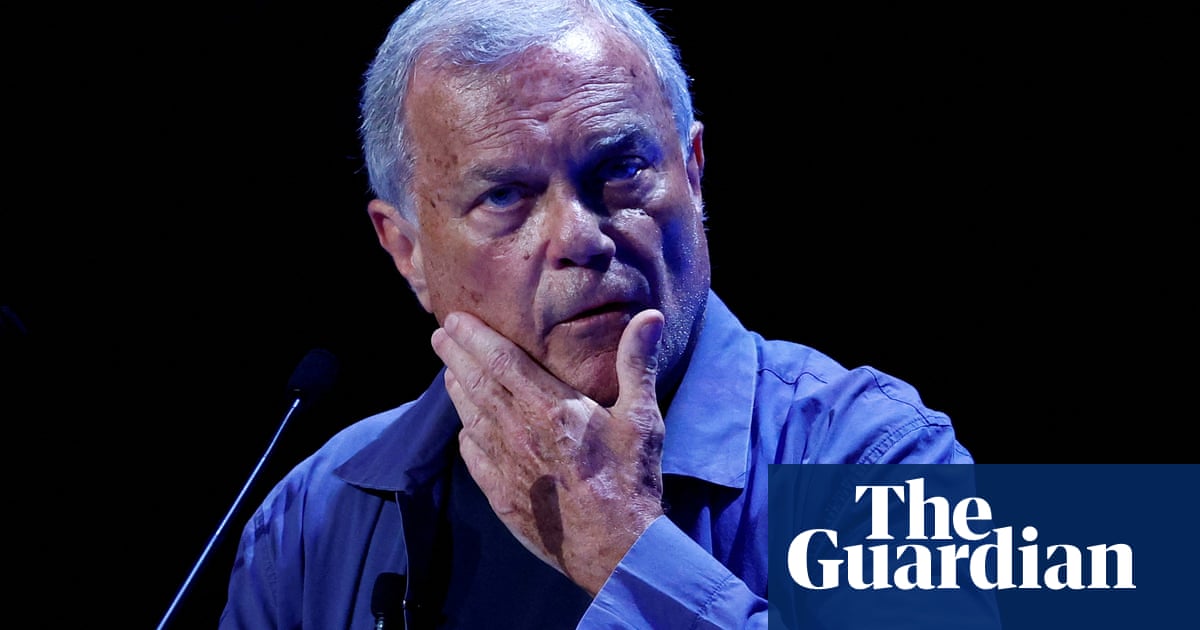

The share price of Sir Martin Sorrell’s advertising business has fallen further after a surprise delay from its auditors caused the postponement of financial results and a dive in the company’s valuation.

S4 Capital’s share price dropped by 36% on Wednesday afternoon after it announced the delay by the auditors PricewaterhouseCoopers without outlining a reason. On Thursday afternoon it was down by a further 5.6% to 292p, its lowest point since July 2020.

The company said it had received notice “at 2:30pm” on Wednesday from PwC that “they were unable to complete the work necessary for S4 Capital to release the preliminary statement tomorrow morning”.

Sorrell started S4 in May 2018, only weeks after he was ousted as chief executive of WPP, the company he transformed from a shopping basket manufacturer into a FTSE 100 advertising and marketing agency. His departure followed allegations of personal misconduct, which he has always strenuously denied, and he left without having to go through a non-compete period.

Since then Sorrell has built up S4 through near-incessant dealmaking, and its market value reached £4.8bn in September, closing in on the valuations of some FTSE 100 companies as it benefited from the economic rebound from the pandemic.

However, since then its share price has fallen back dramatically, and the company’s market value fell by £1bn on Wednesday to £1.7bn. The decrease has dented Sorrell’s net worth: he owns 10% of S4 stock, suggesting his worth on paper fell by almost £100m on Wednesday and Thursday alone.

Delayed financial results often prompt investors to sell because of fears that auditors have found problems, although S4 did not offer any update on Thursday morning on why the results were postponed.

It is the second time S4 has suggested that results had been delayed, after PwC at the start of March “requested a further period to complete its audit work” because of the “impact of Covid and Omicron on travel and resource allocation, particularly in the Netherlands”.

S4 said on Wednesday it would release its results for 2021 “as soon as PwC have completed their work”. It added that it believed the results for 2021 remained “within the range of market expectations and continued to trade strongly in the first two months of 2022”.