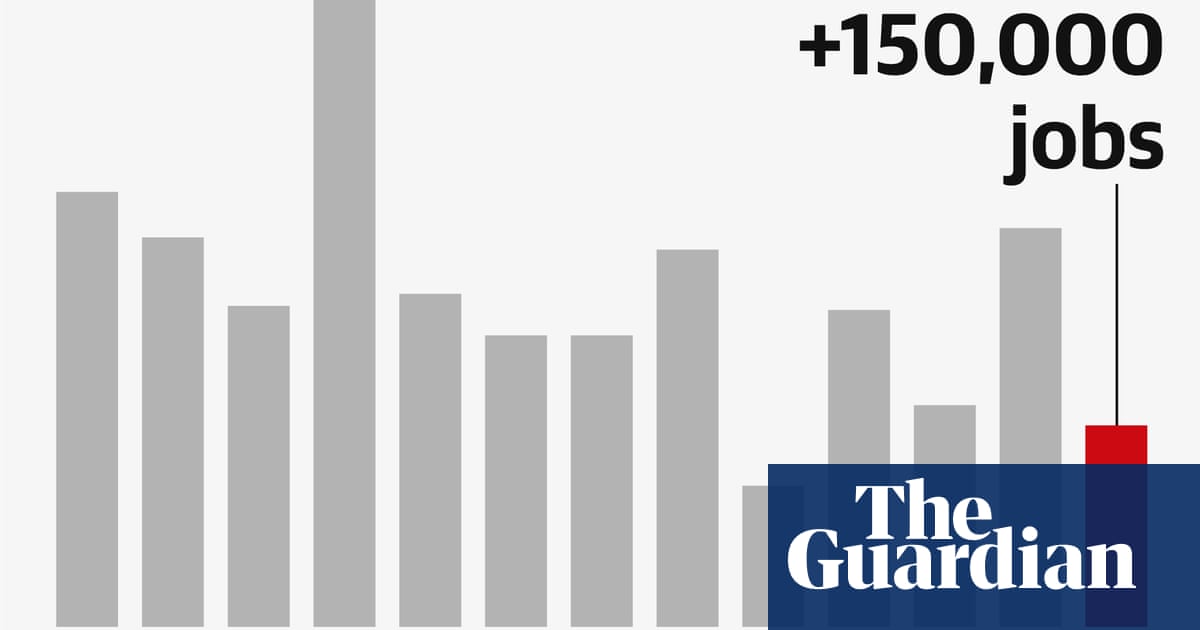

The latest snapshot from the US Labor Department showed the number of non-farm payroll jobs rose for a fourth straight month by 266,000 in April, after growth of 770,000 in March, but sharply below Wall Street forecasts for a rise of about 1m.

The unemployment rate climbed to 6.1% in April, up from 6% a month earlier. A year ago, as the pandemic hit and employers shed staff rapidly, unemployment hit 14.7%.

Economists had been forecasting stronger growth in US jobs as pandemic restrictions are gradually relaxed and the Biden administration pumps trillions of dollars of fresh stimulus into the economy, with $1,400 (£1,005) cheques paid directly to eligible US households.

Millions of consumers have begun spending their extra cash on restaurant meals, airline tickets, road trips and new cars and homes. The US economy grew sharply by 6.4% on an annual basis in the first quarter of 2021.

Oxford Economics, a consulting firm, predicts that 8m US jobs will be added this year, reducing the unemployment rate to a low of 4.3% by year’s end.

The economic rebound has been so fast that many businesses, particularly in the hard-hit hospitality sector – which includes restaurants, bars and hotels – have been caught flat-footed and unable to fill all their job openings.

Some unemployed people have been reluctant to look for work because they fear catching the virus.

Others have entered new occupations rather than return to their old jobs. And many women, especially working mothers, have left the workforce to care for children.

Nonetheless, the easing of lockdown measures helped drive up employment in the hardest-hit sectors of the economy, with leisure and hospitality jobs rising by 331,000, while the reopening of in-person schooling meant local government education payrolls rose by 31,000.

More than half of the increase was in food services and drinking places, where payrolls increased by 187,000.

However, those gains were smaller than anticipated, and offset by declines in other sectors, including car manufacturing.

Michael Pearce, a senior US economist at the consultancy Capital Economics, said the snapshot suggested labour shortages were becoming a significant drag on the US recovery. “Most of the other evidence suggests economic activity is rebounding quickly, but it is a clear reminder that the recovery in the labour market is lagging the rebound in consumption,” he said.

The lacklustre growth in jobs will weigh on expectations among financial investors that the US Federal Reserve will raise interest rates, amid concern that a stronger recovery from Covid-19 would trigger a bout of inflation.

“For the Fed, we suspect that means it will be many months before it judges the economy has made ‘substantial further progress’ towards its ‘broad based and inclusive’ full employment goal. That means any talk of tapering, let alone rate hikes, is still some way off,” Pearce said.

Although the Fed has forecast strong growth and falling unemployment this year, it has resisted calls to slow its quantitative easing bond-purchase programme or consider raising interest rates soon. Some economists also said that higher levels of unemployment support, including a government-funded $300 weekly supplement, pay more than most minimum-wage jobs.

Neil Wilson, the chief market analyst at Markets.com, said low wages could now be pushed higher, which could then fuel inflation. “Lower-paid jobs that were lost in the pandemic are coming back, but they may not be as low paid as they used to be,” he said. “This suggests further upside pressure on inflation over the coming months as businesses seek to attract staff.”

Silvia Dall’Angelo, the senior economist at the investment manager Federated Hermes, said: “The US labour market will continue to improve, as the economy re-opens and confidence comes back, supported by further progress in the vaccine rollout and fiscal stimulus. However, as the April report shows, the process of healing will be lengthy, possibly somewhat bumpy, and it might be incomplete as the crisis could leave some degree of scarring in the labour market.”