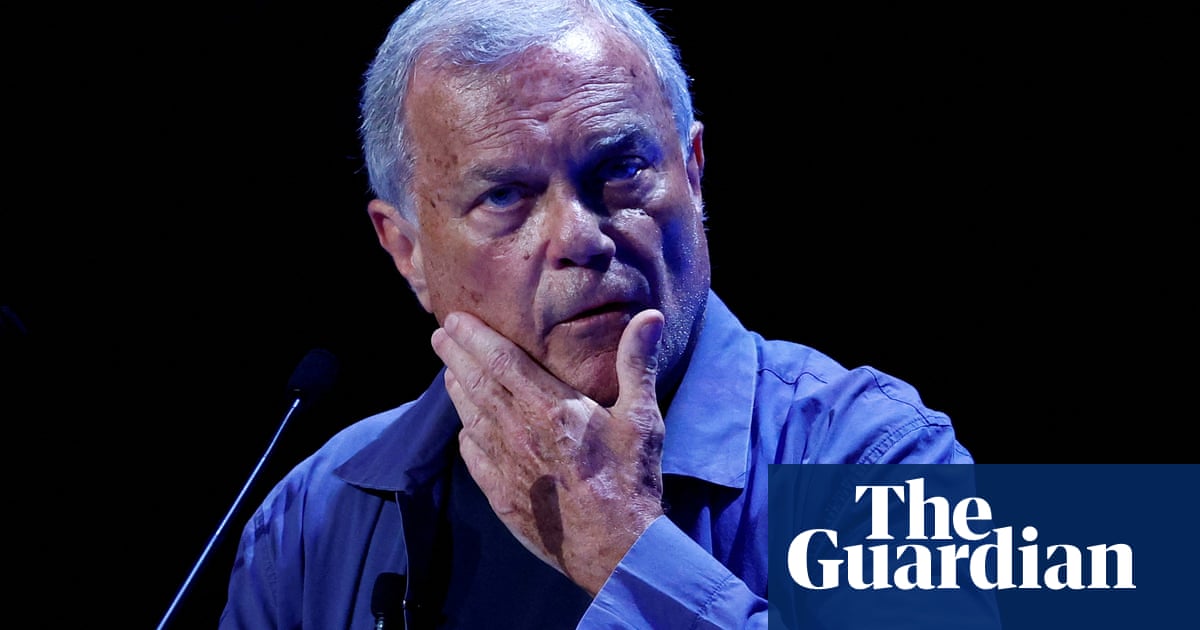

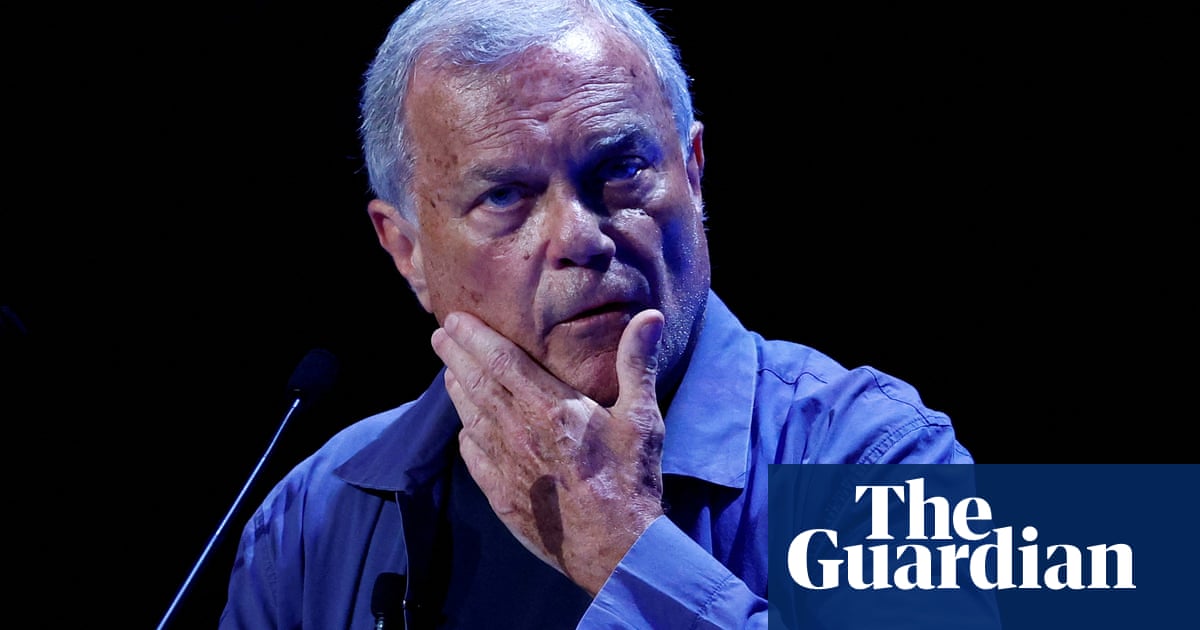

The veteran advertising boss Sir Martin Sorrell’s digital marketing group S4 Capital has cut 500 jobs in the face of a plunge in spending from clients fearful of an impending recession.

Shares in the company, founded after his acrimonious departure from the advertising company WPP in 2018, fell by 30% to a record low after it said it expected revenues to shrink and profit margins to narrow, although those losses later eased and it closed about 21% down, stripping about £120m off its market value.

“We had a very mixed first half of the year reflecting challenging global macroeconomic conditions and consequent fears of recession, which resulted in client caution to commit and extended sales cycles, particularly for larger projects,” said Sorrell, the executive chair of S4 Capital, which has now cut its annual forecast for the second time in as many months.

S4 Capital has a significant dependence on technology clients, who accounted for just under 50% of total revenues last year, but are now reining in spending. The company said it had cut the number of employees – known as Monks – from 9,041 to 8,550 at the end of June compared with the same point last year.

The group said inflation in staff costs and higher IT costs meant more job cuts were looming and the firm would “continue to take action, especially in its content division, “given the current market outlook”.

Its content practice, which makes creative campaigns for clients that run across digital platforms, saw profits plunge by more than 70% like-for-like in the first half compared with last year.

“Advertising agencies are at the mercy of the economy,” said Russ Mould, the investment director at AJ Bell. “Martin Sorrell’s digital advertising agency is currently suffering from subdued client activity – its customers are worried about recession so they are cautious about signing off big advertising campaigns.”

S4 Capital said it expected total group revenues for the year to fall by 1%, compared with a previous forecast of 2.5% growth, while profit margins have been lowered to 12%, from 14.5% previously.

“We expect the year as usual to be weighted to the second half, especially the fourth quarter,” said Sorrell. “Stimulated, in particular, by increased seasonal levels of clients’ activity and our artificial intelligence initiatives and the use cases we are developing with our clients.”

The company said that like-for-like revenue growth among its top 20 clients was still up by 8.9% year-on-year and it still expects over the longer term to outperform rivals and return its profit margins to above 20%.

“We remain confident our talent, business model, strategy and scaled client relationships position us well for above average growth in the longer term, with a new emphasis on deploying free cashflow to dividends and share buybacks,” he said.